This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Thanks to the Federal Reserve and its central bank peers, the world is now awash in debt. This is particularly the case in the corporate sector where debt has been accrued to record levels, an issue that is of concern, particularly when one of two scenarios play out; a rise in interest rates or a slowing of the economy. In the most recent version of theInternational Monetary Fund’s Global Financial Stability Report for April 2017, the IMF takes a detailed look at the global corporate sector debt levels and expresses concerns over the worsening debt serviceability issues. In this posting, we’ll look at the debt situation for the corporate sectors in both the United States and take a brief look at the corporate debt situation in the world’s emerging economies.

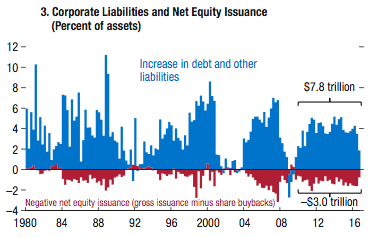

The IMF begins by noting that the U.S. corporate sector has added $7.8 trillion in debt and other liabilities since 2010 with traditional equity financing being outstripped by share buybacks as you can see here:

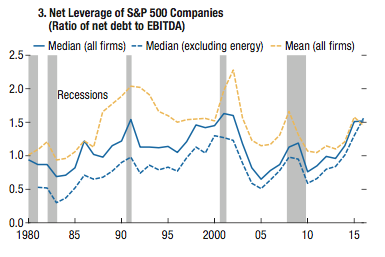

Here is a graphic showing how the net leverage (ratio of net debt to EBITDA or earnings before income tax, depreciation and amortization) for big corporations in the United States:

As you can see, median corporate leverage among large corporations has grown steadily since the end of the Great Recession and is now close to historically high levels at 1.5 times earnings.

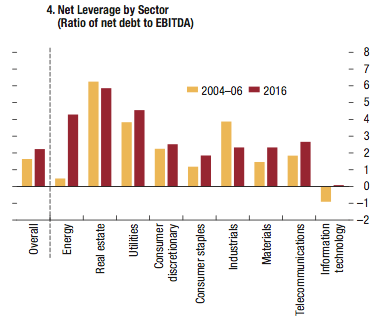

Here is a graphic showing net leverage for key sectors of the economy, comparing the level in 2004 to 2006 to the level in 2016:

Eight out of ten sectors showed an increase in leverage with only two showing a decrease over the decade; industrials and real estate, although the net debt of these three sectors is still very high.

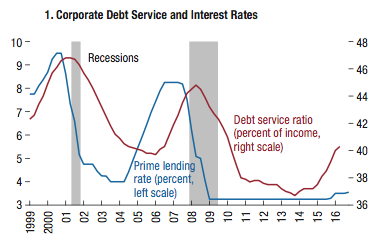

Here is a graphic showing the debt service burden (red line) for the American corporate sector:

Despite the current ultra-low interest rate environment, the debt service burden for Corporate America has risen substantially since 2015.

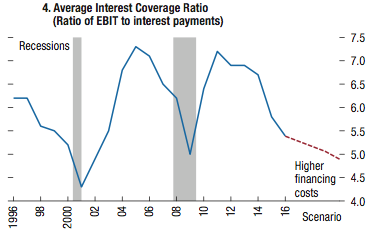

Here is a graphic showing interest rate coverage ratios (ratio of EBIT (earnings before income tax) to interest payments):

As you can see, higher interest rates could push the interest rate coverage ratio downwards even further, significantly weakening the ability of corporations to cover interest owing on their debt.

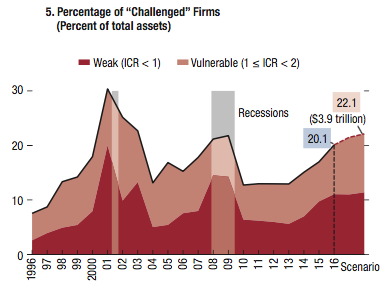

Here is a graphic showing the percentage of firms at risk of default:

At 22.1 percent, the percentage of firms that are at risk of default is at the highest level since the turn of the millennium.

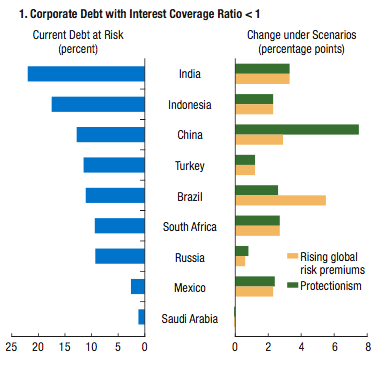

Now, let’s take a brief look at the corporate sector debt situation in the world’s emerging market economies. Here is a graphic showing which nations have corporate debt that is at risk (i.e. interest coverage ratio of less than 1) should global trade decline, economic growth decrease and protectionist trade pressures rise:

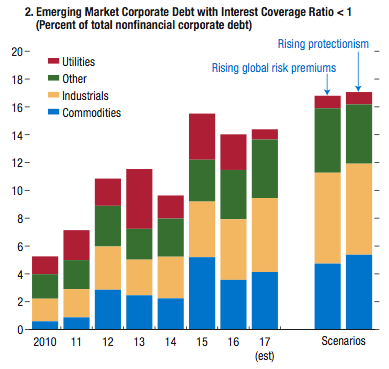

Corporations in nations that rely heavily on manufacturing and commodity exports are particularly vulnerable to increases in debt risk since they are the economies that will be impacted the most by protectionism as shown here:

As we can see from this report, thanks to the current ultra-low interest rate fantasy land, the corporate sector in both the United States and the world’s emerging market economies is highly vulnerable to changes in interest rates, largely because it has gorged itself at the cheap debt trough. Earnings have dropped to less than six time interest expense, a level that is close to the lowest levels seen during the Great Recession. While many of these troubled firms are in the beleaguered energy sector, firms in both the real estate and utilities sector are showing debt pressures as well. Under a scenario where there is a sharp rise in interest rates, the IMF projects that the combined assets of debt challenged American firms could reach almost $4 trillion, a scenario that does not bode well for investors, particularly those that have invested in high yield corporate debt.

Click HERE to read more.

Vote for Shikha Dhingra For Mrs South Asia Canada 2017 by liking her Facebook page.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment