This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…The central bank of central banks, the Bank for International Settlements or BIS has recently published its Annual Report for 2012 – 2013. In this report, the BIS looks at the actions of the world's central banks since the worldwide financial crisis began in 2007 and the effectiveness of the banks prolonged period of low interest rates and record-high balance sheets.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…The central bank of central banks, the Bank for International Settlements or BIS has recently published its Annual Report for 2012 – 2013. In this report, the BIS looks at the actions of the world's central banks since the worldwide financial crisis began in 2007 and the effectiveness of the banks prolonged period of low interest rates and record-high balance sheets.

In the five year period since 2007, central banks were forced to "do whatever it took" to prevent the collapse of the financial system through two means:

1.) Lowering policy rates to zero.

2.) Expanding their balance sheets to what is now, in total, three times the pre-crisis level.

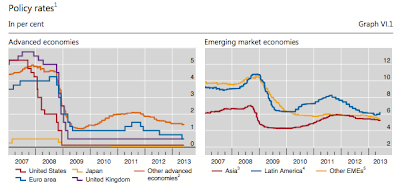

The first action, lowering policy rates, was intended to prevent the impending collapse of the world economy. Here is a graph showing what has happened to policy rates in both advanced and emerging economies as the crisis took hold:

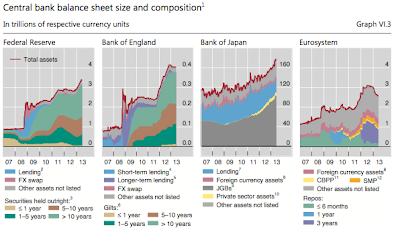

Since then, the goal of central bank policy has changed; the expansion of central bank balance sheets has been used in a desperate effort to prod the world's sluggish economy back to life and to achieve some semblance of strong, sustainable growth. Here is a graph showing what has happened to central bank total assets/balance sheets:

Here is a graph showing the composition of the balance sheets of the Federal Reserve, the Bank of England, the Bank of Japan and the Eurosystem:

Note that total central bank balance sheets were approximately $8 trillion in 2007 and that they now sit just above $20 trillion, more than the GDP of the United States. Outside of the advanced economies, the central banks of the emerging economies have accumulated massive foreign exchange reserves to prevent appreciation of their currencies. The total stock of these foreign reserves is now more than $5 trillion or about half of the world's total stock of foreign reserves.

Here's a paragraph from the first chapter showing us where the problems still lie and who will be to blame when things don't turn around before the next economic slowdown hits:

"What central bank accommodation has done during the recovery is to borrow time – time for balance sheet repair, time for fiscal consolidation, and time for reforms to restore productivity growth. But the time has not been well used, as continued low interest rates and unconventional policies have made it easy for the private sector to postpone deleveraging, easy for the government to finance deficits, and easy for the authorities to delay needed reforms in the real economy and in the financial system. After all, cheap money makes it easier to borrow than to save, easier to spend than to tax, easier to remain the same than to change." (my bold)

The authors of the report note that in some countries, households have made some improvements to their balance sheets, however, the same cannot be said for governments. The government sector seems to be waiting for economic growth to reduce their debt-to-GDP levels, doing the heavy lifting for them, rather than showing budgetary discipline.

The report notes that central bank policies have become less effective "at the margins". For example, there is normally a hefty interest rate premium attached to long-term bonds; this premium is now highly negative in other words, the spread between short-term and long-term interest rates is highly compressed. The prolonged low interest rate policy has had other side effects including:

1.) Excessive risk-taking and distortions in the prices of financial instruments in the marketplace.

2.) Sending signals to various sectors of the economy that it is not necessary to repair balance sheets.

3.) Putting upward pressure on exchange rates and encouraged capital flows to faster-growing emerging market economies and small advanced economies.

So, what does the report recommend as an exit strategy now that central banks may well have painted themselves into a policy corner? Central banks will have to balance the risk of exiting early with the risk of delaying exiting. The issue is even more complex than in the past when central banks simply raised interest rates; this time, there are two complicating factors:

1.) The size of the central banks cumbersome balance sheets.

2.) The extremely high levels of government debt that was issued at fire sale interest rates.

Let's close with another paragraph from the report:

"Alas, central banks cannot do more without compounding the risks they have already created. Instead, they must re-emphasise their traditional focus – albeit expanded to include financial stability – and thereby encourage needed adjustments rather than retard them with near-zero interest rates and purchases of ever larger quantities of government securities. And they must urge authorities to speed up reforms in labour and product markets, reforms that will enhance productivity and encourage employment growth rather than provide the false comfort that it will be easier later." (my bold)

Perhaps more easily said than done!

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment