This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…The thawing of relations between the United States and Cuba after fifty years of pointless embargo is interesting, particularly given that American business investments that were nationalized in 1959, may at some point be reopened to U.S.-based companies. As a petroleum geoscientist and a world class cynic, my mind naturally turns to oil, the hydrocarbon that lubricates the world's economy. As you will see in this posting, Cuba appears to have potential for significant hydrocarbon reserves.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…The thawing of relations between the United States and Cuba after fifty years of pointless embargo is interesting, particularly given that American business investments that were nationalized in 1959, may at some point be reopened to U.S.-based companies. As a petroleum geoscientist and a world class cynic, my mind naturally turns to oil, the hydrocarbon that lubricates the world's economy. As you will see in this posting, Cuba appears to have potential for significant hydrocarbon reserves.

Under the current embargo, Cuba cannot access U.S. oilfield equipment for both drilling and environmental protection. The embargo prohibits the exporting and re-exporting of items that contain more than 10 percent American components under the De Minimus Rule under Sections 734.4 and 736.2 (b)(2) of the Export Administration Regulations (EAR). What is particularly interesting about the embargo is the fact that Washington refued to allow an exemption for U.S. oil spill prevention and response companies even though the Obama Administration was very concerned about potential oil spills from drilling operations located relatively close to the U.S. – Cuba maritime boundary in 2012.

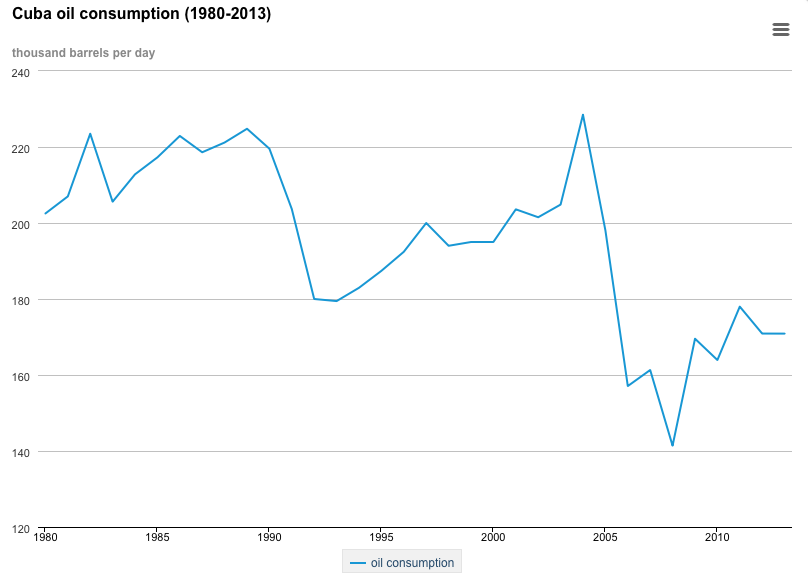

Let's look at Cuba's hydrocarbon potential. According to the Energy Information Administration, Cuba produced 51,000 barrels of oil per day (BOPD) in 2012 and consumed 151,000 BOPD; the shortfall is made up of imported crude from Venezuela. Here is a graph showing Cuba's total daily oil production from 1980 to 2013:

Here is a graph showing Cuba's oil consumption from 1980 to 2013:

As of January 2013, Cuba had 124 million barrels of proven oil reserves.

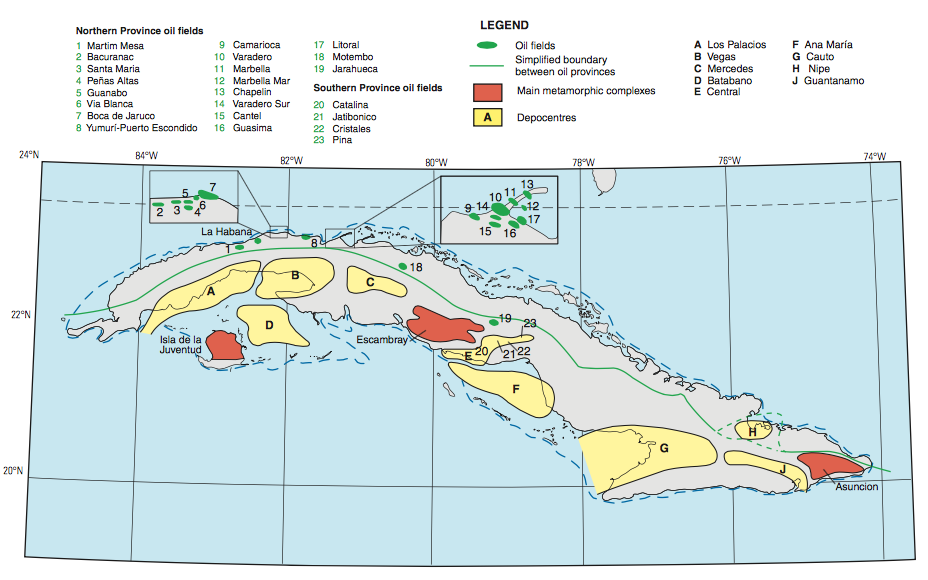

Here is a map showing the main geological features and the current oil fields (current to 2002):

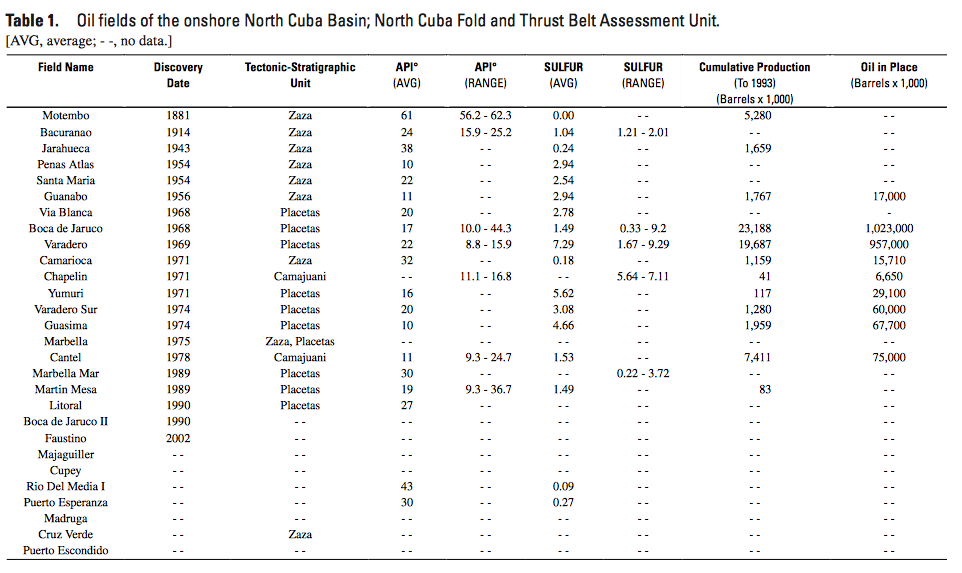

Here is a table showing Cuba's main oil fields, the year of discovery, the gravity of the crude and the production statistics for each:

Here is a map showing the current areas under lease for oil exploration and the companies involved dated in 2012:

You will notice the conspicuous absence of any American multi-national oil companies.

The most prospective area for oil in Cuba is called the North Cuba Basin. It is located in the Gulf of Mexico, along the north shore of the island. The United States Geological Survey (USGS) has divided the basin into three parts or assessment units; the North Cuban Platform Margin Carbonate, the North Cuba Foreland Basin and the North Cuba Fold and Thrust Belt as noted on this map:

It is important to remember that the geology of the Caribbean area is very complex, making it difficult to ascertain the precise geological history of the region.

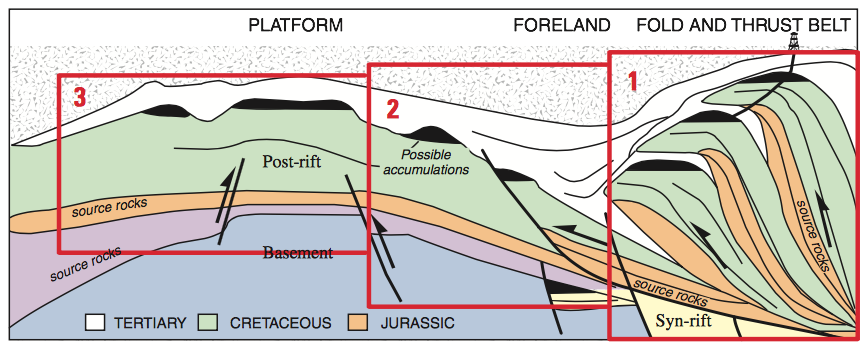

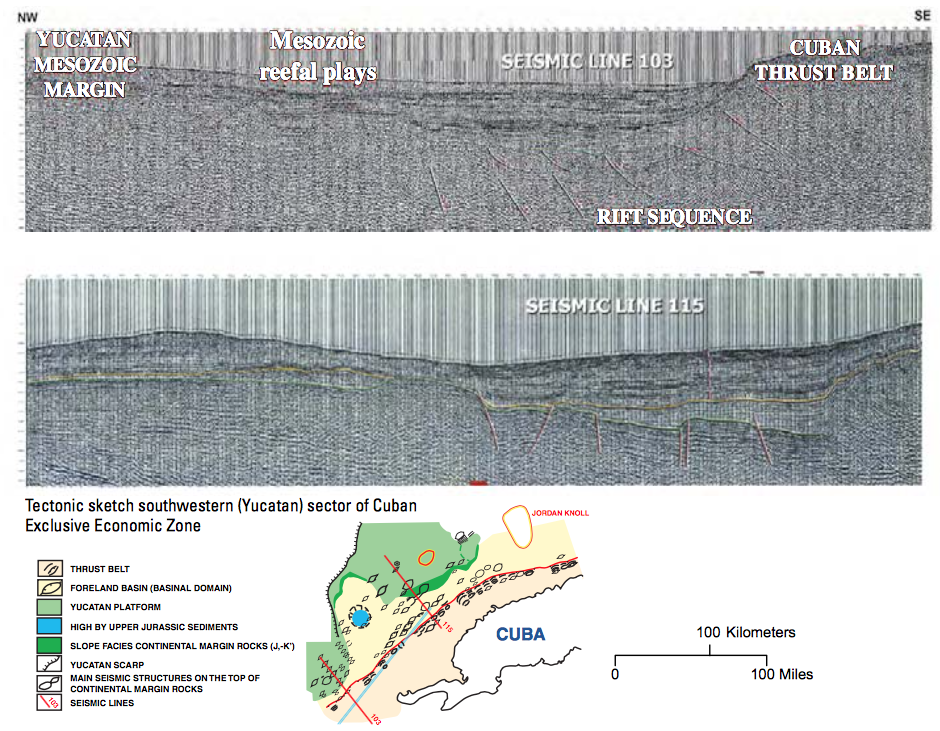

Petroleum was generated in the North Cuba Basin as a result of thrust loading (pushing rock layers laterally) of Jurassic and Cretaceous oil source rocks during the formation of the North Cuba Fold and Thrust Belt. As the rocks of the Caribbean plate were thrust toward the north as the Yucatan Basin opened, they collided with the passive southern margin of the North American plate, creating a very complex series of structures into which petroleum fluids migrated. This cross section (a slice cut through the earth with the surface located at the top of the diagram) will give you a sense of the geological complexity of the North Cuba Basin:

Here are two seismic lines showing the complexity of the faults in the North Cuba Basin with the seismic lines marked in red on the map:

Let's look at each of the three assessment units in turn.

1.) The North Cuba Fold and Thrust Belt: This assessment unit is mainly located onshore. This is the region that contains all of the known oil and gas fields currently producing in the North Cuba Basin. The structural history of the area is very complex with many folds and faults often stacked on each other. The oil in most of the current reservoirs is quite heavy (20 degrees API or less) probably due to biodegradation as a result of the shallowness of the reservoirs. One of the biggest operators in this assessment unit is Canada's Sherritt International who has been operating in Cuba for more than 20 years. Sherritt is currently producing 20,042 BOPD (100 percent basis – 2013 data) and has drilled more than 195 oil wells since 1992.

2.) The North Cuba Foreland Basin: This assessment unit is entirely located offshore. At the time of the analysis by the USGS (2008), only one well had been drilled in this assessment unit by Repsol in 2004. The well encountered high quality oil in non-commercial quantities. Hydrocarbons are trapped in structural features and reservoirs are expected to have excellent porosity. It is unknown whether the main hydrocarbons present will be oil or natural gas, however, estimates used suggest that new fields would be 90 percent oil fields and 10 percent gas fields.

3.) The North Cuba Platform Margin Carbonate: This assessment unit is smaller in area than the other two units, however, the reservoirs may be much more prolific with very high levels of porosity based on analogies from rocks of equivalent age elsewhere in the Gulf of Mexico. At the time of the USGS assessment, there had been no drilling in this assessment unit. It is estimated that reservoirs in this unit will be oil-charged.

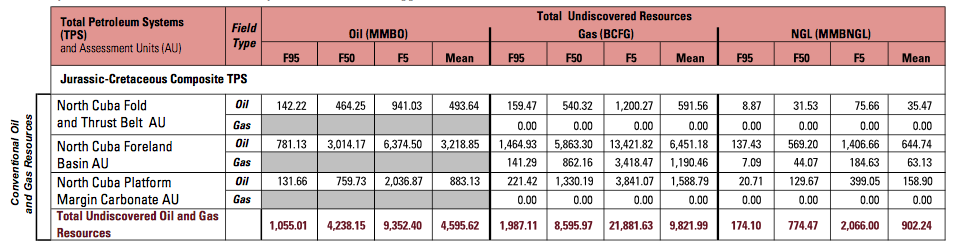

Now, let's look at a table showing the potential resources of the North Cuba Basin:

The USGS estimates that there could be up to 4.6 billion barrels of oil and 9.8 TCF of natural gas in the North Cuba Basin. The natural gas component is composed of 8.6 TCF of associated/dissolved gas (dissolved in oil) and 1.2 TCF of non-associated gas. Most of the oil will be found in the North Cuba Foreland Basin and all of the non-associated gas will be found in the North Cuba Foreland Basin.

While the oil and natural gas resource assessment by the USGS is speculative, it suggests that with further drilling, Cuba could contain substantial (and valuable) reserves of hydrocarbons. This is particularly interesting in light of the fact that Cuba approached Russia for assistance with their oil drilling program; in May 2014, Russia's Rosneft and Zarubezhneft signed an energy agreement with Cuba to explore for offshore oil. Given that, once the embargo is lifted, it will be interesting to see how long it takes before major American oil companies are lining up to acquire drilling rights in Cuba.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment