This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

At long, long last, the fine folks at the Federal Reserve have figured out who is to blame for America’s multiyear housing market crash. No, it’s not their own tempting policy of ultra-low interest rates and no, no one on Wall Street is to blame in any way. The answer to this pressing question is to be found in the Federal Reserve Bank of New York’s Liberty Street Economics analysis entitled ""Flip This House": Investor Speculation and the Housing Bubble".

At long, long last, the fine folks at the Federal Reserve have figured out who is to blame for America’s multiyear housing market crash. No, it’s not their own tempting policy of ultra-low interest rates and no, no one on Wall Street is to blame in any way. The answer to this pressing question is to be found in the Federal Reserve Bank of New York’s Liberty Street Economics analysis entitled ""Flip This House": Investor Speculation and the Housing Bubble".The authors, Andrew Haughwout, Donghoon Lee, Joseph Tracy and Wilbert van der Klauuw, begin by noting that the cause of the rise and fall of the housing market in the United States during the 2000s has been the subject of much speculation. Virtually all purchasers of homes use debt to purchase a home thereby allowing themselves to purchase a larger home than they could afford if they had to pay cash. Most borrowers are solely motivated as owner-occupants who intend to live in their homes but there is a class of residential real estate purchasers who wish to purchase homes as an investment. It is these homeowners that are more likely to walk away from their homes if the value of the home drops to a level below the value of the mortgage. These investors pushed prices up during the mid-2000s and then when prices started to turn down in early 2006, they defaulted in large numbers; a process that contributed to the intensity of the down cycle in the real estate market.

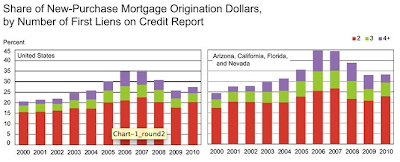

Here are two graphs which show the number of first lien mortgages (aka first mortgages by non-central bankers) held by individuals as a share of the total number of mortgages remembering that each property can only have one first or primary mortgage, noting that the four colours represent the number of first mortgages for borrowers:

From the left graph, you’ll note that in 2006, nearly 35 percent of all first mortgages issued in the United States were issued to multiple residence owners. On the right graph, you can see the data for the "sun’n’sand" states of Arizona, California, Florida and Nevada showing that in 2006, nearly 45 percent of all mortgages were issued to multiple mortgage holders. It is these states that have seen the largest price "readjustments". As well, from 2000 to 2006, the number of multiple mortgage holders in the four states nearly doubled from 24 percent to 45 percent. What is shocking to me is the rapid growth in the number of consumers that held first mortgages on four or more properties (in purple); by 2006, nearly 10 percent of all mortgages in the four state area were held by consumers with four or more properties, up from 3 percent in 2000. That’s a lot of house!

Individuals who invest in three or more properties are highly unlikely to ever occupy all three properties, in fact, during the early part of the decade, these owners were more likely to flip their properties relatively quickly as the real estate market rose. On top of their buy and flip modus operandi, these owners tended to make higher bids for houses since their intention is to sell as soon as they reach a modest level of profit and, as you may recall, it appeared that the rise in housing prices in the first half of the 2000s appeared to be a never-ending wealth creation machine. The fact that these borrowers intended to flip their investments quickly meant that they were more likely to shop around for cut-rate deals on mortgages, often using subprime credit to make their purchases as shown on these graphs and paying a very low downpayment:

Note the rise in the use of subprime credit as the decade passed, particularly in the four aforementioned states. Since these owners had very little money "in the game", they had very little to lose once the market started to turn down, making it very simple to just walk away and never look back. After all, one can’t get homesick if it was never home, can one?

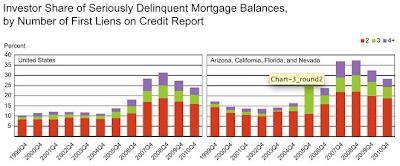

Now let’s look at how these speculators did as the housing market started to correct on these two graphs, once again, with the same colour scheme representing the number of first lien mortgages:

When measured using mortgage delinquency, multiple mortgage holders tended to do well in the first half of the 2000s because house prices were on that uphill treadmill. Things rapidly changed in late 2006 and early 2007 when house prices started to drop. Multiple first mortgage holders across the United States were responsible for only 10 to 15 percent of serious delinquencies during the first half of the 2000s. This changed dramatically, and by the fourth quarter of 2007, multiple first mortgage holders were responsible for just over 30 percent of delinquencies. In the "sun’n’sand" states, multiple first mortgage holders were responsible for just under 40 percent of delinquencies. That’s a pretty stunning number!

The authors of the study conclude that speculative real estate investors were more important for the formation and collapse of America’s housing market than was first thought. The availability of ultra-low interest rates (particularly teaser rates), the use of minimal (or no) down payments and other creative financing obligations allowed unsophisticated American investors to buy the "dream" several times over. Unfortunately, as the market started to fold back on itself, not only were speculators driven out of the market, but honest American families who prudently put a 20 percent down payment on their dream home and paid their monthly "pound of flesh" were collateral damage as housing prices collapsed to lows not seen since the early part of the decade. Unfortunately, the Federal Reserve seems unable to see that they paid a role in this horror story; it is their policy of easy, nearly free credit that is in large part responsible for the genesis of the problem. That, and their pals on Wall Street who used subprime mortgages as a self-perpetuating revenue creating machine. It would appear that all of them have not learned their lesson as well.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

We’re currently in the mcomment_IDst of the greatest mortgage refinancing frenzy of the past 5 or 6 years. Rates are now the lowest they’ve been since mcomment_ID to late 2003, I worked with a company called 123 Refinance I refinanced my current mortgage to 3.12% search online for them if you are planning to do refinance.