I apologize in advance for the second depressing posting in a row but I thought I’d get this posted now since the subject is linked to my last article.

In looking through this document from the Congressional Budget Office last week, I found this particularly frightening line:

"Interest payments, which absorb federal resources that could otherwise be used to pay for government services, currently amount to more than 1 percent of GDP; under this scenario, they would rise to 4 percent of GDP (or one-sixth of federal revenues) by 2035."

Needless to say, it caught my eye. I thought that it was well worth looking into a bit deeper.

The document in question is a report entitled "The Long-Term Budget Outlook" dated June 2010 and revised August 2010. It is a cornucopia of interesting very long term fiscal projections by the Congressional Budget Office.

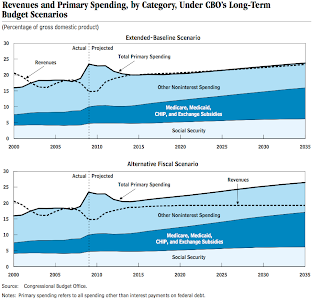

The scenario of which the CBO speaks is one that they term the "extended-baseline scenario". In this scenario, long-term tax increases would take place in lockstep with economic growth, the tax cuts of 2001 and 2003 would expire and overall total government revenue would rise to 23 percent of GDP by 2035 (and increase thereafter), a much higher rate than the norm seen in recent decades. On the spending side, government spending on everything other than mandatory health care programs, Social Security and interest on the federal debt would decline to the lowest percentage of GDP since before World War II. Yup, that’s going to happen. This would mean cuts in just about all domestic programs including national defence. To summarize, in this out-of-this-world scenario, the CBO hopes that the increase in revenue and decrease in most domestic program spending will offset MOST of the rise in spending on health care and Social Security necessitated by the baby boomers moving into their senior (and more expensive) years.

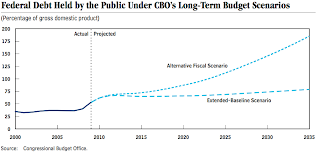

If this "Alice In Wonderland" scenario takes place, than and only then will federal debt held by the public grow from 62 percent of GDP this year to 80 percent of GDP by 2035. Then, and only then, will interest payments only rise to 4 percent of GDP as noted above.

Three letters: OMG. Basically the CBO, in its wildest dream state, can only fudge the revenue and expenditure numbers enough to keep our interest payments down to one-sixth of federal revenues by 2035.

Just in case you thought that the extended-baseline scenario wasn’t the stuff made of nightmares, here’s the CBO’s other scenario. This scenario has the rather innocuous-sounding moniker "alternative fiscal scenario". It doesn’t sound that bad, does it? Certainly, it couldn’t be any worse than having a root canal, could it? Under the alternative fiscal scenario, the CBO assumes that Medicare payment rates for physicians would gradually increase (they won’t under current legislation) and that several policies enacted recently that would restrain growth in health care expenditures will not continue after 2020. Once again, as seen in the extended-baseline scenario, spending on other activities other than mandatory health care programs, Social Security and interest on the federal debt would fall below the average level of the past 40 years relative to GDP but not as low as under the extended-baseline scenario. The CBO also assumed that most of the provisions of the 2001 and 2003 tax cuts would be extended, among other things, which would keep tax revenues near their historical average of 19 percent of GDP. Should the CBO’s worst-case (and probably most likely) scenario unfold, interest payments would rise to 9 percent of GDP or roughly one-third of revenues by 2035 and much more in later years because of ballooning debt. While not used in the CBO scenarios, they state that as the debt rose, upward pressure on interest rates would be exerted making interest outlays even larger.

Let’s take a graphical look at the two budget scenarios noting that the top chart is the best case scenario and the second chart is the one that we don’t want to think about:

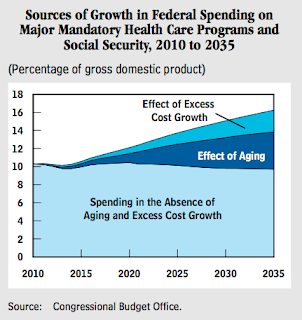

Lest we forget, as noted previously, the aging baby boomers are going to put a really bad crimp into the best laid plans of government. Those of us that are boomers are already using more of the social network (i.e. health care) that our government supplies than we did a decade or two ago and, looking at the lives of our parents, we are likely to use more of the goodies that our government provides as the next decades pass. Here’s a little graph from the CBO showing just that:

Notice that pretty, little dark blue wedge "Effect of Aging" and how it adds about 4 percent of GDP to the cost of supplying health care and Social Security by 2035? Can you imagine how wide that wedge will be by 2050 when the youngest of the baby boomers are in their mid-80s?

The CBO, as noted earlier in this posting, mentions briefly that the massive accrual of federal debt could have an upward impact on interest rates. Let’s take a look at the impact of rising interest rates on the entire scenario. A study entitled "Projected Interest Payments on Federal Debt Balloon" by Veronique de Rugy a Senior Research Fellow at George Mason University, linked here, has a most interesting chart which shows the projected interest payments to the year 2084 from the CBO’s alternative fiscal scenario as noted above. In their analysis, the CBO assumes constant long-term interest rates at just below 5 percent. In Ms. de Rugy’s research, she uses the same budgetary data but changes the interest rate. At an interest rate of 6 percent, the interest cost of the debt reaches 59.8 percent of GDP by the year 2084. If the interest rate rises to 7 percent, the interest on the projected debt reaches 136 percent of GDP in 2084.

Three more letters and two exclamation marks: OMG!!

Back to the CBO report. Here’s a look at the debt situation as a percentage of GDP under the two scenarios:

Enough said.

Here is Congressional Budget Office’s summary of the issues facing government from their report:

"Keeping deficits and debt from growing to unsustainable levels would require raising revenues as a percentage of GDP significantly above past levels, reducing outlays sharply relative to CBO’s projections, or some combina- tion of those approaches. Making such changes while economic activity and employment remain well below their potential levels would probably slow the economic recovery. However, the sooner that long-term changes to spending and revenues are agreed on, and the sooner they are carried out once the economic weakness ends, the smaller will be the damage to the economy from growing federal debt. Earlier action would require more sacrifices by earlier generations to benefit future generations, but it would also permit smaller or more gradual changes and would give people more time to adjust to them." (my bold)

President Obama, Senators and Congressmen/Congresswomen (and anyone else in government from any other country who cares): the horse has already left the barn. It’s likely already far too late to shut the door.

By the way, the interest on the debt for the first two months of fiscal 2011 is $43,538,808,068.78.

Click HERE to read more of Glen Asher’s columns.

References:

Congressional Budget Office – The Long-Term Budget Outlook – June 2010 (Revised August 2010)

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment