On January 2nd, 2011, White House Economic Advisor Austan Goolsbee told ABC’s "This Week" that Congress needs to act on raising the United States’ debt ceiling. The current debt ceiling was set at $14.3 trillion back in February 2010, an amount that is likely to be reached by April or May of this year. Congress must vote to extend the country’s borrowing limit or face the humiliation of a default. Here is a quote from his interview:

"The impact on the economy would be catastrophic…that would be a worse financial and economic crisis than anything we saw in 2008….we shouldn’t even be discussing that — people would get the wrong idea."

Mr. Goolsbee, exactly what wrong idea would people be getting? Isn’t it already apparent that there is absolutely no hope that the debt will ever be repaid let alone bringing annual expenditures in line with annual expenditures? Apparently the elites in government need to learn from the example of American households which have had to learn the hard way that spending more than you bring in cannot go on forever.

The very idea of Congress increasing the so-called debt ceiling is becoming more and more ludicrous as the years (and administrations) pass. In this posting, we’ll take a brief look at the recent history of limitations placed on federal debt and where the whole idea of debt ceilings came from in the first place.

As background, the debt ceiling is a statutory limit which is set by Congress, the only body in the United States with the legal ability to change the debt ceiling, that restricts the amount of debt that the federal government is allowed to accumulate. This statutory limit has restricted the amount of federal debt since the year 1917 when Congress passed the Second Liberty Bond Act which was enacted to finance the United States’ entry into World War I. This Act allowed the Treasury to issue $8 billion worth of long-term Liberty Bonds in addition to its more commonly issued short-term debt instruments. Normally, the Treasury finances federal activities of all types, however, when the federal debt nears its legal pre-determined limits, the ability of the Treasury to issue new debt to fund its short-term activities or to finance yet another annual deficit are severely constrained. It is at that point in time that Congress needs to act to increase the debt ceiling since, apparently, government is rarely capable of spending less than it receives in revenue from generous and philanthropic American taxpayers.

Looking back at the year 1995 we get a fine example of what happens when the spending habits of the government are curtailed. During the Clinton Administration, Republicans in the Congress under Newt Gingrich refused to raise the debt ceiling for six months until polling numbers forced them to change their mind. Mr. Gingrich even reached the point where he very unwisely threatened to send the United States into default on its existing debt. This politically motivated refusal resulted in the first "debt ceiling crisis" and caused government to shut down twice. While shutting down government does not seem to be an entirely bad thing, the unfortunate bearers of the brunt of the weight of shutdowns are ordinary Americans who rely on government for their Medicare, Social Security and unemployment insurance. Once again, those of us who are least responsible for the malfeasance of government are the ones most likely to suffer. During that six month period, the Secretary of the Treasury declared a debt issuance suspension requiring the government to raise funds in other ways to meet its spending needs.

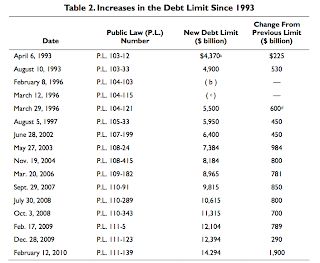

Let’s take a brief look at the history of the debt ceiling starting after the Second World War and running up to the George W. Bush era. The ceiling was reduced from $300 billion to $275 billion after the end of World War II where it remained until 1954. Between 1954 and 1962, the ceiling was raised seven times and reduced twice and by 1962 had reached $300 billion. Between 1962 and 2008, Congress has altered the limit 69 times with most of the changes being quite small. In relatively recent history, Congress raised the ceiling to $4.9 trillion on August 10th, 1993. That ceiling was reached in the fall of 1995 when the "debt ceiling crisis" took place as noted above. On March 29th, 1996, the ceiling was raised to $5.5 trillion and again to $5.95 trillion on August 5th, 1997. During the fiscal years from 1998 to 2001, the government ran budget surpluses which actually reduced the public debt by almost $450 billion.

Let’s see just how close our government can get to the debt limit before they are forced to blink. In fiscal 2002, the Bush Administration became aware that there was a deteriorating budget outlook and asked Congress to raise the debt ceiling by $750 million. In April, the Treasury reached the point of desperation because the debt was within $25 million of its maximum limit. Despite the influx of tax revenues in mid-April, the debt had risen to within $15 million of the allowable limit in very short order (the $15 million was about five minutes of federal spending!). On June 11th, 2002, the Senate adopted a bill that would raise the debt limit to $6.4 trillion, hoping that the increase would carry the government through to fiscal 2003.

Here, in summary chart form, are the debt ceiling changes from 1993 to the present showing the debt limits and the changes from the previous limits:

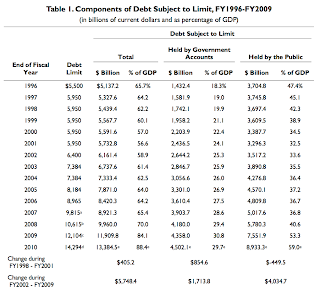

Just in case we’ve forgotten, here’s a look at the debt and the debt ceiling in terms of GDP:

Notice how the changes to the debt ceiling have become more frequent (sometimes twice a year) and larger over the past 17 years? With all of these habitual debt ceiling increases, why have a ceiling at all? Why not just make it an even quadrillion dollars and save Congress, the Senate and the President a whole lot of time and pen ink? It would certainly give the mainstream media and bloggers a whole lot less to write about once we lost interest in the quadrillion number!

If the current Congress should refuse to raise the debt ceiling, severe negative pressure would affect the world’s bond markets as was seen back in 1995 – 1996. New Treasury bonds would not be brought to market and this could result in a run on the existing supply of Treasuries since they would no longer be deemed to be the world’s choice as a secure reserve. This would be pretty unwise, especially in light of the fact that bond traders have recently become a overly sensitive when it comes to sovereign debt issues in the Eurozone.

Government has some very difficult decisions to make. For fiscal 2011, budget expenditures of $3.8 trillion are projected with a $1.3 trillion deficit being incurred. Of that, interest payments on the debt of $244 billion are required to prevent defaulting. This means that nearly 40 percent of all other expenditures will have to be cut in order to balance the 2011 budget.

Meaningful (and much needed) spending cuts are NOT going to happen, especially in light of the fact that the so-called "recovery" is weak at best and practically non-existent in some parts of the United States.

I think that this is what they call the space between a rock and a very, very hard place.

Oh yeah, according to the TreasuryDirect website, the debt on December 30th, 2010 stood at $13,871,130,353,817.40 in case you were wondering.

Click HERE to read more of Glen Asher’s columns.

References:

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment