This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

While I don't want to sound like a broken record, it is becoming increasingly clear that the Federal Reserve, other central banks and governments around the world are laying the foundation for a negative interest rate environment that will more than likely be imposed during the next recession. Governments are involved because they play a very key role in any movement toward negative interest rates since it is obvious that if consumers are paying for the "privilege" of holding funds in a bank, many will simply convert at least some of their savings to cash, an issue that could prove to be problematic since the whole point of negative interest rates is to get consumers to spend more. Obviously, the only way to beat consumers at this game is to put an end to cash, one way or another.

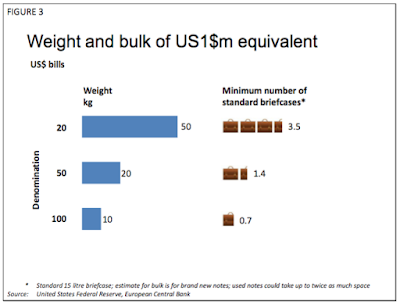

A recent item by former Treasury Secretary under Bill Clinton, former Chief Economist for the World Bank and current Harvard University Professor, Lawrence Summers, in the Washington Post acts as a bit of a trial balloon for the impending "cashless society" by noting that "It's time to kill the $100 bill". In the item, Lawrence Summers cites his reasons for the abolishment of the 500 euro note, including the oft-cited "fact" that the criminal and terrorist spheres operate using high denomination currency. He points out that the 500 euro note is known as the "Bin Laden" and that the fact that $1 million in $100 notes weighs only 22 pounds compared to 110 pounds (filling four briefcases) if a $20 bill was the highest denomination note as shown on this figure:

Here is the closing paragraph of his item:

"Even better than unilateral measures in Europe would be a global agreement to stop issuing notes worth more than say $50 or $100. Such an agreement would be as significant as anything else the G7 or G20 has done in years. China, which is hosting the next G-20 in September, has made attacking corruption a central part of its economic and political strategy. More generally, at a time when such a demonstration is very much needed, a global agreement to stop issuing high denomination notes would also show that the global financial groupings can stand up against “big money” and for the interests of ordinary citizens."

I like that, "for the interests of ordinary citizens". It has a nice, homey ring to it, doesn't it?

In the item, Dr. Summers quotes from a study by Peter Sands et al at Harvard's Mossavar-Rahmani Center for Business and Government entitled "Making it Harder for the Bad Guys: the Case for Eliminating High Denomination Notes". In the study, the authors look the flow of illegal money and the impact of illicit money flows on tax revenues, global financial crimes and other corruption. Let's look at their argument for ending what they consider high currency notes:

1.) Illicit flows of money results in tax evasion which robs the public sector of between 6 and 70 percent of what tax authorities estimate that they should be collecting. In the United States, the IRS estimates that in 2006 (the latest year available) that there was a tax gap of $385 billion or 14.5 percent of total tax liabilities. In nations were Value Added Taxes are part of the tax system, cash receipts are often undeclared; in 2011, across the EU, the VAT tax gap mounted to 193 billion euros in 2011.

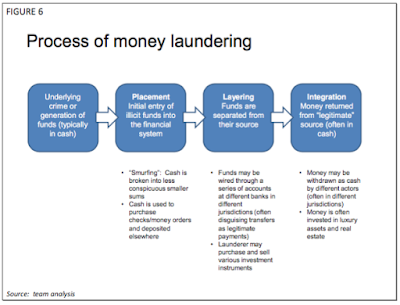

2.) Global financial crime money flows (excluding tax evasion and corruption) are estimated at over $2.1 trillion annually (2011 data) or 3.6 percent of global GDP. Here is the mechanism used to break the link between crime and cash:

3.) Corruption through the use of illicit cash amounts to $1 trillion annually. The World Bank estimated that total bribes around the globe added up to $1 trillion back in 2001 – 2002 or around 5 percent of global GDP.

4.) Less that 1 percent of illicit cash flows are seized.

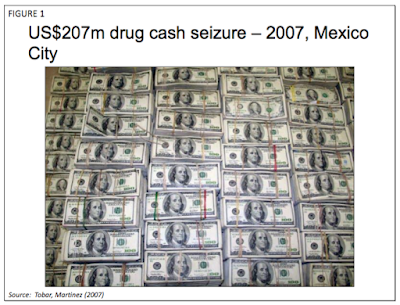

To make their point, the authors even include this picture of seized $100 bills:

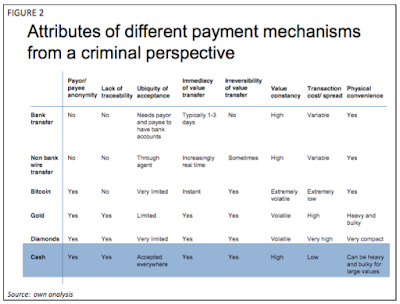

The authors note that high denomination notes are the payment choice for those people that are trying to evade taxes, commit crimes, finance terrorism or pay/receive bribes and that a stack of high denomination bank notes is far more attractive than dealing with precious metals, diamonds or bank transactions. Here is a table showing the advantages and disadvantages of several methods of payment that could be used by criminals:

The paper goes on to note that, in the United States, cash payments account for 40 percent of payments by number but only 14 percent by value. Only 1 percent of payments by number were cash payments over $100 which corresponds to 5 percent by value.

The authors close by refuting several arguments for retaining high denomination notes. I found this comment in the section under "High Denomination Notes as a Way to Save or Hoard" particularly interesting:

"There may well be some legitimate hoarding or saving driven through fears of calamities such as the collapse of the banking system, societal breakdown, or cybercrime. There was some evidence of increased demand for high denomination notes in the wake of the financial crisis in 2008. However, the question is whether issuing high denominations represents a sensible policy response to such fears. For example, if people are holding high denomination notes to protect themselves against the risk of the banking system collapsing, surely deposit guarantee schemes and robust prudential regulation represent a more effective response? Moreover, if what we are talking about is normal people hoarding relatively small amounts of money (tens of thousands not millions) in safes in their own homes, then the added inconvenience of holding smaller denominations is probably a price worth paying for the benefits of eliminating high denominations.

There may also be hoarding or saving driven by libertarian antipathy towards institutions like banks and governments. For example, Hennigsen at the Centre for Research on Globalisation: “It has long been the dream of collectivists and technocratic elites to eliminate the semi-unregulated cash economy and black markets in order to maximize taxation and to fully control markets…If the cashless society is ushered in, they will have near complete control over the lives of individual people”. Discounting the hyperbole, there is a legitimate concern about the extent to which official scrutiny of electronic payment transactions might infringe civil liberties and the right to privacy. Yet we face this issue already. Most people’s savings and higher value transactions are potentially subject to scrutiny because they are conducted and held within the banking system. Yet if society has decided that this is something we are prepared to tolerate to tackle financial crime, then it would seem perverse not to extend such scrutiny to the self-selected subset of the population that use high denomination notes to transact and save." my bold

Given all of this data, much of which is basically very rough estimates given that it is impossible to quantify the use of illicit cash, the authors recommend the following:

"Our proposal is to eliminate high denomination, high value currency notes, such as the €500 note, the $100 bill, the CHF1,000 note and the £50 note. Such notes are the preferred payment mechanism of those pursuing illicit activities, given the anonymity and lack of transaction record they offer, and the relative ease with which they can be transported and moved."

While the authors present a thorough argument for abolishing what can only be considered relatively high denomination notes, particularly the U.S. $100 bill, when taken into context with the current negative interest rate policy trial balloons being floated by the world's central bankers, any moves to abolishing these notes could be the top of the slippery slope that leads to an eventual end to cash of all forms.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment