This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Today, Ireland’s Prime Minister Brian Cowen, announced details of the IMF/EU bailout package that is going to save the country’s economy from collapse. Here are the highlights:

1.) The bailout will total €85 billion; of the €85 billion, €17.5 billion will come from Ireland’s National Pension Reserve Fund and other cash that the Irish government has lying around collecting dust resulting in a net loan of €67.5 billion. Each of the European Financial Stability Mechanism, the IMF and the European Financial Stability Fund will kick in €22.5 billion. A total of €50 billion will be allocated to run the country’s operations (i.e. pay civil service and the all important politicians who really didn’t help create this mess) and funds will be drawn down as required by the state. A total of €35 billion will go to run the banks. An immediate investment of €10 billion will go to the banks because, after all, that’s what created the mess in the first place. The remaining €20 billion will be doled out to the banks on an "as need" basis, in other words, sooner rather than later. The United Kingdom is kicking in €3.44 billion which they can ill-afford because they have their own debt demons to deal with.

2.) The combined average interest rate for the funds will be approximately 5.8 percent but, in fact, will vary according to when the funds are drawn and market conditions at that time.

It is now being acknowledged that Ireland may not meet the deficit to GDP target of 3 percent by 2014 that last week’s National Recovery Program had originally targeted and that an additional year may be required because growth estimates for 2011 and 2012 were over-stated (other governments beware of your own overly optimistic projections for return to fiscal balance based on projections of economic growth!). It is now anticipated that Ireland could reach the 3 percent deficit target by 2015, just in time for the next recession! In order to meet this target, the country is cutting expenditures by €10 billion and increasing taxes by €5 billion as noted in last week’s National Recovery Plan.

Interestingly enough, Ireland now gets to bail out of its assistance to Greece, its fellow fiscal eunuch. Ireland’s commitment to the Loan Facility to Greece would have totalled €1 billion to mid-2013.

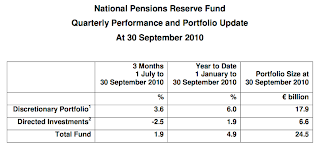

Another interesting fact is that, according to the National Pension Reserve Fund website, the NPRF was not to be drawn down before 2025 since it was formed to provide security for Ireland’s pension scheme. In February 2009, the Minister for Finance announced that the Fund would provide €7 billion to recapitalize Ireland’s banks. Once again, Ireland’s banks have come to the NPRF trough for a bailout. Interestingly enough, as of October 2010, the fund totals only €24.5 billion as shownhere:

Fortunately, the Cowen government planned ahead and raised the state pension age to 66 years of age in 2014, 67 in 2021 and 68 in 2028. Who knows what it will be by 2035?

I’d say that between increases in VAT, cuts to the National Minimum Wage and the pillaging of their Pension Reserve Fund, that the taxpayers of Ireland have done plenty to bail out their banks, wouldn’t you. Heaven help us if other nations around the world reach the position where they are backed into the same fiscal corner.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Although I am unclear on the behind the scenes networking taking place there, (i can barely keep up here), I am glad for the people of the Irish Nation, that they will not go under. My question is regarding the SuperGrcomment_ID.

Will the export revenue from the electric export go to the Irish People to repay the loss of what i can only see as the Social Security of Ireland? What will happen to the people as they age there?

I ask because I can see the writing on the wall here. Having pacomment_ID into the SS system here for 30+ years, I am aware that it was sold to the IMF, and I will be watching to see what the people of Ireland do to care for their Elderly. I lost my retirement in the dot com bubble bust, and then again with the financial bailout a couple years ago. Now unemployed i face the reality that im too old to serve, too young to retire, and unprepared to expire.