This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

On Friday, the Congressional Budget Office released its analysis of the First Quarter 2011 Federal Budget Deficit. Here are a few of the details.

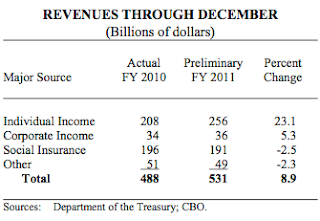

On the revenue side of the ledger, the Federal government brought in $531 billion over the 3 month period ending December 31st, 2010, up $43 billion year-over-year. Most of that increase ($33 billion worth) was due to increases in withholding of income tax and social insurance payroll taxes from individuals (you are most welcome, Washington!). As well, individual income tax refunds were lower than last year meaning that the government didn’t have to give back as much as they did last year. On the corporate side, revenue was up by $2 billion or 5 percent year-over-year, mainly because of an increase in estimated payments made in the month of December alone. All in, revenues were up 9 percent.

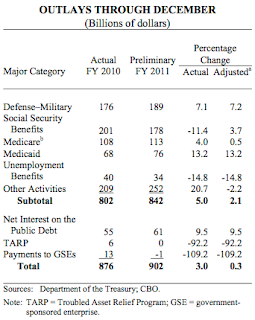

On the spending side, the Federal government spent $902 billion, up $26 billion or 3 percent year-over-year. Compared with last year, defence spending was up 7 percent and, this is the scary one, interest payments on the debt were up 9.5 percent year-over-year from $55 billion to $61 billion. These increased interest payments are a result of the growth in the debt which is particularly frightening since growth in the federal debt shows few signs of meaningful slowing. Spending for Medicare was up 4 percent and Social Security was up less than 1 percent. On the upside, spending for unemployment benefits was down 15 percent because of a decline in the number of claims and because benefits paid were lower than the previous year despite the fact that there over the year, the number of unemployed has changed very little over the past year (excluding the past two months).

Here’s a table showing where the money came from:

Here’s a table showing where the money was spent:

Simple subtraction gives us a deficit of $371 billion for the first three months of fiscal 2011. That’s down $18 billion on a year-over-year basis. The deficit in the month of December 2010 alone was $80 billion, down $12 billion from a year earlier. The December numbers can be deceiving because there was an additional work day in December 2010 compared to a year earlier. As well, many corporations pay bonuses during December and since these vary from year to year, the drop in taxes withheld can vary on an annual basis. Projecting forward (using simple multiplication) gives us a deficit of $1.48 trillion for the entire year, up from last year’s deficit of $1.294 trillion and a new record.

What I find interesting is that the interest on the debt is only 25 percent below the outlay for Medicaid. What will happen once interest rates rise to historical norms as they surely will, especially since the federal government is going to find itself in a situation where it is competing for bond dollars with the corporate world? Interest on the debt is rapidly approaching the point where it is going to interfere with the government’s ability to fund programs.

You’ll also notice that two additional items saved the federal government’s bacon this quarter when compared to last year. Payments to Government Sponsored Enterprises (GSEs – i.e. Fannie Mae and Freddie Mac) and TARP outlays decreased from $18 billion to zero (well okay, -$1 billion). If those payments were subtracted from last year’s deficit of $388 billion, the deficit numbers for this year would be pretty much the same. I guess we have to just hope that Wall Street, the banks and Government Sponsored Enterprises don’t need more assistance from American taxpayers, don’t we?

To put the $371 billion number into perspective, let’s look at the full year 2010 Gross Domestic Product numbers for a few countries as provided by the International Monetary Fund:

Hong Kong $226.5 billion

Finland: $231.9 billion

South Africa: $354 billion

Norway: $413.5 billion

Taiwan: $427 billion

In closing, here’s a quote from a speech given on January 8th, 2011 by John Lipsky, Managing Director at the International Monetary Fund about the fiscal situation in the United States:

"…federal debt held by the public has risen from about 36 percent of GDP in 2007 to about 62 percent of GDP in 2010, while prospective debt dynamics have worsened significantly. In the absence of corrective measures, and taking into account underlying fiscal pressures that predated the crisis, debt could reach about 95 percent of GDP by the end of this decade—a level last reached immediately following World War II. Without policy adjustments, subsequently the debt simply would keep rising. From this perspective, the need for urgent action to secure medium-term fiscal sustainability appears to be self-evident."

Self-evident? Apparently not to many in Washington!

Click HERE to read more of Glen Asher’s columns.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment