This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

The Trump Administration’s trade scuffle with China has now reached the hallowed halls of Walmart. In a recent letter to Robert Lighthizer, the United States chief Trade Representative, Walmart weighs in on the “Proposed Modification of Action Pursuant to Section 301: China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property and Innovation“, a rather wordy way to say “The U.S. – China Trade War”.

Let’s take a brief look at Section 301 and what it does. Under Sections 301 to 310 of the Trade Act of 1974, the President is authorized to take actions including retaliation, against any policy, act or practice of a foreign government that violates an international trade agreement. Concerns by the Trump Administration regarding China’s policies on intellectual property, forced technology transfer and innovation policies and the impact of these policies on the United States economy has led to the launching of a Section 301 investigation of the aforementioned policies. Once the United States Trade Representative (USTR) begins a Section 301 investigation, it must seek a negotiated settlement with the foreign country concerned, either through compensation or through the elimination of a barrier or practice. The Trump Administration began its actions on March 22, 2018 targeting economic aggression by China and outlined four policies that justified U.S. actions against China under Section 301 as follows:

1.) China uses joint venture requirements, foreign investment restrictions, and administrative review and licensing processes to force or pressure technology transfers from U.S. companies to a Chinese entity;

2.) China maintains unfair licensing practices that prevent U.S. firms from getting market-based returns for their IP;

3.) China directs and facilitates investments and acquisitions which generate large-scale technology and IP transfer to support China’s industrial policy goals (such as the Made in China 2025 initiative); and

4.) China conducts and supports cyber intrusions into U.S. computer networks to gain access to valuable business information.

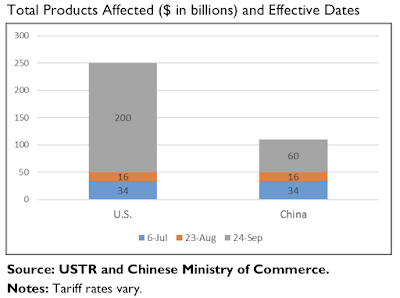

Here is a list of tariff increases that have resulted from this spat and their effective date:

1.) July 6, 2018 – 25 percent tariff increase on $34 billion worth of imports from China

2.) August 23, 2018 – 25 percent tariff increases on $16 billion worth of imports from China

3.) September 24, 2018 – 10 percent tariff increase on $200 billion worth of imports from China, increasing to 25 percent on January 1, 2019

As well, the USTR warned of additional tariffs on $267 billion worth of Chinese goods if China retaliated (which they did).

Here is a graphic showing the three rounds of implemented tariff increases:

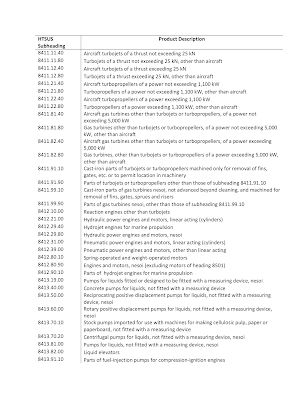

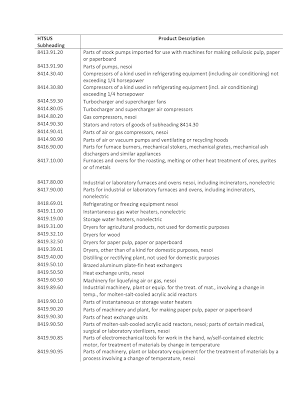

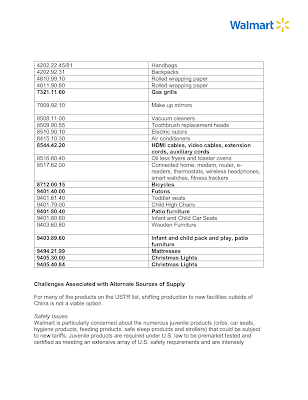

The first two tariff increases covered a total of 1102 tariff lines with an estimated total value of $50 billion. You can find the list of products for the first list here and the second list here. Here is a sampling of the two lists:

Obviously, these increased tariffs on goods imported from China will have a significant impact on U.S. consumers. One need look no further than the labels on items that Americans purchase at their local Walmart to see how many of the items stocked by America’s largest retailer are made in China.

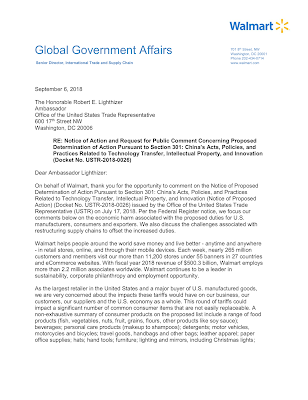

As I noted at the beginning of this posting, Walmart has entered the trade battle as part of the consultation process that takes place during a Section 301 trade dispute. Here is a letter from Sarah Thorn, Walmart’s Senior Director of Global Government Affairs to Robert Lighthizer, the current United States Trade Representative:

The letter outlines Walmart’s concerns about the disruptive impact of the Trump trade war with China on its customers and suppliers, although my suspicion is that they are more concerned about the impact on Walmart’s profits which have an ultimate impact on the compensation of its Named Executive Officers.

The letter notes that the latest tariffs on $200 billion worth of Chinese imports will impact households who consume a myriad of products that Walmart carries and that there simply is no viable alternative source for these products. Not only will the tariffs impact Walmart’s domestic operations, there is an impact on Walmart’s operations in China where the retailer sells many U.S. products to Chinese consumers (i.e. American pork, beef, cherries, nuts, wine, apple, cheese and milk) which are now subject to a retaliatory duty imposed by China, a tariff that could end up hurting American producers of these goods.

Obviously, Walmart has some difficult decisions to make; they can either raise prices to consumers or they can absorb the cost of the tariffs and watch their profits (and stock price) drop.

While Donald Trump has proclaimed that trade wars are easy to win, it’s pretty clear that someone has to lose and, in this case, it looks like it will be the consumers of Main Street America unless, of course, Walmart decides to absorb all of the costs of increased tariffs on its retail products. As always, there is one thing that we can count on; there is an unintended consequence to government decisions.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment