This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…Let's open this posting by looking at the latest data on the Federal Reserve's balance sheet. Since the Federal Reserve began its unprecedented involvement in the United States bond market, its balance sheet has ballooned as shown on this graph:

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…Let's open this posting by looking at the latest data on the Federal Reserve's balance sheet. Since the Federal Reserve began its unprecedented involvement in the United States bond market, its balance sheet has ballooned as shown on this graph:

In the latest Federal Reserve Statistical Release, on November 12, 2014, the Fed held $2.451 trillion in U.S. Treasuries, mainly nominal notes and bonds, up $329.9 billion from the previous year. As an aside and just in case you were curious, the Fed now provides those of us that are interested with a transaction level database so we can see when the Fed bought and sold Treasuries, who the counterparty was and a description of the security bought or sold. Unfortunately, the database is two years behind (I have no idea why there is such a long delay) but in the latest report which reflects the activity in the quarter ending September 30, 2012, there were nearly 8050 transactions with Morgan Stanley and Co. being the counterparty (seller or buyer) in nearly 2500 of those transactions, by far the largest beneficiary of the Fed's activities in the bond market during that quarter.

According to SIFMA, at the end of October 2014, there were $8.1997 trillion in Treasury notes and $1.5471 in Treasury bonds outstanding. This means that the Federal Reserve holds 25.35 percent of all outstanding Treasury notes and bonds. With that kind of "Treasury muscle", the great minds at the Federal Reserve should have a great deal of control over the direction of future interest rates; unfortunately, it doesn't necessarily appear to be the case. Despite the fact that the Federal Reserve has announced that it is going to wean the American economy from its long-term monetary policy of pushing interest rates to the zero bound, the bond market, particularly in longer 10 and 30 year bonds has not reacted as one would expect.

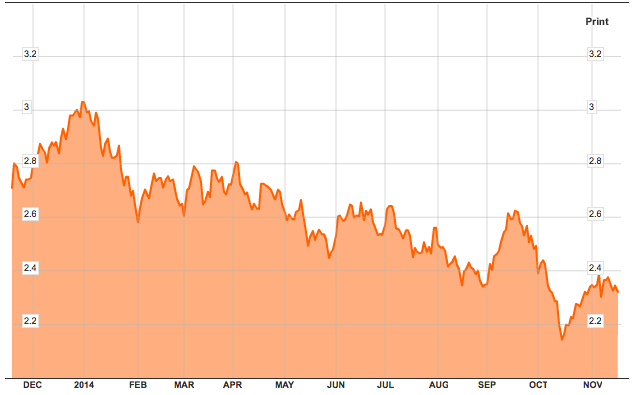

Here is a chart showing what has happened to yields on 10 year Treasuries over the past year:

Yield on 10 year Treasuries are currently between 2.3 and 2.4 percent, down from a high of 3 percent back in January 2014. Yields are just above their year-long closing low of 2.1 percent in mid-October 2014 around the time that the Fed announced that its purchase of Treasuries was coming to an end.

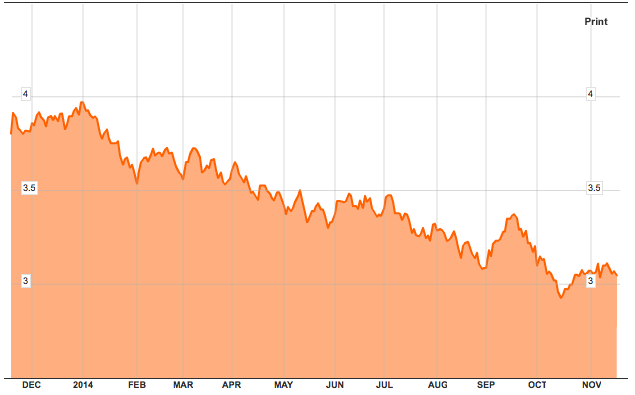

Here is a chart showing what has happened to yields on 30 year Treasuries over the past year:

Yields on 30 year Treasuries are currently between 3.0 and 3.1 percent, down from a high of 3.9 percent in January 2014. Yields are just above their year-long closing low of 2.95 percent in mid-October 2014, again, around the time that the Fed announced the end of its monetary experiment.

One would think, that under normal circumstances, the Federal Reserve's announcements over the past year and a half that QE was coming to an end would push Treasury prices down (as the Fed's demand for Treasuries dries up) resulting in higher and higher yields If you have forgotten, former Fed Chair Ben Bernanke first announced that the Fed could begin to taper back in June 2013 and reiterated his stance in the September 18, 2013 press conference where he stated:

"In light of this cumulative progress, the FOMC concluded at our June meeting that the criterion of substantial improvement in the outlook for the labor market might well be met over the subsequent year or so. Accordingly, the Committee sought to provide more guidance on how the pace of purchases might be adjusted over time. The Committee anticipated in June that, subject to certain conditions, it might be appropriate to begin to moderate the pace of purchases later this year, continuing to reduce the pace of purchases in measured steps through the first half of next year, and ending purchases around midyear 2014. However, we also made clear at that time that adjustments to the pace of purchases would depend importantly on the evolution of the economic outlook—in particular, on the receipt of evidence supporting the Committee’s expectation that gains in the labor market will be sustained and that inflation is moving back towards its 2 percent objective over time."

Instead of a gradual rise in interest rates over the past year, as you saw in the 10 and 30 year yield charts, interest rates have been stubbornly heading down, contrary to what one would normally expect. This has happened in the past; back in 2004, Alan Greenspan began to raise the benchmark overnight rate to tighten credit. This resulted in higher short-term interest rates but his plans completely failed when interest rates on the long end of the curve did not increase as they normally would. From what long interest rates are showing us over the past year, it looks like history is repeating itself and the market for Treasuries is totalling ignoring the Fed's signals. In response, the Federal Reserve may have to resort to selling at least part of its massive portfolio of Treasury bonds and notes to force interest rates up at the longer end of the yield curve. Whether the Fed will be forced to sell their ample assets at a loss is anyone's guess.

Apparently even the smartest of central bankers may have forgotten the lessons taught by history.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment