This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Trillions of dollars worth of sovereign bonds are now trading with a negative yield, largely as a result of the actions of the world's central bankers who are discovering that the effectiveness of seven years of non-traditional monetary policies like quantitative easing and "The Twist" are dwindling. Global economic growth is stagnating despite more than half a decade of zero interest rates, the intention of which was to prod consumers to spend and banks to lend, meaning that central banks are increasingly turning to the completely unproven ability of negative interest rates to restart the global economy. Like the massive asset purchases during quantitative easing, central bankers really have no concept of the unintended consequences of negative interest rates although, recent research by ING, an Amsterdam-based bank, gives us some idea.

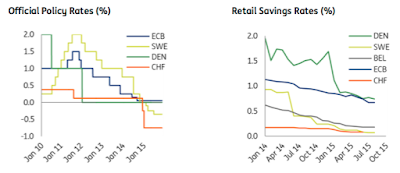

Researchers at ING surveyed 13,000 consumers in Europe, Australia and the United States, asking them how they will react if/when interest rates become negative. This is looking more and more likely given what has happened to central bank policy rates and retail savings interest rates in Europe as shown here:

The current European Central Bank official deposit rate sits at -0.2 percent and is expected to drop even further into negative territory given that the current negative rate really has done little to stimulate economic growth in Europe.

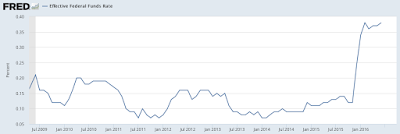

For completeness sake, here is what has happened to retail savings rates (savings accounts with balances of less than $100,000) in the United States:

This sustained and lengthy drop in interest rates is interesting given that the Federal Reserve actually raised its policy rate by 0.25 percent back in December 2015 as shown here:

The question asked by ING was as follows:

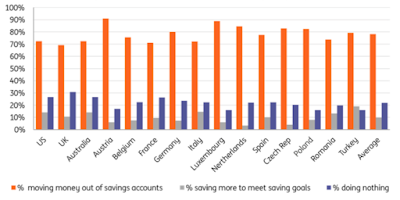

"What would you do if the interest rate(s) on savings account(s) fell below 0 percent, for example to -0.5 percent, so that you would receive less money in the future than you originally saved?"

Here is a graphic showing the responses of 13,000 people from 15 nations with the percentage of people who would pull their money out of a savings account in orange, the percentage of people would who save more to ensure that they met their savings goals in grey and the percentage of people who would do nothing in blue:

Banks should be very concerned that people would start withdrawing savings if they started charging on deposits in a negative interest rate environment. Obviously, even though an average of 78 percent of people in the fifteen nations state that they would withdraw money from their savings accounts if they were charged by the banking system for their savings, inertia would settle in and many would just pay whatever fees would charge so the 78 percent response is likely somewhat on the high side. What is of more concern is that only 12 percent of respondents state that they would spend more, the entire purpose of pushing interest rates into negative territory in the first place.

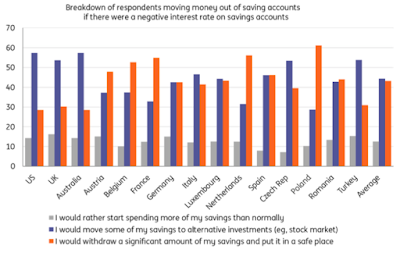

Let's look at more details about the behaviours of the 78 percent of people that state that they would withdraw money from their savings accounts in a negative interest rate environment. On average, Of those, 43 percent of those would would withdraw money from their savings accounts state that they would hoard cash (as shown in orange), 44 percent would move their savings into other investments (i.e. the stock market) (as shown in blue) and 13 percent would spend more than they normally would as shown in grey on this graphic:

Let's look at one last graph which shows the massive growth in the size of the savings glut sitting in American savings accounts since the beginning of the Great Recession:

While the amount of money sitting in American savings accounts stalled during the Great Recession, it has grown from $4.471 trillion in June 2009 to $8.477 trillion in July 2016, an increase of 90 percent. One would have to think that the U.S. banking sector would love to see an negative interest rate policy that would allow them to charge their customers for the "privilege" of holding this massive pile of money in savings accounts. After all, the banking sector is particularly creative when it comes to implementing new policies that improve their profits.

The efficacy of negative interest rates in stimulating the economy is highly suspect, given that the near zero policies of the past seven years have had no lasting impact on stimulating real spending by either consumers or businesses. Unfortunately, central bankers seem to learn the lessons taught by their marginally effective policies about the same time as they experience the unintended negative consequences of poorly executed monetary experiments.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment