This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…A recent posting by Nerd Wallet examines Americans and their credit card debt. While the data is not terribly surprising, the fact that the Federal Reserve is contemplating an end to their unprecedented zero interest rate policy will cause significant discomfort for American households.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…A recent posting by Nerd Wallet examines Americans and their credit card debt. While the data is not terribly surprising, the fact that the Federal Reserve is contemplating an end to their unprecedented zero interest rate policy will cause significant discomfort for American households.

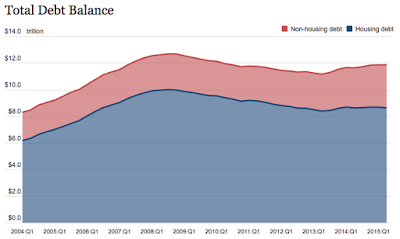

Let's start by looking at what has happened to overall household debt levels as of June 30, 2015 from the New York Federal Reserve Bank:

At the end of Q2 2015, non-housing debt (in pink) reached $3.24 trillion on top of $8.62 trillion in housing debt (in blue). While overall household debt is 6.5 percent below its peak of $12.68 trillion in Q3 2008, non-housing debt is now at the highest level that it has been since Q1 2004. In fact, non-housing debt peaked at $2.71 trillion in Q4 2008 during the Great Recession and dropped to a post-Great Recession low of $2.56 trillion in Q2 2010. Since its low in 2010, non-housing debt has risen by $680 billion or 26.6 percent.

Let's focus on non-housing debt and then take a closer look at credit card debt. Here is a graph from the Philadelphia Federal Reserve showing how total revolving and non-revolving consumer credit has reached a 24 year high:

In the first quarter of 2015, total outstanding consumer credit reached $3.364 trillion which is composed of $890.9 billion in revolving credit and $2.473 trillion in non-revolving debt. This is up $811.9 billion or 31.8 percent from the Great Recession low of $2.552 trillion in 2009.

According to Tim Chen at Nerdwallet and based on an analysis of Federal Reserve statistics, an average American household had the following consumer debt in July 2015:

Credit card debt: $7400

Mortgage debt: $156,584

Student Loan debt: $33,090

If the households that have no credit card debt are removed from the equation, the average outstanding credit card debt more than doubles to $15,863.

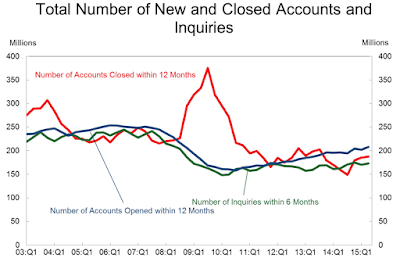

As we can see on this graph, the number of credit card accounts (in blue) has risen to its highest level since the Great Recession:

As well, the number of credit accounts opened (in blue) and number of credit inquiries (in green) have risen to or just below new post-Great Recession highs:

Over the second quarter, the number of credit inquiries rose by 3 million to 173 million. This is a key indicator of consumer non-housing credit demand and would suggest that consumers are feeling rather confident.

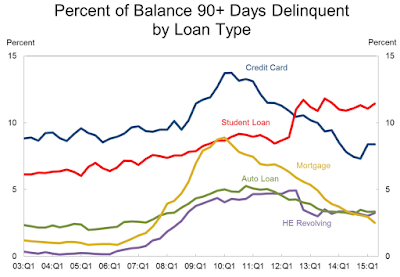

In the second quarter of 2015, credit card balances increased to $703 billion with 8.4 percent of balances delinquent by 90 days or longer. Here is a graph showing how the percentage of credit card delinquent balances (in blue) have begun to rise over the last two quarters:

While the level of delinquencies is still well below the levels seen in early 2010, as Tim Chen points out, credit card indebtedness and delinquency levels are connected to a significant increase in credit card companies who continue to write-off (charge-off) seriously delinquent credit card debts.

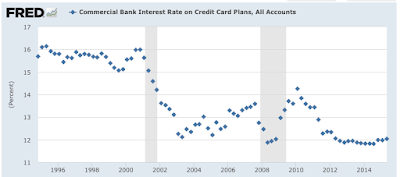

It is interesting to see how consumer debt, particularly credit card debt, has reached post-Great Recession highs and how consumer credit inquiries are up. It appears that the current and prolonged low interest rate environment has lulled consumers into a false sense of credit reality. As we can see on this graph from FRED, the current average interest rate of 12.04 percent on commercial bank credit cards is among the lowest in the last two plus decades:

It will be interesting to see how quickly consumer credit delinquency rates begin to rise once the Federal Reserve begins to normalize its monetary policies if, indeed, it does.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment