This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…FRED, that wonderful source of all things economic, has a lot of interesting data that is there for the taking. As you'll see in this posting, there is one very little discussed aspect of America's housing market that has shown almost no improvement since the end of the Great Recession.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…FRED, that wonderful source of all things economic, has a lot of interesting data that is there for the taking. As you'll see in this posting, there is one very little discussed aspect of America's housing market that has shown almost no improvement since the end of the Great Recession.

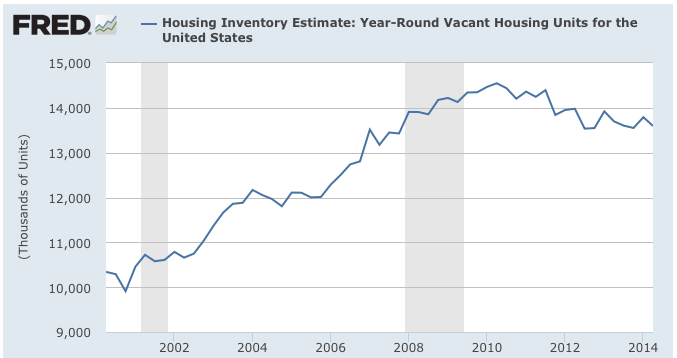

Here is a graph showing the year-round vacant housing units for the United States:

In the first quarter of 2014, there were 13,596,000 housing units in America that were vacant year-round. This includes housing units that are for sale, for rent or those that have been sold but not yet occupied but does not include housing units that are temporarily occupied by persons whose usual residence is elsewhere. It also includes vacant mobile homes. These year-round units are those which are, obviously, intended for year-round use. At its peak in the second quarter of 2010, there were 14,580,000 year-round vacant housing units, up from 13,428,000 in the fourth quarter of 2007 just as the Great Recession began. We can see that while the current number of year-round vacant housing units is down by 6.7 percent from the post-Great Recession peak, it is actually higher than it was at the beginning of the last recession.

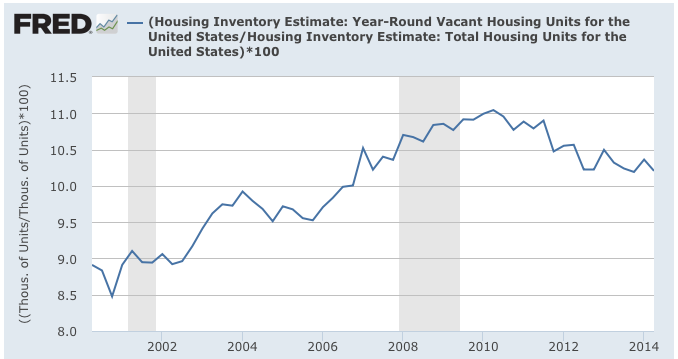

Here is a graph showing the percentage of total housing units in the United States that are vacant year-round:

In the first quarter of 2014, 10.2 percent of all housing units in America were year-round vacant, down from 11.0 percent in the second quarter of 2010 but only slightly lower than the pre-Great Recession level of 10.35 percent.

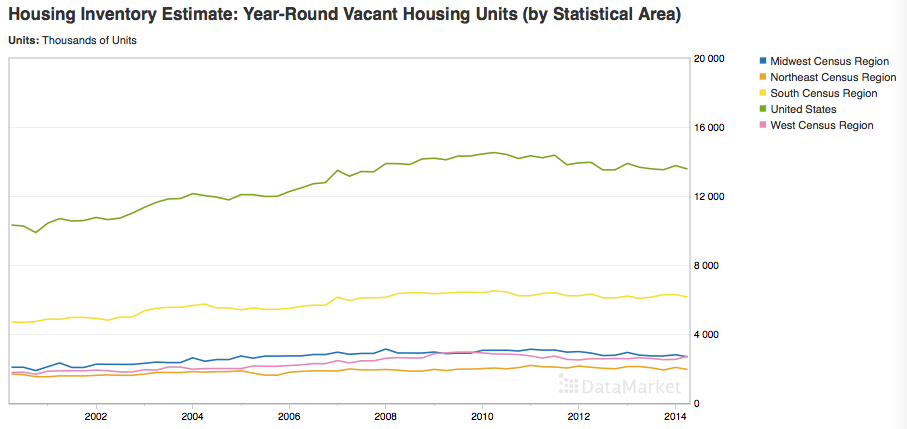

Here is a graph showing year-round vacant housing units by Census Regions since 2000:

