A recent publication, “We’ll Live to 100 – How Can We Afford It” by the World Economic Forum takes a sobering look at the financial repercussions of living to the century mark, a greater likelihood than it has ever been. As many current studies have shown, while we may be living longer, we are most likely to live longer and live poorer with a very significant portion of the world in both developed and undeveloped nations simply not saving enough to fund their elder years.

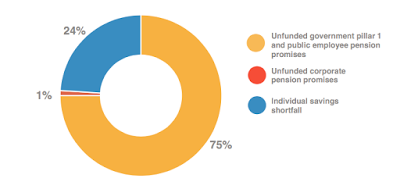

Since the 1950s, life expectancy has been increasing at an average rate of one additional year of life for every five years that passed. Here is a graphic showing how longevity has been increasing over the past 7 decades:

Of course, these are merely projections based on “past performance”; any number of factors could reduce longevity. While this all seems wonderful, there is a significant downside; the global dependency ratio (the ratio of those who are in the workforce to those who are in retirement) will drop significantly from 8:1 today to 4:1 by 2050. This likely means that retirement age will have to rise since there is no way that the current pension/retirement system can be sustained. As well, the population over the age of 65 will increase from 600 million today to 2.1 billion in 2050. The rise in longevity and the drop in the dependency ratio will combine to form the “perfect retirement storm” meaning that governments around the world will have to take significant actions to prevent hundreds of millions of their citizens from retiring to a cat food future (if they are that lucky).

Here is a summary of the challenges facing the current retirement system:

1.) Lack of easy access to pension plans – this is particularly problematic in the growing self-employed/informal job sector.

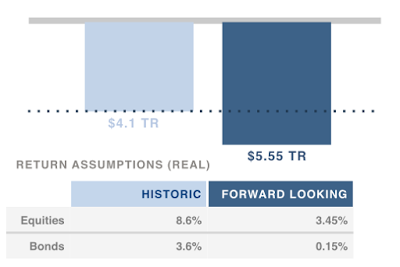

2.) Long-term, low-growth investment environment – the past is the past when it comes to returns on investments. Baring any sudden changes, equities are projected to perform about 5 percentage point below historic averages and bond returns are projected to perform about 3 percentage points below historic averages. As well, low returns on long bonds have created a growing underfunding crisis in the pension world where high interest rates are needed to assure long-term viability.

3.) Low levels of financial literacy combined with a high degree of individual responsibility to manage pension funds – this is particularly problematic in our new defined contribution pension plan world where individual investors are expected to make investment decisions on their own. As it stands now, over 50 percent of global retirement assets are held in defined contribution plans, far different from the 20th century where most pension plans were defined benefit plans that were professionally managed with an assured payout upon retirement.

4.) Inadequate savings rates – to support retirement, 10 to 15 percent of one’s annual salary needs to be saved. Savings rates in most nations are far lower meaning that retirement incomes will be significantly below what is needed to retire with financial security.

With this background information, let’s look at the size of the shortfall in pension saving for eight of the world’s largest economies with the following assumptions:

1.) governments provide the first pillar pension

2.) employers (public or private) provide the second pension

3.) Individual savings make up the balance needed to retire

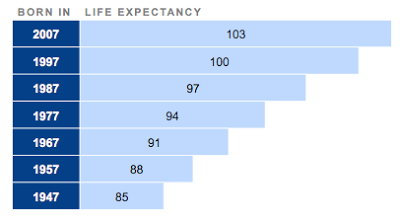

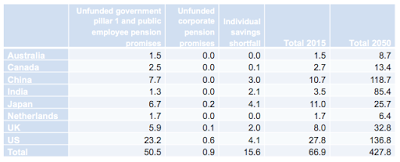

Here is a graphic showing the size of the retirement savings gap (in trillions of dollars) assuming that retirees will require income totalling 70 percent of their pre-retirement income to adequately support their needs:

For these eight nations, the individual retirement savings gap (in 2015) is estimated to be about $66.9 trillion with the largest shortfall being in the United States, currently at $28 trillion and growing to $137 trillion in 2050. The $70 trillion gap is roughly 1.5 times the annual GDP of these eight nations and is expected to grow by an average of 5 percent annually, reaching $427.8 trillion by 2050 or a daily growth rate of $28 billion.

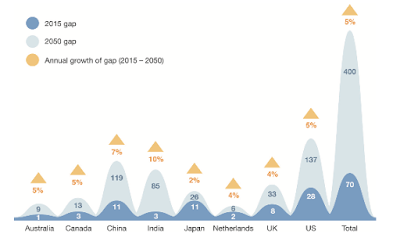

Now let’s look at what the pension system funding situation looks like when we add in the shortfalls in corporate pension plans, government public pensions and public employee pension plans and the individual retirement savings gap:

While we in the developed world regularly here about the funding shortfall in the corporate pension system, as you can see here, the corporate pension funding gap is quite small when compared to the unfunded government public pension system and public employee plans and the individual retirement savings shortfall. Here is a table showing the shortfall for all three aspects of retirement funding for all eight nations in the study:

Let’s focus on the individual retirement savings gap in the United States. Here is a graphic showing the individual retirement savings gap for Americans and how the lower returns on investments have had an impact on the personal retirement savings underfunding:

While some of the shortfall can be blamed on the low investment returns, as you can see, the low returns have increased the $4.1 trillion shortfall by 35 percent to $5.55 trillion, a rather significant increase thanks to central bankers and their low interest rate experimentation.

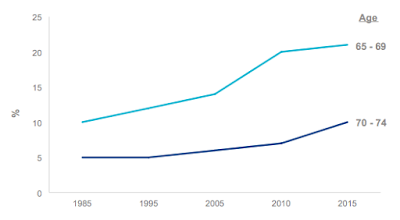

Given that this is what has happened over the past three to the percentage of people in the United Kingdom over the age of 65 that are still working:

…and this is what has happened to the U.S. labour force participation rate for Americans over the age of 65 since 2008:

…it looks like individuals have figured out that the old standard of retiring at age 65 no longer applies for financial (and other) reasons, suggesting that the WEF analysis is not far from wrong.

This analysis by the World Economic Forum is sobering. Given that hundreds of millions of workers will be retiring over the next two decades, there is an urgent need for changes to the system and and an equally urgent need for people to realize that funding their sunset years is key to a happy retirement. While the prospect of living to be 100 years old is appealing, the prospect of being forced to eat cat food to get there is most definitely not!

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment