This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Once again, Washington finds itself dealing with the debt ceiling, an issue that seems to tie up an increasingly polarized Congress that seems to put its own best interests ahead of Main Street America. In this posting, I want to take a look at the concept of the statutory debt limit/debt ceiling and how Congress has dealt with this issue in the past.

In recent years, as the federal government has added significantly to the debt through deficit spending, Congress has had to deal with the statutory debt limit on a relatively regular basis. The statutory debt limit applies to nearly all federal debt including debt held by the public (i.e. outside of the federal government itself) and debt held on the government’s own accounts (intragovernmental debt). Approximately 0.5 percent of total federal debt is excluded from debt limit coverage. Most of the government’s own debt is held in federal trust funds like Social Security, Medicare, Transportation and Civil Service Retirement accounts. Even though there are hundreds of federal government trust funds, the 12 largest government trust funds hold 98.8 percent of the intergovernmental debt.

The modern debt limit was created in 1939 as the Public Debt Act of 1939 and was replaced with the Public Debt Act of 1941 (aka H.R. 2959 – 77th Congress) that set the stage for the financing of modern government debt financing. Here is the title page for the Act:

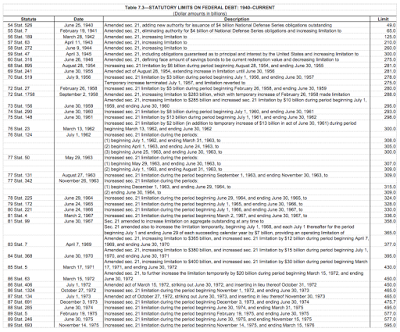

Until the 1941 act was passed, the federal government treated all interest and capital gains on its debt obligations as tax exempt. The 1941 act changed this by making the difference between the purchase and redemption price for savings bonds taxable. At the time that the Public Debt Act of 1941 was passed, the aggregate limit on all federal debt obligations was placed at $65 billion. Keeping in mind that the United States was about to enter the Second World War, this limit was raised as follows:

1942 – $126 billion

1943 – $210 billion

1944 – $260 billion

1945 – $300 billion

In 1946, the Public Debt Act was once again amended, lowering the debt limit to $275 billion.

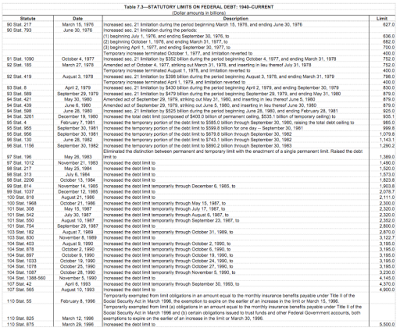

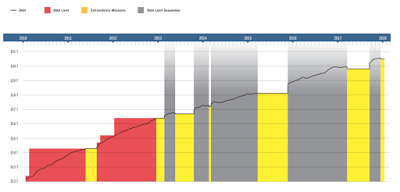

Here is a complete history of what has happened to the statutory limits on the federal debt from 1949 to March 2017:

Congress has either changed, amended or suspended the statutory debt limit 115 times since the Public Debt Act of 1941 was passed.

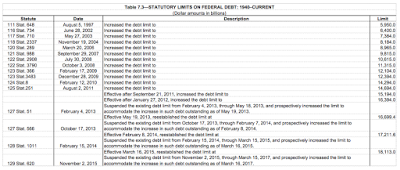

Let’s focus on the period since 2010 as shown on this graphic:

As you can clearly see, Congress has repeatedly used various measures that have “kicked the debt can” further and further down the road. As shown in grey on the graphic, since 2013, rather than coming right out and increasing the debt limit, Congress has tried to save face by temporarily suspending the debt limit five times with the latest suspension ending on March 15, 2017. When the debt limit was reinstated, it was always reset at a new, higher level. As I have said before, the new debt ceiling becomes the new debt floor since Washington has no hope of ever paying back any of its outstanding obligations.

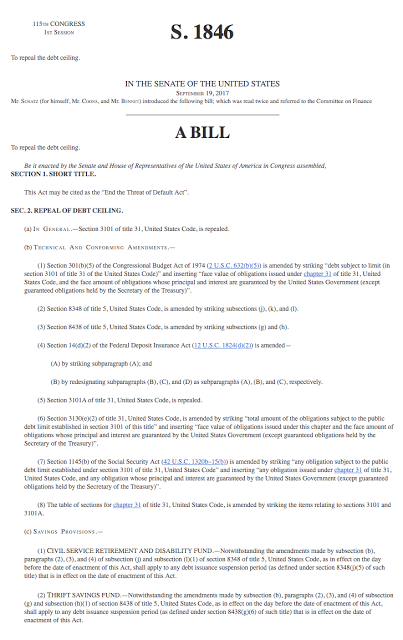

Interestingly, as a “solution” to the repeated debt ceiling crises that have faced Congress over the past decade, back in September 2017, 3 Senate Democrats came up with the brilliant inspiration of pushing legislation to eliminate the debt ceiling, an idea backed by Donald Trump. The text for the “End the Threat of Default Act” or S.1846 is as follows:

So, instead of dealing with keeping spending within the limits of revenue, the Congressional solution appears to be to get rid of the debt ceiling entirely, a move that would allow Washington the uncontrolled spending powers it desires with no fear of retribution by either Treasury holders or the American voting public.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment