This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

With the Federal Reserve signalling a continuation of their monetary normalization plans, a recent speech by James Bullard, President and CEO of the Federal Reserve Bank of St. Louis shows us that even the Fed’s main players are advising caution. Let’s look at some of the details.

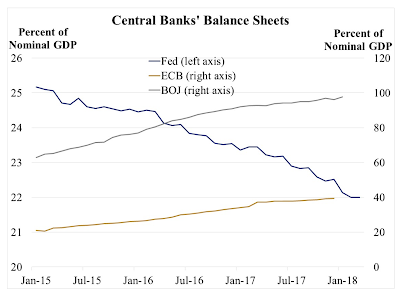

Mr. Bullard begins by noting that the Federal Reserve’s balance sheet has actually been shrinking as a percentage of GDP, unlike its peer group:

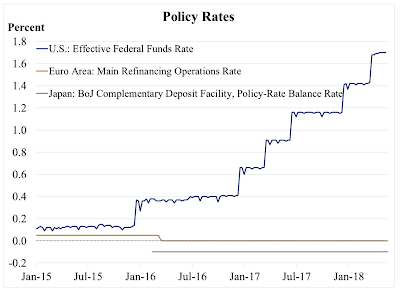

Also, unlike its two most influential peers, the Fed has been boosting its key interest rate as the American economy appears to be strong:

Given that the Bank of Japan and the European Central Bank are showing no signs of raising their key interest rates, Mr. Bullard asks how far the Fed can increase interest rates without causing significant problems.

Here are three factors that should cause the Fed’s banksters to ponder the wisdom of further rate increases:

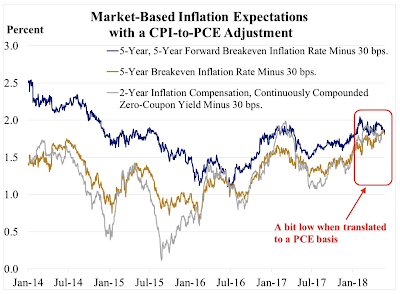

1.) United States market-based inflation expectations remain “somewhat low”:

The market’s expectations of inflation remain below the Fed’s 2 percent target, clearly showing that the Fed cannot use inflation as a reason to further raise interest rates. As shown in this diagram, the financial markets do not believe that the Fed will hit the Personal Consumption Expenditure (PCE)-based 2 percent inflation target even looking as far out as five years in the future:

At least some of the recent increases in inflationary expectations can be attributed to oil price gains, however, Mr. Bullard observes that this factor will have only a temporary effect on inflation.

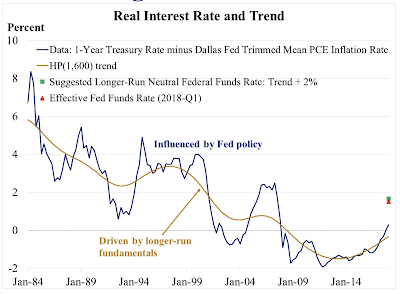

2.) The current U.S. policy rate is neutral:

The U.S. trend short-term safe real interest rate or r-star has changed over the decades, driven by productivity growth, labour force growth and the global demand for safe assets (i.e. U.S. Treasuries) since the 1980s. All of these factors are pushing the real interest rates to well into negative territory, particularly since the Great Recession as shown on this graphic:

As you can see, the green square and red triangle on the right side of the graphic show that the current Fed interest rates are well above the real short-term safe interest rate trend, suggesting that the Fed should be cautious in raising rates further. As well, the negative real yield experience in the United States is shared by both Germany and Japan, showing that low safe real interest rates are a global phenomenon.

3.) The U.S. yield curve is relatively flat:

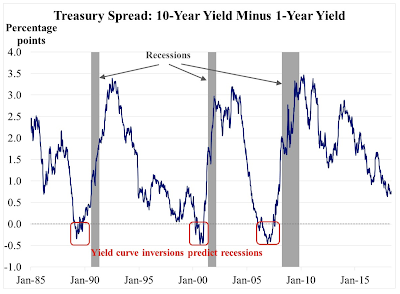

Economists know only too well that, when yield curves invert (i.e. short-term interest rates are higher than long-term interest rates), an economic contraction is in the offing. Here is some historical data showing how the spread between one- and ten-year Treasuries can be used to predict U.S. recessions:

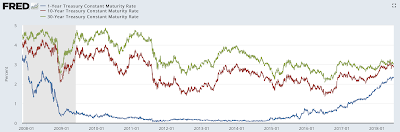

Since 2014, the U.S. nominal yield curve has been flattening as shown here:

Over the past year, the spread between one- and ten-year rates has fallen from 0.94 percentage points to 0.55 percentage points and the spread between ten- and thirty-year rates has fallen from 0.56 percentage points to 0.15 percentage points. This is due to rising short-term rates and stable long-term rates; in other words, the Fed has been completely unsuccessful at pushing longer term rates higher no matter what they have raised short-term rates.

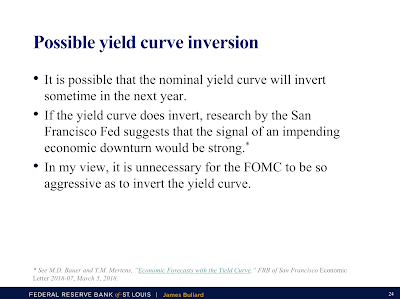

Here is a slide from his presentation noting the potential impact of this trend should it continue:

Here is the conclusion from his presentation:

“Inflation expectations in the U.S. remain somewhat low, suggesting that further normalization may not be necessary to keep inflation near target. The current level of the U.S. policy rate appears to be neutral, meaning it is putting neither upward nor downward pressure on inflation. The U.S. nominal yield curve could invert later this year or in 2019, which would be a bearish signal for U.S. macroeconomic prospects.”

Investors beware. Too much monetary meddling can prove to be disastrous; there’s always a downside to the economy and, as we know, central bankers rarely predict economic contractions.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment