This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

In this, my last posting of 2016, I want to examine the story of the year, the rather miraculous performance of the U.S. stock market, particularly since Donald Trump’s surprise win in November.

Here is a chart showing the one year performance of the Dow Jones Industrial Average:

During the first two months of 2016, Dow fell from its 2016 opening level of 17,405 to a low of 15,460 on February 11. It rose to its 2016 high (and all-time high) of 19,987 on December 20, an increase of 14.8 percent from its 2016 opening level. It has retreated to its closing level of 19,819 on December 29, however, the index still shows a year-over-year gain of 13.9 percent. Interestingly, and by way of comparison, here is what happened to growth in after-tax corporate profits on a year-over-year basis since the beginning of the Great Recession:

Profits in the third quarter of 2016 grew by 4.3 percent on a year-over-year basis, the strongest growth rate since the third quarter of 2014.

Since I haven’t visited Robert Schiller’s CAPE or Cyclically Adjusted Price-Earnings Ratio also known as the P/E 10 Ratio since August, I thought it was time to take another look at what this indicator suggests about the current level of the stock market. The CAPE Ratio is defined as follows:

“…the price of stocks (or the stock market as a whole) divided by the moving average of ten years of earnings adjusted for inflation.”

Higher than average CAPE Ratios suggest that there will be lower than average long-term annual returns and lower than average CAPE Ratios suggest that there will be higher than average long-term annual returns on stocks.

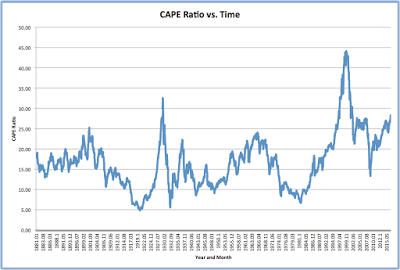

Here is a line graph showing how the CAPE Ratio has varied on a monthly basis since 1881:

There are 1631 data points in Dr. Schiller’s analysis which provide us with an average CAPE Ratio of 16.63 over the 135 year period keeping in mind that this includes the extremely anomalous CAPE Ratios that resulted from the tech sector bubble in the early 2000s.

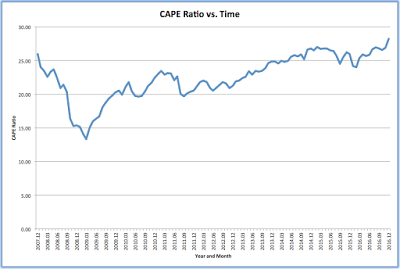

Let’s focus on the period of time since the Great Recession began at the end of 2007:

As you can see, the CAPE Ratio fell to a low of 13.32 in March 2009, the lowest level since March 1986 when the CAPE Ratio stood at 13.19. Over the past six and three-quarters years, the CAPE Ratio has risen to its current level of 28.26 in mid-December 2016, an increase of 112.2 percent. That said, the current CAPE Ratio is very high compared to the long-term average, in fact, at 28.26, it is 69.9 percent above its 135 year average as noted above.

The current level of the CAPE Ratio suggests that the stock market is significantly overvalued, unfortunately, the CAPE Ratio does not telegraph when the stock market will return to normal valuations. My suspicion is that the flight out of the bond markets have led investors into equities and that only time will tell when sanity returns and market valuations better reflect the reality of stagnant profit growth.

Click HERE to read more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment