This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…While the market focuses on the ISM Manufacturing monthly data, the Insittute for Supply Management also tracks another interesting statistic that is less followed by the mainstream media that provides business sentiment about the expected direction of price changes in the economy.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…While the market focuses on the ISM Manufacturing monthly data, the Insittute for Supply Management also tracks another interesting statistic that is less followed by the mainstream media that provides business sentiment about the expected direction of price changes in the economy.

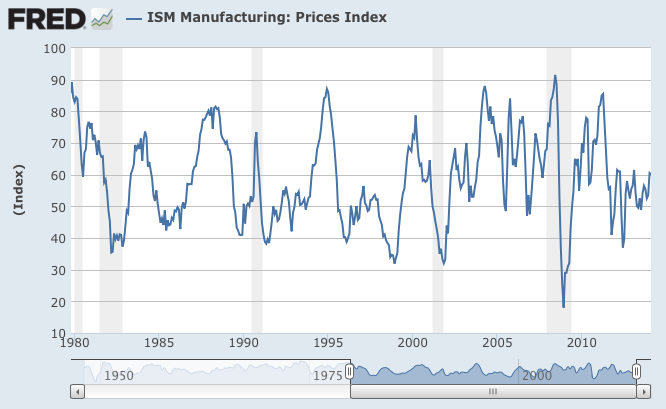

From FRED, here is a graph showing the ISM Manufacturing Prices Index from 1980 to the present:

Notice how whenever there is a recession (or shortly thereafter), the manufacturing sector anticipates very low inflationary pressures? It's all in the supply – demand mantra that determines prices in the marketplace.

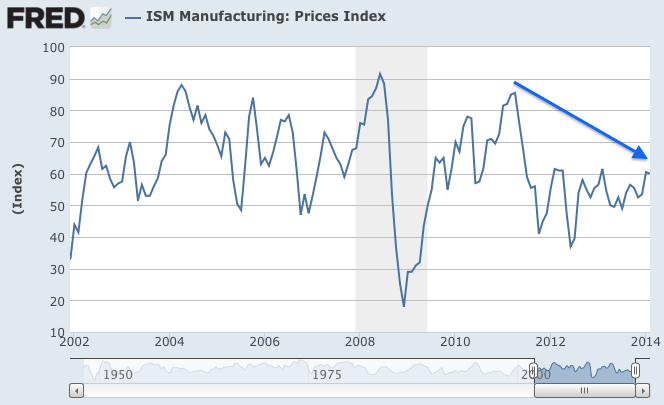

Now, let's focus in on the period from 2002 to the present:

In general, the ISM Prices Index since 2012 shows that manufacturing executives surveyed generally do not expect high levels of inflation with the prices index being at its lowest levels since the depths of the Great Recession. Inflationary pressures are also expected to be very low compared to most of the period between 2002 and 2008.

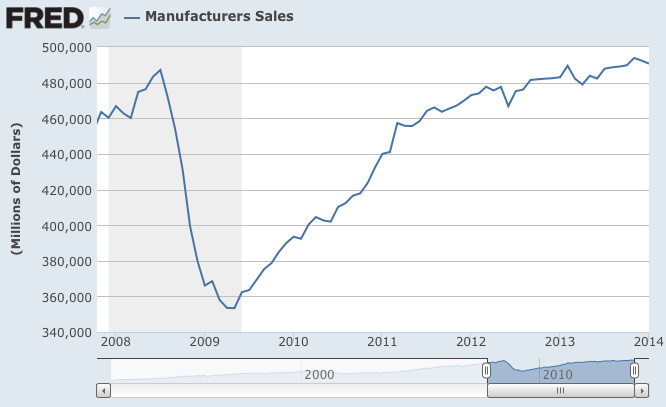

Why is this the case, particularly given the substantial expansion of the monetary supply by the Federal Reserve since 2008? This graph might give us a clue:

In January 2014, manufacturers' sales reached $490.67 million. At its peak in July 2008 just as the Great Depression took hold, manufacturers' sales hit $487.114 million. Over the four and a half year period since the pre-Great Recession peak, American manufacturers have seen sales rise by a paltry $3.56 million or 0.73 percent. You will also notice that since January 2012 manufacturing sales have been in a nearly no-growth situation, rising by only $17.62 million over 24 months. This is exactly the point in time when America's manufacturers dropped their expectations for inflationary pressures.

While the American manufacturing sector plays a less important role in economic growth than it did in the past, it is often provides us clues of what is to come for the economy. In general, economists note that trends in manufacturing foretell trends in the overall economy. As we can see from the ISM Manufacturing data, inflationary pressures are low, likely because the growth rate in the manufacturing sector has been so modest for so long. This suggests that economic growth is likely to be modest at best as this "recovery" grinds on.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment