This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Now that CHMC is suggesting that Canada's housing market is not in for a major correction and that it expects that housing prices will actually grow more slowly than they have recently in certain markets, I thought that it was time to take a look at CMHC, also known as "The Canadian Taxpayer" since ultimately, it is our wallets and purses that are responsible for backing CMHC because it is a Crown Corporation.

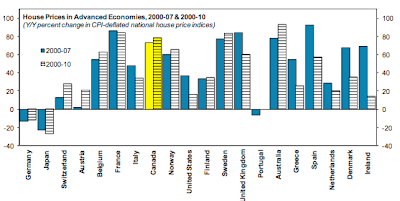

Let's open by looking at house price indices in some of the world's advanced economies between 2000 and 2007 and 2000 and 2010:

Notice that Canada is right up there with Australia, the United Kingdom, Spain and France, all of which have experienced modest to very large price readjustments in the past two years.

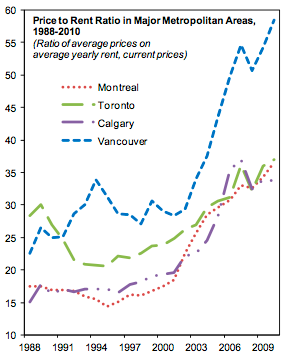

Here is a look at the price-to-rent ratio for four major Canadian centres from 1988 to 2010 which suggests that housing is well over-priced:

Here is a look at who is insuring Canadian mortgages at the end of 2010 according to the IMF:

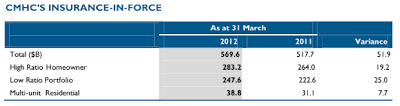

Nearly 50 percent of Canada's outstanding pile of mortgages are insured by CMHC but, even more interesting is the fact that in terms of total volume of insured mortgages, CMHC is estimated to have a 70 percent market share. At the end of the first quarter of 2012, here is the composition of CMHC's mortgage portfolio:

Notice the $569.6 billion number? The value of mortgages that CMHC insures is actually nearly as high as the current federal net debt.

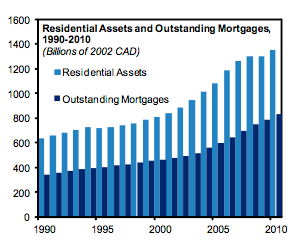

Between 2000 and 2010, the residential assets of Canadian households grew by an annual average of 7 percent. During that same timeframe, mortgage liabilities grew by an average of 8 percent as shown on this graph:

Against this backdrop, CMHC has seen its mortgage portfolio increase more than 1200 percent during that same 2000 to 2010 timeframe.

While I'm not a huge fan of the IMF, in this case I agree with their analysis:

"Our econometric findings suggest that house prices are higher than the levels consistent with current fundamentals in a number of Canadian provinces and that a correction in house prices would have measurable effects on consumption and output through wealth effects. As discussed in the staff report, the authorities have appropriately taken macro-prudential measures to curb the growth of household debt. Given the unsettled global economic environment that could trigger adverse shocks on the Canadian economy, the authorities should remain vigilant to the developments affecting household balance sheets; further macro-prudential measures may be needed if the debt build-up continues."

CHMC is a ticking time bomb. It is not overseen by the Office of the Superintendent of Financial Institutions (OFSI) unlike Canada's banks and, given the importance of its role in the Canadian housing and mortgage market, perhaps it is time that the Harper government seriously consider additional oversight. This is particularly important since it is likely that CMHC will come, sooner rather than later, begging hat in hand for an increase to its $600 billion insurance limit, all of which we are ultimately responsible for.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment