This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…In case you weren't aware, the Federal Reserve's H.8 database provides the public (most of who don't pay any attention) with information about the assets and liabilities of the American commercial banking system. Here is some interesting data from the latest version:

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…In case you weren't aware, the Federal Reserve's H.8 database provides the public (most of who don't pay any attention) with information about the assets and liabilities of the American commercial banking system. Here is some interesting data from the latest version:

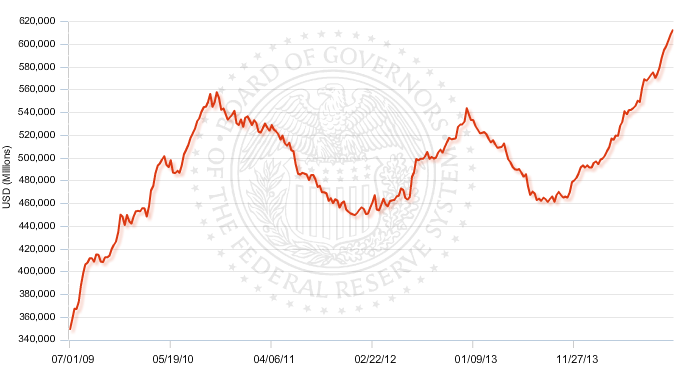

This graph shows us the total Treasury holdings of the American commercial banking system on October 15th, 2014. Right now, America's commercial banks are holding $605.8 billion in Treasuries, down slightly from the previous week's record of $612.5 billion. This, despite the fact that many of nation's market sages are predicting a rise in interest rates that will push down the value of fixed income assets.

Here is a graph showing the growth in the holdings of Treasuries by America's commercial banks over the past year:

On October 23rd, 2013, banks held $465.14 billion in Treasuries; this has grown by $140.7 million or 30.2 percent over the past twelve months.

What is surprising about this information is that, at the same time as banks were going long on bonds (i.e. actually buying bonds), their brokerage arms were recommending that clients go short on bonds because the health of the American economy would mean that interest rates would go up and the value of bonds would drop. By shorting Treasuries, bond investors could profit from the declining value of a Treasury as interest rates rise. We all win!

While banks are advising us that it's pretty much a sure thing if we short bonds through various inverse ETFs and mutual funds issued by them, it is interesting to see that they are taking a completely different approach, buying Treasuries and bringing their own inventories up to record levels.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment