This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

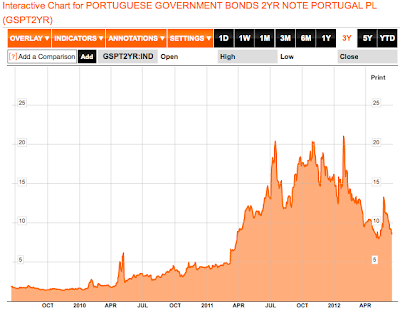

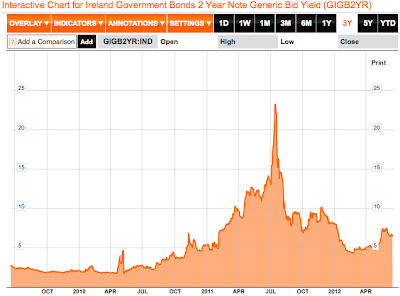

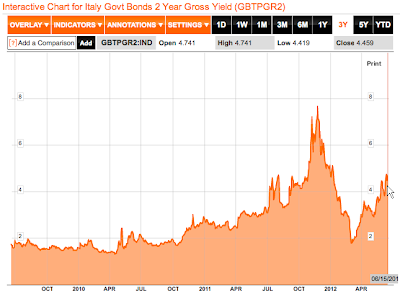

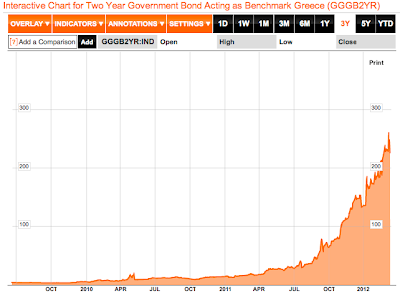

As someone who follows the world's bond market relatively closely, over recent months, I have noticed an interesting trend in European bond yields and have seen yields that I would never have thought possible. I'm going to let several charts do my writing for me, noting that all charts follow the changes in yield over the past 3 years.

Here is the chart showing the yield for 2 year Portuguese bonds:

Here is the chart showing the yield for 2 year Irish bonds:

Here is the chart showing the yield for 2 year Italian bonds:

Here is the chart showing the yield profile for 2 year Greek bonds:

Lastly, here is the chart showing the yield for 2 year Spanish bonds:

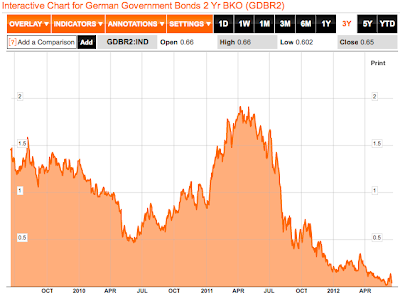

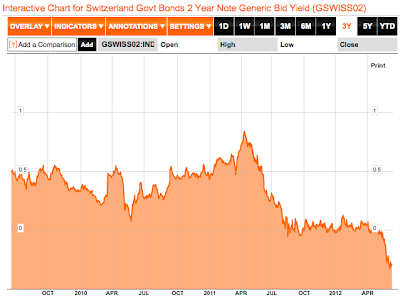

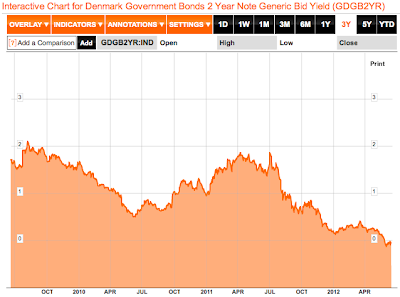

Now, let's look at the contrasting yields on several non-PIIGS European bonds:

Here is the chart showing the yield profile for 2 year German bonds which actually went negative in late May/early June:

Here is the chart showing the yield profile for 2 year Swiss bonds which are currently well into negative territory where they have been for days:

Here is the chart showing the yield profile for 2 year Danish bonds which were negative and are sitting very, very slightly above zero percent:

Lastly, here is the chart showing the yield profile for 2 year Finish bonds:

If we exclude Ireland, there seems to be a very strong north-south split. It's also interesting to see investors' desperate "flight to security"; their willingness to pay to have a nation hold onto their funds for two years and get less back in the end is nothing short of astonishing!

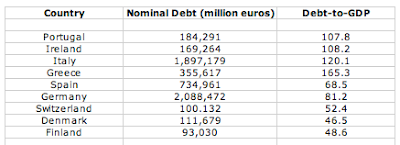

Here is a chart showing the debt, debt-to-GDP profiles for the aforementioned countries current to the end of 2011 according to Eurostat (except Switzerland as linked here):

Germany is definitely getting a pass on its high debt level because of its strong economy, however, that could change if interest rates rise and their debt continues to climb as they are forced to bailout their neighbours.

Since all European nations are sharing a common currency, technically, they should all be sharing similar interest rates, a situation that was the case until the beginning of the Great Recession as shown here:

Now that you've looked at all of these charts, what do you the odds are that Europe will survive in its current incarnation? My suspicion is that the union of the unequals is doomed.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment