This article was last updated on May 19, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

June 28th, 2010 is going to be a very special day for some of Canada’s MPs. While Canada’s finance ministers wrangle over the idea of increases to the Canada Pension Plan (of course, funded by the taxpayer), an additional 75 MPs are about to qualify for a pension of their own. This lucky lot was elected way back on June 28th, 2004 so they have now qualified for an MP pension.

Canada’s Member of Parliament pension plan was founded in 1952. At that time, Prime Minister Louis St-Laurent was concerned that some people were reluctant to run as Members of Parliament because they believed that long years spent in public service would prevent them from adequately saving funds for their later years. Pardon my cynicism but "yeah, right".

Canada’s MPs qualify for their taxpayer-funded pensions after 6 years of "service" once they reach the age of 55. That is why it is so critical for each MP to win a second mandate from their constituents. As it stands now, after a paltry 6 years of time spent in Ottawa, each MP (even those who are underachievers languishing in the furthest back of the back benches) qualifies for a minimum annual pension of $28,000. That may not sound like much but how many ordinary Canadians would qualify for a pension of that size after only 6 years of service to any employer? As well, when you consider the fact that MP base salaries for 2010 are $157,731 plus additional pay for Committee work etcetera, you can see that they are hardly suffering financially. In fact, their base salaries put them in the top 2% of Canadian earners.

Here is the chart from the Government of Canada’s Member of Parliament website showing just how our MPs are compensated for the fiscal year 2010:

MP pensions also increase based on their services to Parliament. If they are Committee chairpersons, Party Whips, Deputy House Leaders right on down to the rather cumbersome Vice-Chairperson of Standing and Standing Joint Committee, they can earn extra income which eventually forms part of their pension.

In this report released by the Treasury Board Secretariat for the year ending March 31, 2009, facts regarding contribution levels for MP pensions can be gleaned. According to the report, an MP contributes seven percent of their salary toward their MP pension. MPs earn three percent for each year of service times the average of the best five years of service to a maximum of 75% of their average salary. For every dollar that the MP contributes to their pension, Canadian taxpayers shell out an additional $3.84 to $7.19. I’d say that’s mighty generous of us, wouldn’t you? As well, the pension is fully indexed to inflation for life; right now, it is indexed at 3.3% annually, well above Statistics Canada’s posted inflation rate. For the fiscal year 2008 – 2009 in the Report, MPs and Senators contributed $2.61 million to their Retirement Compensation Arrangements Account and the Canadian Government (in actuality you and I as taxpayers) contributed $17.9 million, 6.9 times the amount that MPs contributed to their own pensions. As well, contributions to the Members of Parliament Retiring Allowance Account totalled $1.65 million by Members and $6.07 million by you and I.

In digging around on the internet, I found the following individual pensions amounts quoted. I can’t verify their accuracy because I simply have been unable to find any Government of Canada links that will give me the information that Canadians should have ready access to, so you can take the numbers with an appropriate grain of salt.

Jean Chretien: more than $325,000 annually

Stephen Harper: more than $177,977 annually

Gilles Duceppe: $139,270 annually

I find it interesting to recall that Stephen Harper, the Chief Policy Officer for the original Reform Party who campaigned on their strict policy of not accepting their MP pensions, will have a taxpayer-funded pension that is nearly triple the current household income of the average Canadian family.

To put the whole MP pension plan scheme into perspective, let’s compare it to the Canada Pension Plan, the fallback pension for the 70% of Canadians who are not covered by any other pension plan. An average Canadian who pays into the Canada Pension Plan for his or her entire working life can only collect a maximum CPP benefit of $934.17 per month for an annual total of $11208. I think I’d rather collect the MP pension thank you very much.

In closing, here’s a comment from former Edmonton-Strathcona MP Rahim Jaffer about his MP pension:

"It’s not overly generous. Compared to other pensions, people will say yes it is, but I think when you consider the work and the commitment you’re making, I think there was a reason why it was instituted that way."

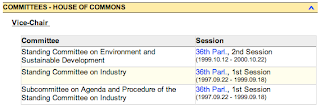

Mr. Jaffer will qualify for his first pension cheque, courtesy of Canadian taxpayers, on December 15th, 2026. It’s not going to be a small one either; here’s his curriculum vitae from the Parliament of Canada website:

His service as Conservative Party Caucus Chair for nearly 2 years back in 2006 to 2008 added an additional $10,700 to his annual salary and his service as Vice Chair of four Standing Committees back in 1997 to 1999 added $10,500 to $10,900 to his annual salary for those two years so, in combination with his eleven years of service, his MP pension will be well above the minimum allotted.

You’re welcome Mr. Jaffer.

Oh yes, and his wife Helena Guergis is one of the lucky ones who qualifies for her pension on June 28th, 2010.

References:

Here’s a list of the lucky 75.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment