This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

As the Joint Select Committee on Deficit Reduction wiles away the hours agonizing over tax cuts, tax increases and spending cuts, I took a look back at the tax revenue that Washington has gleaned from both individuals and the corporate world. I was most interested in the amount of corporate taxes paid over the years as my initial impression was that corporations, particularly in recent years, are paying a smaller and smaller portion of Washington’s overall revenue. Fortunately, the Congressional Budget Office has a data bank that provides any researcher with a case of information overload! Here’s what I found.

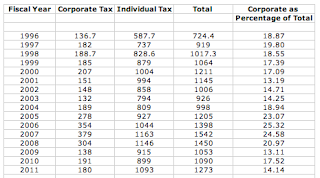

As the Joint Select Committee on Deficit Reduction wiles away the hours agonizing over tax cuts, tax increases and spending cuts, I took a look back at the tax revenue that Washington has gleaned from both individuals and the corporate world. I was most interested in the amount of corporate taxes paid over the years as my initial impression was that corporations, particularly in recent years, are paying a smaller and smaller portion of Washington’s overall revenue. Fortunately, the Congressional Budget Office has a data bank that provides any researcher with a case of information overload! Here’s what I found.I looked at Washington’s revenue data as far back as 1996, giving me 15 years of data to deal with. Remember those heady days of balanced budgets and budget surpluses? I didn’t think so! First, let’s look at the corporate tax revenue fifteen year history followed by the taxes collected from individuals and then how much corporations are remitting as a percentage of Washington’s total tax revenue, excluding Social Insurance taxes. Here is a chart showing the database that I am using:

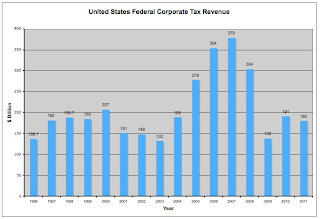

Back in the second half of the 1990s, corporations paid an increasing amount of taxes to Washington, growing from $136.7 billion in 1996 to $207 billion in 2000 just prior to the 2001 recession. In that year, corporate tax revenue dropped by 27 percent to $151 billion, hitting a low of $132 billion in 2003, a drop of 36 percent from their peak. Corporate taxes didn’t recover to their late 1990s level until 2004 when they remitted $189 billion. In the 15 year period, corporate taxes reached a peach of $379 billion in 2007 and from this zenith, dropped to as low as $138 billion in 2009, just after the end of the Great Recession. Since then, they have recovered but, at $180 billion in 2011, are still below their peak in 1998 when fiscal balance was the name of the game. Here is a graph showing the rather volatile ups and downs of the corporate tax world:

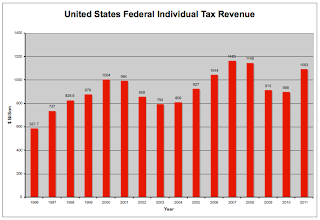

Now let’s look at the poor, beleaguered individual taxpayer. In 1996, individuals remitted $587.7 billion to Washington. This rose to $1.004 trillion in 2000 but fell by only 1 percent to $994 billion during the 2001 recession. Note that this compares to a 27 percent drop in corporate tax revenue in the same year. Individual tax revenue hit a low of $794 billion in 2003; that’s a drop of 21 percent from peak to trough compared to a 36 percent drop in corporate taxes over the same period. Individual taxes reached a peak of $1.163 trillion in 2007 and have dropped as low as $899 billion in 2010, recovering to $1.093 trillion in 2011. Here is a graph showing the much less volatile ups and downs of the tax world for Main Street America:

Let’s summarize the last four years. From the 2007 peak to fiscal 2011, Washington’s individual tax take has only dropped by $70 billion or 6 percent. Over the same timeframe, Washington’s corporate tax take has dropped by $199 billion or 52.5 percent. Now who looks like they are Washington’s best friend forever? It certainly isn’t Corporate America!

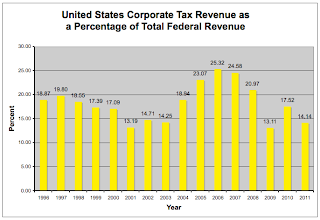

Lastly, let’s look at what percentage of Washington’s total tax revenue (excluding Social Insurance taxes since they are generally equally paid by employer and employee) comes from corporate taxes as shown on this graph:

Note that during the latter half of the 1990s, corporate taxes made up between 17 and 20 percent of total Federal tax revenue. This dropped to 13.19 percent during the recession of 2001 and didn’t recover until 2004 when it climbed to its 15 year peak of 25.32 percent in 2006. From that point, the corporate tax revenue component of Washington’s total revenue dropped to a low of 13.11 percent in 2008, largely because of diminished profitability during the last half of 2008 as the Great Recession took hold. What surprised me the most was that during fiscal 2011, corporate taxes made up just over 14 percent of total revenue, just above its 15 year low despite the fact that Corporate America had a very profitable year accompanied by reasonably good economic growth, particularly during the first half of the year.

To close, let’s take a look at the most recent quarterly net income numbers for a handful of America’s largest corporations:

Apple: $6.62 billion

ExxonMobil: $10.3 billion

General Electric: $3.4 billion

Walmart: $3.801 billion

Bank of America: $6.2 billion

For these five companies alone, net income totals just under $30.5 billion for the latest quarter alone and they pretty much all have released guidance showing that they expect profitability to increase in the next quarter. At the much-touted 35 percent corporate tax rate, these five corporations should be pumping over $10.6 billion on a quarterly basis to Washington. While I realize that this doesn’t allow for any of the numerous tax deductions allowed in the corporate world, the way Corporate America talks about reducing the much-hated 35 percent corporate tax rate, you’d swear that they were all paying the maximum!

Here’s a quote from the The Budget for Fiscal Year 2012 "Putting the Nation on a Sustainable Fiscal Path":

"Beginning the Process of Corporate Tax Reform. The United States has the highest corporate tax rate in the world. Part of the reason for this is the proliferation of tax breaks and loopholes written to benefit a particular company or industry. The result is a tax code that makes our businesses and our economy less competitive as a whole. The President is calling on the Congress to work with the Administration on corporate tax reform that would simplify the system, eliminate these special interest loopholes, level the playing field, and use the savings to lower the corporate tax rate for the first time in 25 years—and do so without adding a dime to our deficit."

Wrong, wrong, wrong. Instead, it’s time to start making everyone pay their fair share, including wealthy and highly profitable Corporate America. Corporations proved themselves capable of hoodwinking Washington back in 2004 and it’s likely that they’ll be up to their old tricks yet again if they are given their own way.

If you want to view all Glen Asher blogs click HERE

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment