Since the beginning of the Great Recession, Canadians (and the rest of the world for that matter) have been bombarded with propaganda from the Harper government telling us all how Canada's private sector banking business is the eighth wonder of the modern world and how, without help, it managed to weather the worst that the economy could throw at it and arise from the ashes of 2009 unscathed. Is this really the case or are we just being lulled into a false sense of security?

Researchers at the Centre for Policy Alternatives, a Canadian think-tank have released a report entitled "The Big Banks' Big Secret", authored by David Macdonald. In this eye-opening report, Mr. Macdonald digs behind the headlines and examines the veracity of the mainstream claims that Canada's banks did, in fact, not require the massive bailouts that other banks around the world have required during and since the Great Recession nearly caused the world's banking system to implode. In this posting, I will select a few of the salient points that will help us better understand just how healthy Canada's flagship banking sector really was and how we could be in for a bit of a surprise in the future.

Let's open with three quotes from Canada's pre-eminent Minister of Finance and his boss, the Prime Minister:

“…we have not had to put any taxpayers’ money into our financial system in Canada, nor do I anticipate that we’ll be obliged to do so.”

—Jim Flaherty, Minister of Finance

“Without wanting to appear arrogant or vain, which would be quite un-Canadian…while our system is not perfect, it has worked during this difficult time, I don’t want the government to be in the banking business in Canada.”

—Jim Flaherty, Minister of Finance

“It is true, we have the only banks in the western world that are not looking at bailouts or anything like that…and we haven’t got any TARP money.” —Stephen Harper, Prime Minister

And lo, the fairy tale was born.

Through Mr. Macdonald's research, we find that the three preceding statements could not be further from the truth. In actuality, between September 2008 and the peak of the crisis in March 2009, Canadian banks received $114 billion in support from three entities; the United States Federal Reserve, the Bank of Canada and Canada Mortgage and Housing Corporation (CMHC) (or in other words, Canada's taxpayers since we implicitly back any investments that CMHC makes through our annual, involuntary donations to Ottawa). This "Extraordinary Financing Framework" was actually prepared to spend up to $200 billion to backstop Canada's banks and other industries. Here is a graph showing the support given by month and the source of the money:

Notice that pretty blue wedge? That's thanks to you and I, Canada's taxpayers. This support was termed CMHC Insured Mortgage Purchase Plan or IMPP and you'll notice right away that it quite rapidly became the largest source of funding to Canada's banks. Within four months of its inception, Canada's banks had receive $50 billion in cash (politely termed liquidity in bankerese) in exchange for mortgage-backed securities. As I noted above, support for Canada's Big Five and a handful of their little buddies like ING, HSBC and National Bank among others had soared to $114 billion. To put that number into perspective, that's 7 percent of Canada's 2007 GDP and represents a subsidy of $3400 for every man, woman and child in Canada.

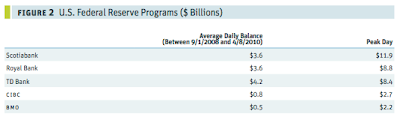

You will also notice that the black and green portions of the bars rise and then disappear. At the peak of the bailout, Canadian banks borrowed $33 billion from the Federal Reserve (black portion of the bar) as shown in this chart, noting that Scotiabank was the heaviest "feeder", with borrowings peaking at $11.9 billion, all of which was repaid by April 2010:

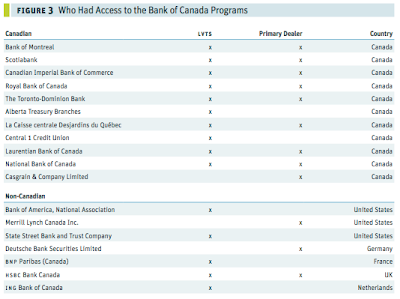

Let's not forget the largesse of the Bank of Canada. The Bank of Canada stands behind a cloak of secrecy, refusing to release the amount of their loans to the banking sector, however, records of the Office of the Superintendent of Financial Institutions (the banks' boss) allowed Mr. Macdonald to estimate that Canada's banks had borrowed over $41 billion from Canada's central bank. As shown in this chart, banks headquartered in other jurisdictions would also have been eligible to avail themselves of the Bank of Canada's generosity, including American banks that dipped very, very heavily into the very, very deep pockets of the Federal Reserve:

Remember, because of the cloak of secrecy under which Mr. Carney operates, we do not know how much the Bank of Canada loaned to the banking sector outside of Canada, however, it's comforting to know that Canada was there for its pals during the Great Crisis, isn't it?

Mr. Macdonald estimates that the biggest users of the Bank of Canada's liquidity was the Bank of Montreal, CIBC and Scotiabank whose borrowing peaked at $9.2 billion. All three would have used those wonderful mortgage-backed securities and provincial bonds as collateral for the amounts borrowed. All of the funds borrowed from the Bank of Canada were repaid on July 8, 2010.

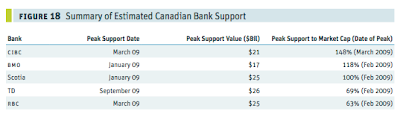

Let's put all of these numbers into perspective. Here is a summary of the estimated support for Canada's banking sector, showing the level of peak support to the market capitalization of the bank on the date of peak support:

Notice that three of the five banks, CIBC, BMO and Scotiabank, all maxed out their "credit cards" by finding themselves in a situation where their borrowing was equal to or in excess of their market value. This has two implications:

1.) Canadians could have been left holding the bag, owning a bank and its assets that were worth less than its debt.

2.) Canada's bankers have now been led to believe that they are too-big-to-fail and are now suffering from a bad case of moral hazard where, no matter how stupid they are, taxpayers and other parties will be there to back up their foolishness.

Why should this concern any of us now? After all, this is two year old history.

This should be of extreme concern to all of us because Canada is one of the few developed nations in the world that has not suffered from a real estate market readjustment. You'll notice that Canada's banks used mortgage-backed securities as collateral in 2008 – 2010. What happens if Canada's real estate market takes a tumble and those mortgagees find themselves underwater? So much for securitizing negative equity mortgages. On top of that, Canada's banks have very little protection from an avalanche of defaulting loans of all types as I posted here since their loan loss provisions are a tiny fraction of what could be required if the bottom fell out of Canada's real estate market or if default rates rose in lock-step with rising interest rates.

Mr. Macdonald's report should give all Canada's cause to reconsider what we think we know about Canada's banking sector. It is quite apparent that all is not what it appears and appeared to be and that it is most definitely not all that we have been told that it is by Canada's political leadership.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment