This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…Just as it looks like the American housing market is finally turning a corner after years of dropping values, another "monster" lurks just around the corner according to statistics from Realtytrac.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…Just as it looks like the American housing market is finally turning a corner after years of dropping values, another "monster" lurks just around the corner according to statistics from Realtytrac.

Let's start by looking at a few statistics to help set the stage. In the U.S. housing market, there are currently a huge number of bank-owned homes on the market as shown here (in red) (current to early 2013):

The estimated cumulative value of all bank-owned and homes in foreclosure was $200 billion in the first quarter of 2013, up 14 percent on a year-over-year basis.

Third quarter 2013 bank repossessions (REOs) dropped 24 percent from the same quarter in 2012, however, they were up 7 percent from the previous quarter. In Q3 2013, a total of 119,485 U.S. properties were repossessed by lenders. Here is a bar graph showing the states with the biggest increases in REO activity in Q3 2013 on a quarterly basis:

As I noted at the beginning of this posting, there is a "monster" lurking in the housing market. By cross-referencing foreclosure data with data from the U.S. Postal Service, Realtytrac was able to analyze the number of foreclosed properties that have been abandoned by their owners. These properties are termed "zombies" because many of them are in less than ideal condition since there is no one around to perform routine maintenance as shown in this example:

As a result of their appearance, these "zombies" drag down home values for surrounding homes.

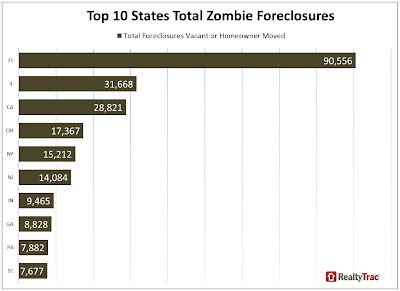

Nationwide, Realtytrac found that 35 percent of properties that were actively in the foreclosure process were "zombies". Certain states have far higher numbers of "zombie" homes than others as shown on this bar graph:

As a percentage of foreclosures, the following states have the worst "zombie" rates:

Kentucky – 54 percent

Indiana – 53 percent

Maine – 53 percent

Oregon – 52 percent

Washington – 50 percent

Nevada – 50 percent

Georgia – 48 percent

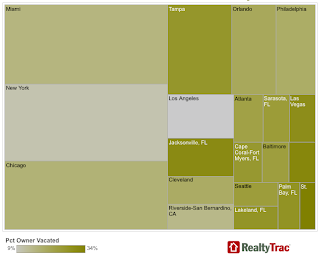

Cities with the worst "zombie" rates are Miami, New York, Chicago, Tampa, Orlando, Philadelphia, Los Angeles and Jacksonville, Florida as shown on this unique graphic:

While the looming spectre of a growing number of vacant REOs is of concern to the overall health of the American real estate market, what is of even greater concern is the fact that 10.7 million residential homeowners still owe at least 25 percent more than what their properties are worth even as real estate values have seen gains in some markets. This represents 23 percent of all U.S. residential properties with a mortgage in May 2013. An additional 8.3 million homeowners find themselves in the range of having between 10 percent positive and 10 percent negative equity, representing another 28 percent of all residential properties with a mortgage in September 2012.

The greatest danger to the recovery of the U.S. housing market is a rise in mortgage rates. As shown on this graph from FRED, while mortgage rates have dropped slightly over the past month, they are still between three-quarters and a full percentage point higher than they were throughly most of 2012 and early 2013:

Apparently, the health of yet another sector of the American economy is in the hands of the Federal Reserve and their plans to end their zero interest rate program sometime down the road. That is far from reassuring.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment