This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…A single sentence in a recent IMF Article IV Consultation by the IMF shows us how the world's current economic situation can only be termed "unusual".

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…A single sentence in a recent IMF Article IV Consultation by the IMF shows us how the world's current economic situation can only be termed "unusual".

"Negative interest rates on banks’ excess reserves may need to be introduced in case of renewed strong pressures on the franc."

This key recommendation was made by the IMF to Switzerland's central bank, the Swiss National Bank or SNB. Like the Federal Reserve and other key central banks around the world, the SNB has backed itself into a policy corner by:

1.) Pushing interest rates to zero percent.

2.) Implementing an exchange rate floor for the Swiss franc.

3.) Expanding the size of the country's monetary base from less than 50 billion Swiss francs to 375 billion Swiss francs as shown on this graph:

This has led to a significant rise in the size of bank loans as a percentage of GDP as shown on this graph:

When borrowing is cheap, why not?

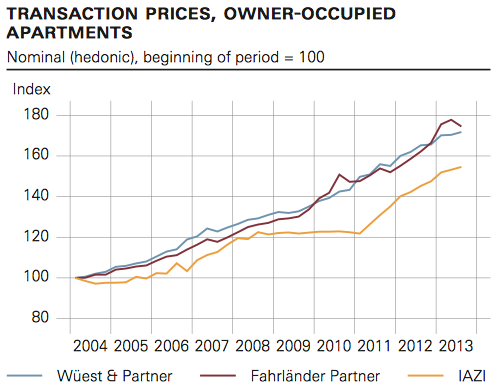

The SNB notes that "…strong lending growth also entails risks for financial stability. In the past, excessive growth in lending has often been the cause of later difficulties in the banking sector." Swiss real estate is feeling the effects of the SNB's long policy of low interest rates with prices for owner-occupied apartments growing at an average rate of 6 percent per year since 2008 as shown on this graph:

To counter this, the IMF recommends that policies be put into place to curb the demand for mortgages and, in particular, to take "…more aggressive policies to discourage vulnerable households from taking on too much mortgage debt…" and that "…this would be an appropriate time to phase out tax incentives that encourage borrowing to finance home buying…". Odd that this didn't seem to be their advice to the United States during the housing price buildup in 2005 and 2006!

These policies and the world's flight to currency security has led to the following problems:

1.) The Swiss franc has risen to 1.13 to the U.S. dollar, well above the rate of 1.048 in March 2013 and 0.88 in March 2009 as shown on this graph:

This is impacting the ability of Swiss exporters to keep their prices competitive with the rest of the world.

2.) Swiss bond interest rates have dropped to extremely low levels as shown on this yield curve:

Note that yields on some bonds maturing between 1 and 4 years were negative in December 2013 and yields on ten year bonds were only 1.1 percent.

3.) Deflationary pressures are becoming problematic as shown here:

Note that core inflation (CPI) was negative for much of 2009, and that it has essentially remained negative since late 2011. Here is a chart showing the Swiss Consumer Price Index components since 2012:

The SNB has backed the Swiss economy into a deflationary cycle, the bane of economists around the world.

Now, back to the IMF and their recommendation for negative interest rates on banks' excess reserves. This recommendation is in sharp contrast to the current policy of the Federal Reserve which pays banks 0.25 percent on excess reserves, a situation that has caused American banks to deposit trillions of dollars in excess reserves with the Fed as shown here:

If a central bank imposes a scenario of negative interest rates on excess reserves to the banking system, the cost of the interest will be ultimately passed along to deposit-holders (i.e. their saving customers), whether through fees or negative interest rates. Under normal conditions, depositors may be willing to pay a small fee for the convenience and security of keeping their money in the bank rather than as cash at home. However, at some point, if negative interest rates become high enough, bank depositors may elect to take their cash out of the system. As well, a brief examination of the issue by the Federal Reserve Bank of New York suggests that there will be systemic changes to how the economy functions. For example, consumers that are owed money will prefer to receive cheques rather than electronic transfers because they can hold off on cashing the cheque, delaying the paying of negative interest rate-related fees. A credit card holder may choose to make a large upfront payment on a credit card and then run down the balance rather than the usual practice of making purchases first and payments later.

In any case, the actions by the world's central banks that were used to avoid The Great Depression Part II are now coming home to roost. By using untried and untested measures to avoid what was a banking system-created crisis in the first place, central banks have backed themselves into a policy corner from which extrication may be painful. We need look no further than the current situation in Switzerland; even though it is small by world standards, the Swiss economy is showing how the impact of unconventional monetary policy can have wide-ranging and unexpected results.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment