This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…The Center for Effective Government and the Institute for Policy Studies have released a rather interesting report, "Fleecing Uncle Sam", a look at Corporate America (remember, it's a person too) and how a growing number of corporations render less to the federal taxman than they pay their executives. Here are a few of the highlights, starting with a summary of the results.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…The Center for Effective Government and the Institute for Policy Studies have released a rather interesting report, "Fleecing Uncle Sam", a look at Corporate America (remember, it's a person too) and how a growing number of corporations render less to the federal taxman than they pay their executives. Here are a few of the highlights, starting with a summary of the results.

1.) Of America's 30 biggest corporations, seven pay their CEOs more than they remitted in federal income taxes in 2013. In total, these companies reported more than $74 billion in pre-tax profits but, through provisions in the current tax code, they were able to get a total refund from the IRS of $1.9 billion. This resulted in a tax rate of negative 2.5 percent.

2.) On average, the seven aforementioned CEOs were paid $17.3 million in 2013.

3.) Of the 100 highest paid CEOs in America in 2013, 29 received more pay than their company paid in federal taxes in 2013. On average, these CEO's made an average of $32 million in 2013 at the same time as their corporations earned $24 billion in pre-tax profits and received $238 million in tax refunds, paying an average effective tax rate of negative 1 percent.

4.) Combined, the 29 companies operate 237 subsidiaries in tax havens with the largest number being owned by Abbott Laboratories who had 79 tax haven subsidiaries.

5.) Of the 29 companies, the company that received the largest tax refund was Citigroup which received an IRS refund of $260 million in 2013 at the same time as they paid their CEO $18 million.

6.) The average CEO pay among those working at companies that paid its CEO more than it remitted to the IRS has grown from $16.7 million in 2010 to $20.6 million in 2011 to $32 million in 2013.

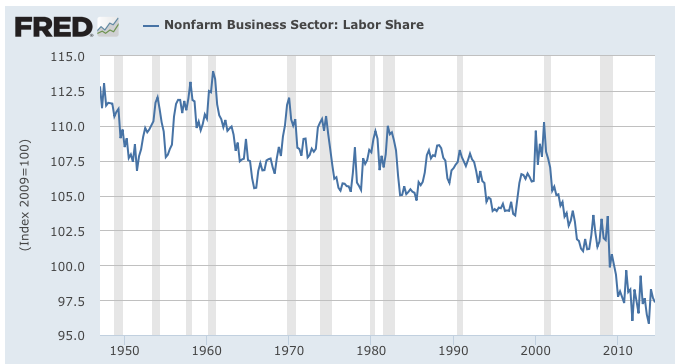

To help us put the following posting into perspective for those of us who don't work in the corner office, here is a graph from FRED showing the labor share (i.e the sweat share) of income:

It's quite obvious that labor's share of income has declined to a multi-decade low as a share of total income earned in the United States, largely because of changes in technology, increased globalization and trade openness. This has been one of the chief causes of income inequality in the United States as top households earn an ever-increasing share of total household income.

Let's go back to the "Fleecing Uncle Sam" report. Corporations in the United States are quite happy to complain about the 35 percent headline corporate tax rate; it makes them uncompetitive, it's the highest in the industrial world and so on ad nauseous. In fact, the average corporate tax rate paid by the largest corporations in the United States between 2008 and 2012 is just 19.4 percent. As shown on this graph, even though after-tax corporate profits set a new record in 2013 of $1.842 trillion as shown here:

…and corporate taxes are still below levels seen before the Great Recession as shown here:

…apparently, there's still plenty of room to complain. In this time of both high underemployment and high levels of discouraged, unemployed workers who are no longer part of the "system", rather than investing their profits in creating more jobs, Corporate America has chosen to buy back shares and increased yields. According to this study, between 2003 and 2012, companies used 54 percent of their earnings to buy back stock on the open market. An additional 37 percent of earnings were used to pay dividends, leaving a rather insignificant 9 percent of profits available for job creation and higher levels of compensation for employees.

Let's get to the meat of the matter, who's getting paid more than the IRS? Here is a chart showing the seven companies among the 30 largest in the U.S. that paid their CEOs more than they remitted in federal income taxes:

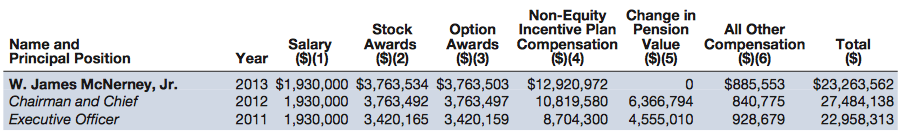

Let's look at Boeing for a moment. Boeing is one of the federal government's top contractors, receiving $20 billion in contracts in fiscal 2013 and an additional $603 million in subsidies over the years from 2008 to 2012 to pay for the company's R and D costs. In fact, the Export-Import Bank, an 80 year-old federal institution that helps American companies sell their goods and services overseas by guaranteeing loans, among other things, provided Boeing with loan-guarantees in fiscal 2013 that totalled 65 percent of all loan guarantees made by the Ex-Im Bank, to help the manufacturer sell 106 of its planes to foreign airlines. This has resulted in the Ex-Im Bank being referred to as the "Bank of Boeing". In 2013, Boeing made $5.946 billion in profits, was handed a federal tax refund of $82 million which resulted in a negative effective tax rate of 1.4 percent at the same time as they paid the company's CEO, W. James McNercy, Jr. total compensation of $23.3 million. From Boeing's 2013 Proxy Statement, here is a breakdown of his compensation for 2013 and the two previous years:

Here is a further breakdown of his total non-equity incentive plan compensation for 2013 and previous years:

On top of all of this, here is a breakdown of his "other compensation" for 2013:

His "other personal benefits" included $305,382 for the use of the company aircraft for personal travel, $67,755 for personal use of company aircraft associated with attendance at outside board meetings, $51,728 for personal use of ground transportation services, $43,775 for tax preparation and planning services and $26,000 in gift matching donations.

If all seven of the top thirty corporations in the United States that paid their CEOs more than they remitted in federal income taxes paid tax at the 35 percent headline corporate tax rate, instead of getting $1.893 billion in refunds, they would have paid $25.9 billion in federal taxes, a total difference of $27.8 billion. According to the report, this would have paid for:

1.) the resurfacing of 22,240 miles of four lane highway or nearly half of the U.S. interstate highway system.

2.) running the Department of Veterans Affairs for two months.

3.) hiring an additional 370,667 teachers at a salary of $75,000 each including benefits.

And Washington wonders why there's anger in the streets and avenues of Main Street U.S.A.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment