This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…Over the past five years since the Fed began its long-term experiment with near-zero interest rates in a desperate attempt to prod the economy back to life, the greatest impact has been on America's savers, most particularly, those who retire and live off the income from a lifetime of savings. How much have savers sacrificed to QE? For the purpose of this posting, I'm looking at non-compounding interest rates on jumbo deposits (i.e. more than $100,000), invested in a five year Certificate of Deposit.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…Over the past five years since the Fed began its long-term experiment with near-zero interest rates in a desperate attempt to prod the economy back to life, the greatest impact has been on America's savers, most particularly, those who retire and live off the income from a lifetime of savings. How much have savers sacrificed to QE? For the purpose of this posting, I'm looking at non-compounding interest rates on jumbo deposits (i.e. more than $100,000), invested in a five year Certificate of Deposit.

Here is a graph from FRED showing interest rates on a five year CD since May 2009:

The first thing to note is that a five year CD is currently paying 0.77 percent. This is down from 2.3 percent in October 2009. Assuming an investment of $100,000, annual interest income has dropped from $2300 in 2009 to just $770 today. Secondly, you should note that interest rates on five year CDs have been below 1 percent since mid-September 2012. That's an interest income haircut of 66.5 percent!

Since FRED does not track interest rates on five year CDs before mid-2009, I'm switching gears a bit so that we can look back past the point where the Fed was really messing with the yield curve. As such, I'm using the Federal Reserve's Selected Interest Rates Historical Data that you can find here. I'm using the interest rates on five year Treasuries between 1953 and the present for the purposes of this posting:

The yield on five year Treasuries peaked at a heady 15.93 percent in September 1981. Yes, those were the good ol' days for savers, weren't they? The yield on Treasuries reached its nadir of 0.62 percent in July 2012 and has remained below two percent since July 2010 except for a very brief three month period in early 2011. The rate currently sits at 1.59 percent. Over the full 61 year period from 1953 to the present, the yield on five year Treasuries averaged 5.79 percent. If we look at the period prior to the Fed's Great Recession meddling (i.e. before November 2008 when QE 1 was announced) and exclude the time since the Grand Monetary Policy Experiment has been in place, the average yield on five year Treasuries rises to 6.21 percent. Since Mr. Bernanke's Experiment began in December 2008, the average yield on five year Treasuries has fallen to 1.52 percent.

Now, let's go back to that imaginary $100,000 that you have lying around, waiting to be invested to provide funding for your retirement years. Using the interest data (interest is paid annually) in the previous paragraph, here are some income scenarios:

$100,000 at 5.79 percent – interest income $5790 per year

$100,000 at 6.21 percent – interest income $6210 per year

$100,000 at 1.52 percent – interest income $1520 per year

Financial planners often banter about the $1 million number as what may be required as savings for retirement, particularly for those retirees that are not covered by a pension plan. If interest rates had remained at or close to their six decade average of 5.79 percent, a million dollars invested would produce interest income of $57,900 annually. Not too shabby and well within what many retirees could live on particularly when other sources of income (i.e. part-time work, government entitlements etcetera) are included. Under the interest rate scenario that has become the new norm since 2008 – 2009, that same million dollars will only produce interest income of $15,200, putting the retirees in a financial bind unless they are willing to draw down the principal, a rather short-sighted approach to the long-term needs of retirement.

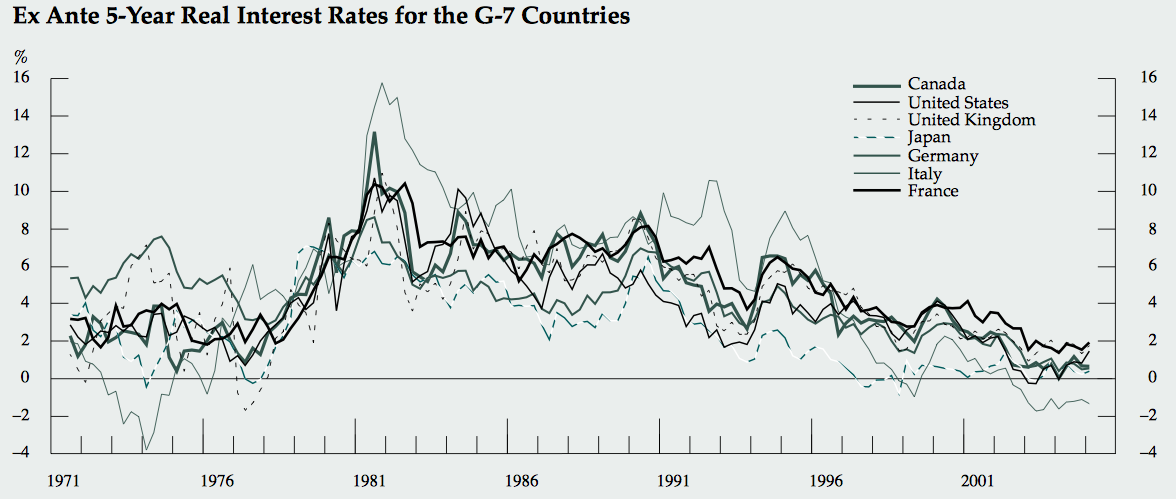

In case you should think that this is an issue facing just American savers, here is a chart from the Bank of Canada showing five year real (i.e. corrected for inflation) interest rates for several key OECD nations between 1971 and 2005:

Note that in several nations, by 2002, real interest rates were either negative or hovering around zero percent. This alone makes it almost impossible for savers to get ahead.

With so much of growth in today's economy requiring spending by consumers, the aforementioned issue may explain part of the reason why the recovery has not been much of a recovery. Quantitative easing and the resulting low interest rate environment has a strong anti-savings bias which, in large part, is its intention. In the current low interest rate environment, there is little point to saving money if one's goal is to increase retirement income Central bankers would much rather have us spend, spend, spend than save, save, save because they view savers as a drag on economic growth whereas, they can rely on spenders to prod the economy back to life. As well, by keeping interest rates low, older savers have been forced to look to more risky investments to make a "living return", ignoring risk in that never-ending hunt for yield. I believe that this is largely why the stock market no longer reflects economic reality rather, it is the unreasonably high demand by desperate and less than experienced investors for overpriced shares in what is currently a very weak economy.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment