This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

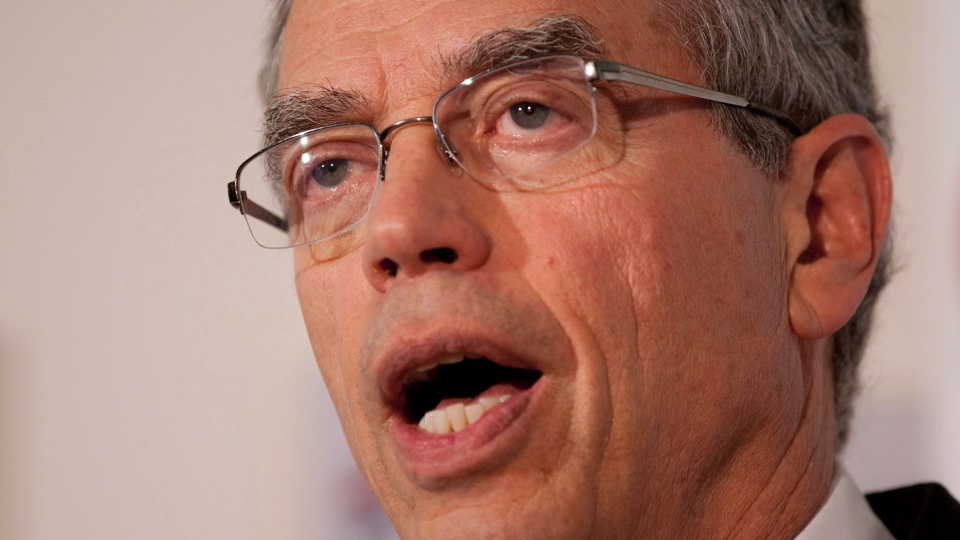

Federal Finance Minister, Joe Oliver, has announced that he does not plan to interfere or influence the housing market as he promised not to force banks to lower their interest rates. According to BNN, Mr. Oliver mentioned in an emailed statement that despite the Bank of Canada’s announced rate cut, “I do not intend to interfere with the day-to-day operations of the banks,” adding that “I have no current plans to introduce new rules regarding residential mortgages.”

Federal Finance Minister, Joe Oliver, has announced that he does not plan to interfere or influence the housing market as he promised not to force banks to lower their interest rates. According to BNN, Mr. Oliver mentioned in an emailed statement that despite the Bank of Canada’s announced rate cut, “I do not intend to interfere with the day-to-day operations of the banks,” adding that “I have no current plans to introduce new rules regarding residential mortgages.”

From the looks of it, at least one big Canadian bank has decided against cutting its prime rate and since Mr. Oliver has now announced that he does not plans to intervene in the market, more banks are anticipates to follow its lead. Announcing the decision made by TD, its spokesperson, Alicia Johnston, mentioned in her remarks that “our decision not to change our prime rate at this time was carefully considered and is based on a number of factors, with the Bank of Canada’s overnight rate only being one of them.”

Mr. Oliver’s announcement to leave the banks alone has come as a surprise since he had a stricter tone earlier when he used discussed mortgage rates and the housing market since took office. This past June, Oliver responded to critics calling for more active participation from the government in reining in the housing market. He stated “I don’t think it’s the role of government to set interest rates or rates for mortgages,” adding that “the rates are quite low and they’ve been coming down but a very small amount.”

Be the first to comment