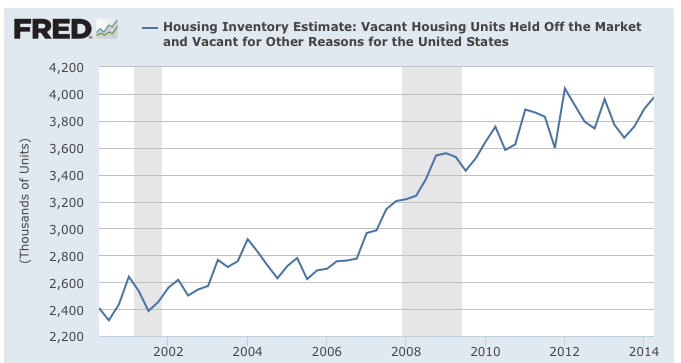

Here is a graph showing the number of vacant housing units that are being held off the market and vacant for other reasons:

Here is how the Census Bureau defines the concept of "vacant for other reasons":

"Included in this category are year-round units which were vacant for reasons other than for occasional use, and units Occupied by persons with usual residence elsewhere. For example, held for settlement of an estate, held for personal reasons, or held for repairs."

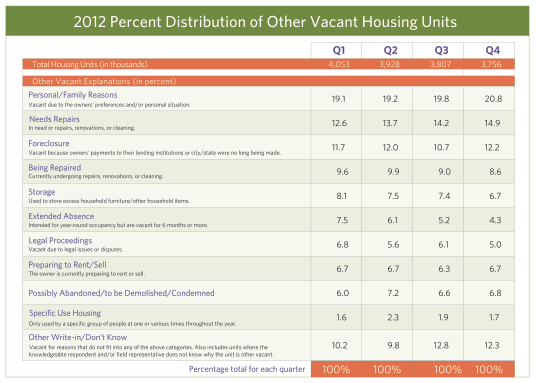

In the second quarter of 2014, a total of 3,975,000 housing units were vacant for the aforementioned reasons. It is interesting to note that this number has steadily climbed from 3,204,000 just prior to the Great Recession, an increase of 24 percent. A study by the Census Bureau in 2012 showed that there were several reasons why there were so many "other vacant" housing units as shown on this graphic:

Note that by the fourth quarter of 2012, 14.9 percent of homes that were vacant for other reasons needed repairs and 12.2 percent were undergoing foreclosure proceedings.

According to Census Bureau data, compared to year-round vacant units, other vacant units were more likely to be units with three bedrooms or more, single family homes, older units built before 1969 and units that had been vacant for more than a year.

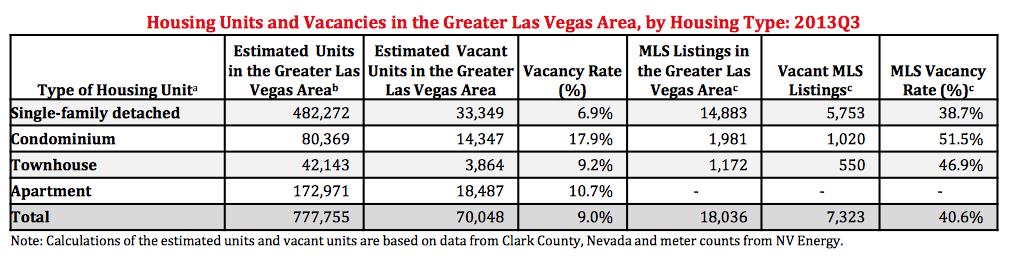

Here is an example of how bad the vacancy issue can be in a given urban area:

Note that in Las Vegas, one of the hardest hit real estate markets in the United States, 17.9 percent of condominiums and 9.2 percent of townhouses were vacant in the third quarter of 2013. Admittedly, this is an improvement over the first quarter of 2013 when the vacancy rates were 19.4 percent and 10.9 percent respectively, however, the real estate situation in Las Vegas can hardly be termed healthy.

The minds behind the Federal Reserve have thought long and hard about this issue. Governor Elizabeth Duke addressed the problem back in October 2012 when she noted that the problem of vacant housing units was not evenly distributed across the United States. In 2012, one-tenth of all census tracts account for nearly 40 percent of the entire vacant housing stock. She noted that homes that are foreclosed but not vacant lower property values by up to 3.9 percent, however, homes that are foreclosed and vacant can lower neighbouring housing values by nearly 10 percent. As well, in general, the longer that a home is vacant, the greater the need for repairs. While she offered no meaningful solutions other than attempting to attract private capital to needy areas and various forms of government assistance, she did state that:

"Solving the problems of long-term vacancies will require the best efforts of public, private, and non-profit leaders locally and across the country. I can assure you the Federal Reserve System will continue to support recovery through the use of all its policy tools and research capacity."

That's a great reassurance to those Americans living in neighbourhoods pock-marked with vacant homes, isn't it? Six years into this economic mess and the Fed still hasn't figured it out!

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment