This article was last updated on May 19, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

With all the recent gab about the debt ceiling, tax cuts or no tax cuts, debt downgrades and deficit control, I thought that this little item entitled "Rebuild American Infrastructure? Companies’ Offshore Profits Can Help" from the Brookings Institute website was rather pertinent. In case you hadn’t gathered from my previous postings, I’m don’t particularly favour the viewpoint that lower corporate taxes are particularly correlatable to improved employment statistics or economic growth. That said, there is one thing that lower corporate taxes do relate directly to and that’s higher corporate profits and, as I’ll show below, wealthier shareholders.

With all the recent gab about the debt ceiling, tax cuts or no tax cuts, debt downgrades and deficit control, I thought that this little item entitled "Rebuild American Infrastructure? Companies’ Offshore Profits Can Help" from the Brookings Institute website was rather pertinent. In case you hadn’t gathered from my previous postings, I’m don’t particularly favour the viewpoint that lower corporate taxes are particularly correlatable to improved employment statistics or economic growth. That said, there is one thing that lower corporate taxes do relate directly to and that’s higher corporate profits and, as I’ll show below, wealthier shareholders.The Rebuild American Infrastructure item was written by Thomas E Mann, a Senior Fellow at the Brookings Institute and Reed Hundt, the Chief Executive at the Coalition for Green Capital, a non-profit Washington-based organization that "…exists for the purpose of designing, developing and implementing green banks (think clean energy) at the state, federal, and international level…". Mr. Hundt was also a former Chairman at the FCC.

The authors note that America badly needs investment in its aging infrastructure. They suggest that at least $1 trillion in improvements are needed to improve many aspects of American infrastructure. In fact, a website cleverly named "Report Card for American’s Infrastructure" created by the American Society of Civil Engineers, graded the United States bridges, highways, parks, schools, transit, energy and other components of domestic infrastructure and found it wanting to the tune of $2.2 trillion in investments over the next five years to improve infrastructure from its current "D" rating.

Oddly enough, cash-strapped state and federal governments are turning their pockets inside out to show us that they simply haven’t got the money to fix up what is important to keep the American economy ticking on all cylinders. The neglect of our collectively owned infrastructure is starting to show; think of the failed levee system in New Orleans and the I-35W bridge collapse in Minneapolis in 2007. If government doesn’t have the money, who does?

It turns out that American corporations are sitting on piles of cash that just happens to be sitting in bank accounts outside the United States. In fact, they are sitting on over a trillion dollars (that’s $1,000,000,000,000 in case you forgot how many zeros there are in a thousand billion) that is stranded overseas simply because they don’t wish to repatriate the cash. Why? If they bring this pile of money back to the United States, they will incur a major tax bill, up to 35 percent of the total. That would, quite simply, never do. The authors note that the CEOs of said companies would much prefer to keep this cash out of the hands of the IRS and spend it buying overseas companies resulting in the creation of jobs outside of the United States. There’s no particular surprise there, is there?

Let me digress for just a few paragraphs. Back in the distant past that was October 2004, the American Jobs Creation Actwas passed by the 108th Congress to provide a temporary, one-time reduced rate of taxation for earnings that corporations repatriated to a maximum of $500 million per company or the amount of earnings shown to be permanently reinvested outside the U.S. before June 30, 2003. A deduction of 85 percent of the increase in earnings was allowed which resulted in a drop in the taxation rate from 35 percent to 5.25 percent. Pretty sweet deal that those of us who live on Main Street would love to share! These repatriated earnings had to be used for domestic investment with the ultimate goal of creating jobs, thus, the title of the Act. Fortunately for America’s Main Street taxpayers, the Congressional Research Service researched the impact of the Act to see whether, in fact, this repatriation led to increased investment and job creation in their "Tax Cuts on Repatriation Earnings as Economic Stimulus: An Economic Analysis" paper.

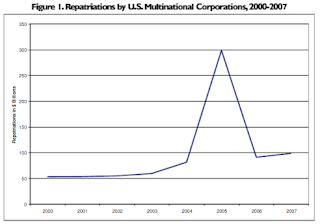

First, let’s take a look at a graph that shows how much money corporations repatriated compared to the normal background, pre-Act and post-Act levels:

Notice how in the years after the special deal, repatriations quite quickly dropped back to normal levels. Apparently, corporations were either anticipating another tax holiday or they really didn’t care about American job creation opportunities. My suspicion – the latter.

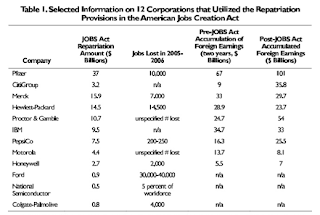

Of the 9700 companies that were eligible to participate, only 843 took advantage of the repatriation with $312 billion coming back home to roost. This created a total tax deduction of $265 billion. As background, in a normal year, corporations normally repatriated a paltry $34 billion. The top 15 corporations that participated repatriated 52% of the total $312 billion; these included Pfizer, Merck, Hewlett-Packard, Johnson & Johnson, IBM, Schering-Plough, Du Pont, Bristol-Meyers Squibb, Eli Lilly, PepsiCo, Procter and Gamble, Intel, Coca-Cola, Altria and Motorola. Notice the recurring appearance of pharmaceutical companies in the top 15 list? My, aren’t we nice to those that sell us overpriced prescriptions?

Now let’s look at what happened at some of these companies that availed themselves of this very special deal after the repatriation to see just how many jobs were created:

If you add the known job losses up at the participating corporations, over 72,000 jobs were lost at these 12 participants just after they repatriated nearly $108 billion of nearly tax free earnings that were supposed to create employment. As well, note how quickly they rebuilt their overseas cache of cash back up after the tax holiday expired.

If the repatriated funds weren’t used to create jobs, where did it go? Apparently, the cash went right into pockets of shareholders. A study entitled "Watch What I Do, Not What I Say: The Unintended Consequences of the Homeland Investment Act" by Dhammika Dharmapala found that every $1 increase in repatriation was associated with a $0.60 to $0.92 increase in shareholder payouts through the buyback of shares. Pretty sweet deal, especially for those who dwell in the corner offices of America’s corporate ivory towers.

Here’s the summary of what the Congressional Research Service said about the efficacy of the American Jobs Creation Act:

“While empirical evidence is clear that this provision resulted in a significant increase in repatriated earnings, empirical evidence is unable to show a corresponding increase in domestic investment or employment by firms that utilized the repatriation provisions.”

Apparently, this is a textbook example of the Law of Unintended Consequences in action.

Now, back to the Hundt and Mann article. These fine gentlemen suggest that Congress might forget the past transgressions of 2004 and let corporations bring their trillion dollar savings back home to the United States where it could be invested in an infrastructure bank for a specified period of time. This infrastructure bank would then loan out this money to needy municipalities or states for American infrastructure projects that were begging to be undertaken. In return for their largesse, corporations would be allowed to invest in the bank for a period of time with the promise of avoiding taxation. Past studies have shown that a billion dollars of construction related infrastructure activity creates about 10,000 job years. That trillion dollars sitting in overseas banks collecting all manner of exotic mould and fungi could equate to the creation of 10 million job years over the next 20 years.

I admit, all of this does sound rather intriguing, especially with the stubborn joblessness of this so-called "recovery". However, with Corporate America’s last foray into the world of Congressionally promoted tax avoidance only six years in the past, I’m certain that the bean counters at more than one American corporation would find a loophole in this sort of infrastructure bank legislation that you could float a foreign-built supertanker through. The Act did prove one thing that at least some of us suspected all along; Corporate America is a whole lot smarter than Legislative America. Either that, or Legislative America is doing favours for their pals in Corporate America.

In conclusion, I do think that, when we hear from our elected officials that we desperately need to lower corporate taxes to remain competitive and create jobs, we need to remember this little tale of corporate tax reduction unintended consequences. As I’ve said before in this posting and elsewhere, lower corporate taxes are guaranteed to lead directly to higher corporate profits and nothing else…except perhaps larger bonuses for the upper floor, corner office dwellers. But then again, I’ve never claimed to be anything but a cynic

Click HERE to read more of Glen Asher’s columns.

Article viewed at: Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment