This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

A financial news story from earlier this week received very little media attention, particularly considering its importance in the scheme of the unwinding of both the Euro and the European Community and the world’s overall sovereign debt crisis.

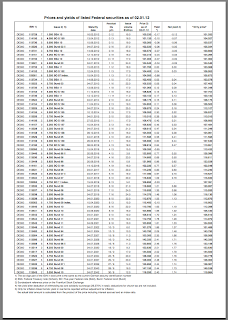

A financial news story from earlier this week received very little media attention, particularly considering its importance in the scheme of the unwinding of both the Euro and the European Community and the world’s overall sovereign debt crisis.On January 9th, the Bundesbank, Germany’s central bank, auctioned 6 month German Treasury discount paper maturing on July 11th, 2012. A total of €3900 million was auctioned with bids received for €7080 million. Here is a summary press release from the Bundesbank showing the results of the auction:

Notice that the lowest accepted price was 100 percent and the weighted average price was 100.00616 percent with average yield over the entire auction of negative 0.0122 percent. Yes, you read that correctly, the yield on a 6 month German Treasury was negative! In case you are confused, remember that Treasuries (including those of the United States, Canada, the United Kingdom et al) are purchased at a discount and redeemed at full value. For example, a one year Treasury yielding 3 percent will be purchased at a 3 percent discount from its maturity value and then redeemed for 100 percent of its value upon maturity. In this week’s case, purchasers of German Treasuries actually paid an average of €100.00616 for every €100 worth of Treasuries that they will only be able to redeem for €100 on July 11th, 2012.

This is the first time in history that a Bundesbank auction of short-term German government bonds have resulted in a negative yield. This means that buyers of the German Treasuries are actually paying the Bundesbank for the privilege of owning their paper.

This is not the first time that German bonds have traded with a negative bond yields, however, in the other cases, the yields became negative on the open bond market as shown here:

Notice that all of the short-term bonds maturing in 2012 at the top of the list have negative market yields.

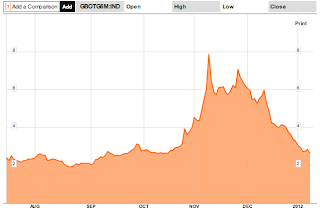

This is not the first time that European government issuers have auctioned bonds with negative yields. Switzerland, Denmark and the Netherlands have all recently sold bonds at negative yields. This shows us just how desperate the world’s sovereign debt situation has become. Major bond investors are either avoiding the bonds of debt-encumbered Eurozone nations or demanding punishingly high yields as shown here in the case of Italy’s 6 month bonds:

Why would anyone purchase a bond with a negative yield? First, risk avoidance has become the name of the game. Investors are looking to hide their cash wherever they perceive safety, unfortunately, safety is just an illusion. Second, Europe’s private sector banks can purchase government bonds and use them as collateral against funds that they wish to borrow from the European Central Bank. These funds which are borrowed from the ECB, most recently at 1 percent, are then loaned to consumers. Unfortunately, the credit market in the Eurozone is very tight, with credit standards rising as shown in this article. This is part of the problem facing the Eurozone; banks no longer trust each other, consumers and corporations and are depositing their overnight funds with the ECB rather than with other banks.

Seeing negative yields on rising levels of sovereign debt is a relatively new phenomenon. Remember, that while Germany is the most prudent of the Eurozone nations, it still sitting on €1.116 trillion of debt. Bond investors are now choosing among the best of a bad lot but that doesn’t necessarily guarantee that their decisions will pay out over the long term. The fact that any investor would pay any government to hold on to their cash for them is a very telling sign that the system is broken.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment