This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Recent comments from the President of the Boston Federal Reserve Bank have gone pretty much unreported by the mainstream media, however, they give us a glimpse into what could be an unanticipated change in the Fed's monetary policies. While everyone has grown accustomed to the dovish tone of Ms. Yellen's interest rate pronouncements, at least one of her Fed colleagues is looking increasingly hawkish, an issue that should be of concern to both equity and bond investors.

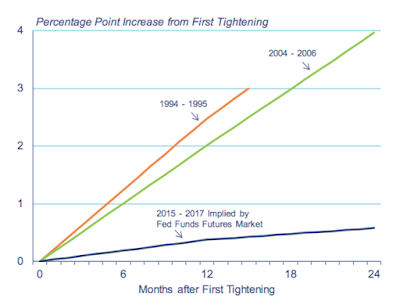

A recent speech entitled "Are Financial Markets Too Pessimistic About the Economy" given by Boston Fed President Eric Rosengren at Central Connecticut State University he points out the strengths in the U.S. economy including dropping unemployment, rising labor force participation and inflation that is closer to the Fed's two percent target. Despite the turbulence in the global market, he notes that the U.S. economy and stock market have remained resilient. He also observes that the current prices in financial markets, particularly the Treasury market, reflect the expectation that there will be very few interest rate increases than have been historically normal when the Fed begins to raise rates after a recession with Fed Fund futures reflecting the expectation that interest rates will rise only one-quarter of a percentage point in each of the next three years for a total of three-quarters of a percent by the end of 2018. Here is a graphic from his presentation showing the anticipated Federal Funds interest rate path in the current recovery as well as the interest rate paths for the post-recession period from the previous two recessions:

As you can see, investors are anticipating that the slope of tightening in this later years of this economic expansion will be far lower than either the period between 1994 – 1995 and 2004 – 2006.

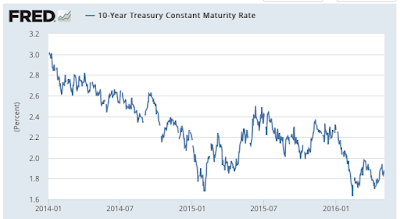

Here is a graphic showing what has happened to the yield on ten-year Treasuries since the beginning of 2014:

This strongly suggests that investors have largely been ignoring any future interest rate increases and are behaving as though the Fed Funds rate will remain at historical lows.

Now, let's look at what Eric Rosengren had to say about the future trajectory of interest rates in his speech:

"While I believe that gradual federal funds rate increases are absolutely appropriate, I do not see that the risks are so elevated, nor the outlook so pessimistic, as to justify the exceptionally shallow interest rate path currently reflected in financial futures markets. The forecast for economic variables contained in the most recent Fed policymakers’ Summary of Economic Projections is consistent with my own estimate – GDP growth slightly above potential and a continued slow decline in the unemployment rate.

Furthermore, I would point out that the extremely shallow rate path reflected in the market for federal funds futures seems at odds with forecasts by private sector economists and by financial firms that serve as counterparties to the Federal Reserve (the so-called primary dealers), as well as my own forecast for the U.S. economy. Most of these forecasts envision a much healthier U.S. economy than is implied by that unusually shallow path of the funds rate, and many of the major private forecasters expect short-term rates to rise more rapidly than implied by financial futures."

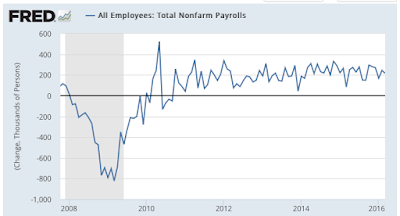

One of the key issues that Mr. Rosengren expects will put upward pressure on interest rates is employment. He anticipates that the unemployment rate, currently sitting at 5 percent, will continue to drift downward. His interpretation is that the unemployment rate is already close to his estimate of full employment which is at the 4.7 percent level, particularly with the economy creating roughly 200,000 jobs monthly as shown on this graph:

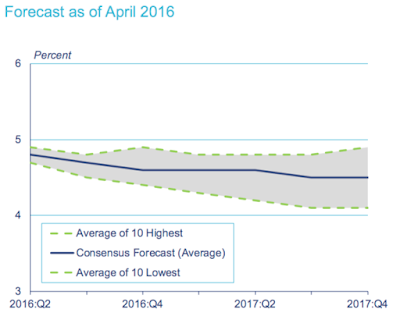

If the economy were to continue to create jobs at the current rate, the unemployment rate could fall well below the natural rate of unemployment, the lowest rate of unemployment that the economy can sustain over the long run without raising the spectre of inflation. Here is a graph showing the Blue Chip forecast for the unemployment rate out to the end of 2017 showing that most experts anticipate that the economy could overshoot the full employment target:

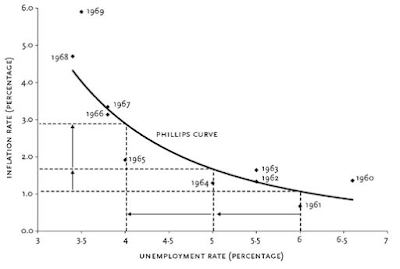

The only way that unemployment can fall below its natural rate is if inflation rises, as shown on the Phillips Curve for the years between 1961 and 1969:

If falling unemployment led to inflation that was higher than the Fed's 2 percent goal, the Fed would be forced to act rapidly, abandoning its current dovish sentiments by increasing interest rates.

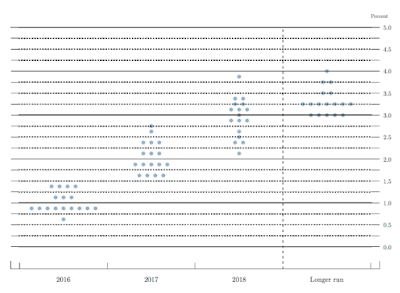

If we look at the latest dot plot from the Federal Reserve, we can see that by 2018, half of the FOMC members feel that the appropriate Federal Funds rate would be in excess of 3 percent, more than 2.5 percentage points above the current level of 0.5 percent:

This is far above the 0.75 percentage point increase that the financial markets are anticipating.

As we can see from this speech by Boston Federal Reserve Bank President Eric Rosengren, the "new normal" of low interest rates is something that cannot be counted on. It also shows us that the braintrust at the Federal Reserve is just as uncertain about the future direction of the economy as the rest of us. That said, investors should be aware that the Fed could abandon its current monetary policy at any point in the future, a move that would put significant downward pressure on overheated equity and bond valuations.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment