This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

A recent letter from Congress to Janet Yellen, Chair of the Federal Reserve Board looks at the ongoing diversity problem that exists at the world's most influential central bank. Here's the letter, excluding the names of the 127 signatories which you can peruse by clicking on the link:

The letter, signed by potential future Democratic presidential candidate, Elizabeth Warren and current Democratic presidential candidate, Bernard Sanders, clearly states the problem. For the purposes of this posting, I am going to focus on the gender bias at the Federal Reserve and follow this posting with a second posting outlining the lack of ethnic and business background diversity.

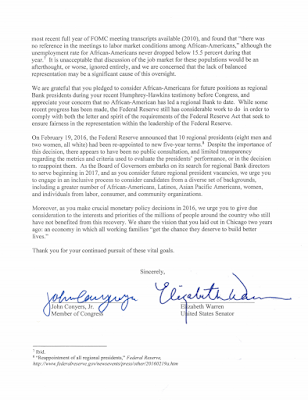

As most of you are aware, the Federal Reserve is comprised of 12 regional/district Reserve Banks and 24 branches as shown on this map:

Each regional Reserve Bank has its own directors (nine directors in total); under the Federal Reserve Act, each Reserve Bank is headed by a President who is appointed by the Federal Reserve Bank's Class B and C directors. Class A directors represent the member commercial banks in each district while Class B and Class C directors are selected to represent the public with backgrounds in agriculture, commerce, industry, services, labor and consumers. Class A and Class B directors are elected by member banks in each district while Class C directors are appointed by the Federal Reserve System's Board of Governors in Washington. Here is a simple graphic to help you understand this arcane system:

When looking for directors, the Fed considers a nationwide pool of candidates, both inside and outside the Federal Reserve System who have the following abilities:

• guide the focus of the Bank's economic research and gather economic intelligence through interactions with the Bank's board of directors and other business and community contacts,

• provide keen insights to Federal Open Market Committee policy discussions,

• communicate clearly about monetary policy,

• be a strong chief executive officer of the Bank,

• ensure the Bank maintains an effective system of bank supervision by faithfully carrying out its delegated authority from the Board of Governors, and

• make strong personal contributions to matters requiring collective System action or direction.

Here is a link to the current directors of all 12 regional Reserve Banks. In addition to the directors of the Reserve Banks, you will also note that some of the banks have branches with their own directors (seven in total) who have been appointed by the Federal Reserve Bank and by the Fed's Board of Governors.

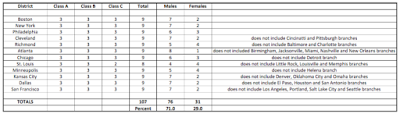

Let's look at each of the 12 districts and the male/female split in directors:

Of the 107 directors, 76 or 71 percent are male and 31 or 29 percent are female. In the worst case, the Atlanta Federal Reserve Bank has only one female director out of its total of nine and in the best cases (excluding St. Louis which has one vacancy), Richmond and Minneapolis each have four female directors and five male directors.

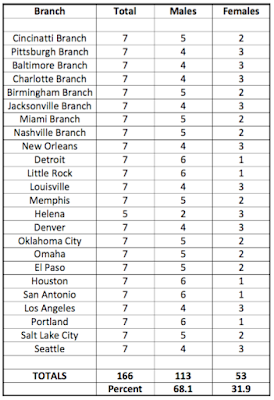

Let's look at the directors of the branches of the Reserve Banks:

Of the 166 directors, 113 or 68.1 percent are male and 53 or 31.9 percent are female. Five of the branches have only one female director out of a total of seven and nine branches have two female directors out of a total of seven.

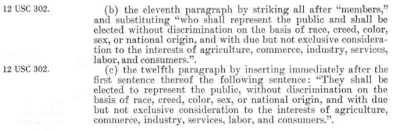

When the original Federal Reserve Act written in 1913, set out the mandate for the regional Reserve Banks, there was no restriction on the gender of the directors selected for each bank since it was generally assumed that men would perform that role. This changed under the Federal Reserve Reform Act of 1977, the selection criteria for the Federal Reserve Bank directors changed and now reads:

The Reform Act also increased Congressional oversight of the Federal Reserve by establishing a monetary policy reporting system and by requiring Senate confirmation of the Board of Governors' chairman and vice chairman to increase communication between Congress and the Federal Reserve about American monetary policy. That said, it looks like Congress has done very little over the intervening four-decade period to fix the Fed's gender bias.

A study by The Center for Popular Democracy also shows the following additional gender biases at the Federal Reserve:

1.) 60 percent of the Federal Open Market Committee members are male

2.) 83 percent of the regional Federal Reserve Bank presidents are male

Given that 51 percent of Americans are female, it's pretty obvious that the Federal Reserve is not even close to meeting a small part of its expanded gender mandate under the Federal Reserve Reform Act of 1977.

In part 2 of this posting, I will look at how biased the Federal Reserve is when it comes to appointing ethnic minorities to its most powerful positions and how it tends to select directors that come from one particular industry, ignoring the requirement to appoint people from a wide variety of backgrounds.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment