This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

With the volatility in the world's stock and commodity markets being foremost on many investors minds, I wanted to take a look at some recent comments by William White, a Canadian economist. His main claim to fame are his prescient views on the debt crisis of 2008. He is currently the chairman of the Economic and Development Review Committee at the OECD, a position that he was appointed to in 2009. He was the Head of the Monetary and Economic Department of the Bank for International Settlements from May 1995 to June 2008 and spent 22 years in various positions at the Bank of Canada, rising to the position of Deputy Governor of Canada's central bank. For those of you who are not aware of the Bank for International Settlements or BIS, it is a Basel-based organization that was founded in 1930 and is owned by 60 of the world's largest central banks whose home nations make up 95 percent of the world's GDP. The BIS' mission is to act as a central bank for central banks and it functions under a high level of secrecy.

As far back as 2003, Dr. White observed that there was a real estate bubble developing in the United States, and that there was simply too much cheap money available to consumers. With the economy bursting at the seams with money "printed" by the Federal Reserve, America's banking system had to find somewhere for all of that money to go, thus, the invention of increasingly imaginative (and ultimately toxic) financial products. At the time, central bankers universally agreed that if there was no inflation, there was no problem, totally ignoring the development of asset bubbles. Dr. White suggested that interest rates should be raised even when the economy is in good shape and there is no sign of inflation since this would counteract the formation of asset bubbles and will allow central banks to rearm their monetary policy "tool kits" so that they can lower interest rates when the economy inevitably turns down. His suggestion would have prevented the Federal Reserve and other central banks from painting themselves into a policy corner as they have now with their prolonged period of near-zero interest rates.

Now, in light of the volatility in the world's markets, let's look at some of Dr. White's more interesting comments from one of his recent speeches. Here are some excerpts from a speech entitled "False beliefs and unhappy endings" given on December 11, 2015 in Canada. Any bolds are mine:

"In a nutshell, central bankers in the major advanced economies have been pursuing increasingly risky policies for some time. In large part,this reflects the political reality that monetary policy is the “only game in town”. Yet, in no small measure, it also reflects some long held, but false, beliefs about how the economy actually works. Moreover, absent any discipline imposed by an international monetary system (we have in fact a non-system), virtually every central bank around the world is now engaged in a process of unprecedented monetary easing. As a result, I think the global economy could now be in an even more dangerous situation than it was in 2007…

It is now impossible to deny that something has gone seriously wrong with the global economy. Moreover, for most economists, it seemed to come out of nowhere and its effects have lingered far longer than most originally anticipated.

While recognizing the great contribution of central banks to restoring financial stability, early in the crisis, there are good reasons for doubting that monetary policy will prove effective in stimulating aggregate demand over time. Much of what has been done recently smells of panic. Arguably, by increasing uncertainty, it might even have encouraged people, both companies and households to hunker down and spend less rather than more. What is more certain is that easy money works by bringing spending forward in time. However, by definition, tomorrow eventually becomes today and it is payback time. In short, inciting more spending through taking on higher levels of debt simply cannot go on forever. And not only has debt accumulation been accelerating for over thirty years, in the advanced market economies, but global debt ratios (non-financial debt) have even risen substantially since 2007…with US interest rates so low and the dollar falling in value (up to mid 2014), much of the borrowing was in US dollars. With the dollar now rising, a mismatch problem could threaten barring an adequate level of prior hedging. Finally, much of the proceeds went into enlarging the capital stock in sectors (like property) where profits are already under strong downward pressure.

As for the unintended consequences, we are observing sharp declines in productivity growth almost everywhere and a slowdown in the formation of new businesses. I think it is not implausible that easy money has encouraged the “evergreening” of zombie companies by zombie banks which has led to this outcome. Moreover, we are all aware of how the prices of almost all assets, financial certainly but also property in many cases, have been bid up to levels where potential future losses might conceivably be severe. Who will suffer and what might be the systemic implications? We simply do not know. Monetary policy has led us into truly uncharted territory. Perhaps when (if?) the Fed starts raising rates, we will get more clarity on these issues, though we might not like what we see.

Finally with respect to unexpected consequences, the health of many financial institutions (especially in the advanced market economies) are also under threat. Bank profits, needed for capital accumulation, are being reduced by low credit spreads and low term spreads. Pension funds and insurance companies, whose liabilities tend to be of longer duration than assets, are similarly threatened and fearful of their longer term solvency. Everywhere, there is the temptation to “gamble for resurrection”, again with unknown consequences.

To boil down Dr. White's comments to one key point, he is concerned about the massive growth in debt, particularly toxic debt, over the last eight years because of near zero interest rates. Let's look at a few examples:

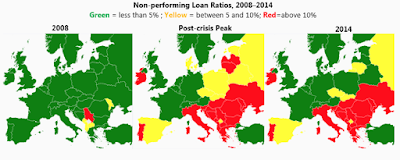

1.) Here is a graphic from Vox showing how Europe's non-performing loans by country have risen since 2008:

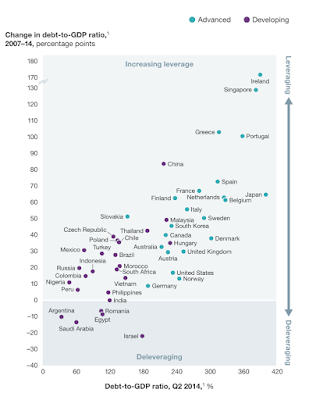

2.) Here is a graphic from McKinsey showing how the global sovereign debt-to-GDP ratio has risen by measuring the change in debt-to-GDP ratio from 2007 to 2014:

The ratio of debt-to-GDP has risen for all advanced economies since 2007 and has fallen or remained steady for only six developing economies.

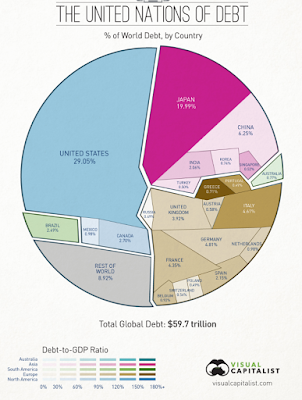

3.) From Visual Capitalist, here is a graphic showing the percent of total global debt by country, current to August 2015:

While the United States economy makes up 23.3 percent of the world's GDP, it has 29.1 percent of the world's total sovereign debt. Japan's economy makes up 6.18 percent of the world's GDP but has 19.99 percent of the world's total sovereign debt.

4.) Here is what has happened to non-financial corporate debt levels in the United States since 2007, keeping in mind that a great deal of this debt is considered "junk":

While there was relatively modest corporate debt deleveraging during and immediately after the Great Recession, non-financial corporate debt is now $1.403 trillion or 21 percent higher than it was in the third quarter of 2008. This is due, in no small part, to ultra-low interest rates on corporate paper.

It has become increasingly apparent that the next recession could well be different. All levels of the economy have leveraged up as central bankers have prolonged their long-term interest rate experiment. Governments, businesses and individuals (particularly in nations like Canada) have lined up at the trough, eagerly availing themselves of ultra-cheap credit without thought for the long-term ramifications of their foolishness. As Dr. White noted so aptly, central bankers have failed to realize that the nature of the global economy is far too complex to be well understood.

Let's close this posting with a recent quote that Dr. White gave to the Telegraph:

"It will become obvious in the next recession that many of these debts will never be serviced or repaid, and this will be uncomfortable for a lot of people who think they own assets that are worth something."

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment