This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

I don’t know if you have ever taken the time to visit the website Open Secrets, but it is a fascinating treasure trove of all things government, most particularly, money in government. This Washington-based non-partisan, independent and nonprofit research group tracks money within the United States political game and how it impacts elections and public policy. Here is their three part mission quoted verbatim from their website:

I don’t know if you have ever taken the time to visit the website Open Secrets, but it is a fascinating treasure trove of all things government, most particularly, money in government. This Washington-based non-partisan, independent and nonprofit research group tracks money within the United States political game and how it impacts elections and public policy. Here is their three part mission quoted verbatim from their website:• Inform citizens about how money in politics affects their lives

• Empower voters and activists by providing unbiased information

• Advocate for a transparent and responsive government

In light of 2011’s OWS movement and the impending 2012 Presidential election and primary cycle, some of the data that can be mined from this website is most compelling. What I’d like to do for this posting is to select some interesting facts regarding the personal assets owned of the major Republican candidates. By doing this, I hope that my readers will see clear evidence for something that most American’s know in their "gut", that federal politics has become a playground for the tiniest fraction of the "one percent".

Fortunately for Americans, every Presidential election cycle, Presidential candidates have to file Personal Financial Disclosures that outline their net worth (within predetermined brackets) and their sources of income. For this posting, I will take a more detailed look at the finances of several of the Republican Presidential candidates, I will include screen captures showing salient points about their investing strategies and their overall net worth, particularly as it relates to their status in American society.

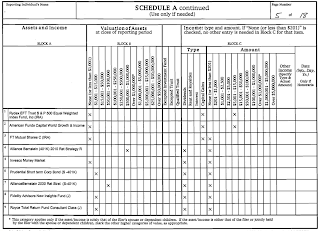

First up and the top of the heap, Mitt Romney. On this page, you’ll note that Mr. Romney owns between $250,001 and $500,000 worth of gold, a fact that I find most interesting:

As well, you’ll see that he is very well compensated for his services as both a director and a public speaker. He was paid a Director’s Fee of $113,880.73 for his services to Marriott International and was paid between $11,475 and $68,000 for each of nine speaking engagements during the year from February 2010 to February 2011 for a total of $374,327 just for talking! That’s roughly seven times the average household income in the United States. While I realize that the going rate for public speeches by the elite is very high, I just don’t see that any speech is worth $68,000 but then, that could just be me.

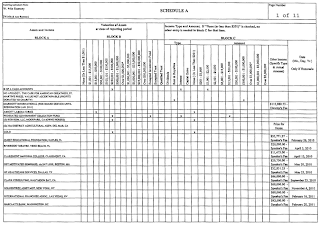

Here’s another page from his Disclosure showing some of Mr. Romney’s other assets:

Notice that he owns twelve Federal Home Loan Bank (FHLB) debt instruments ranging in size between $1,000,000 and $5,000,000 in size and another five ranging in size between $500,000 and $1,000,00 for a total value of between $15,500,000 and $65,000,000. Mere pocket change! These government issued agency bonds are triple-A rated and are used to increase the availability of funds for mortgages. Later in his disclosure, he also lists an additional four FHLB debt instruments with a total value of between $4 million and $20 million. It must be a full-time job keeping track of all of this money…except that it’s held in a blind trust and somebody else gets paid to do the heavy lifting for Mr. Romney.

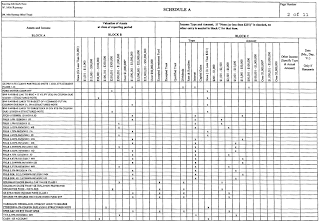

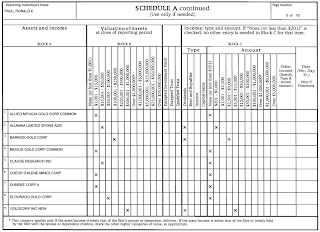

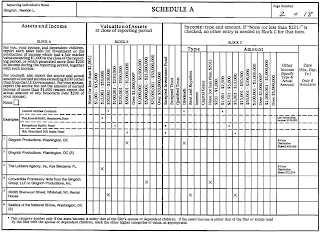

Enough of that. On to Ron Paul. Mr. Paul has a very interesting portfolio as shown on these two pages:

Mr. Paul is heavily invested in both gold and metals mining companies including Barrick Gold ($100,001 to $250,000), Eldorado Gold ($50,001 to $100,000), Goldcorp ($500,001 to $1,000,000), Iamgold ($250,001 to $500,000) and Newmont Mining ($250,001 to $500,000). From what I can see on his Disclosure, he has a very, very interesting and non-mainstream outlook on the world and it’s really not that difficult to see where he thinks that the world’s economy is headed. At least, in Mr. Paul’s case, his investing strategy reflects both his actions and his words. He also has between $250,001 and $500,000 on deposit with the First National Bank of Lake Jackson in Texas. From the same bank, he has a personal loan for between $250,001 and $500,000 for 5 years at 3.75 percent.

Now, on to Newt Gingrich. Here is a screen capture showing some of his assets:

His largest investment is in his Alliance Bernstein 2010 Retirement Strategy Class R where he has between $500,001 and $1,000,000 followed by his stake in Gingrich Productions, a multimedia production company owned by Mr. Gingrich and his wife Callista, also valued at between $500,001 and $1,000,000. In 2010, Gingrich Productions paid Mr. Gingrich a cool $2,453,409 in "distributive shares" as shown here:

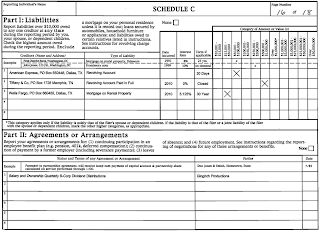

Mr. Gingrich also has CDs at several banks including Columbus Bank, Medallion Bank and GE Money Bank where he has five CDs ranging in size between $50,0001 and $250,000. He has money scattered in several dozen funds in very small amounts, generally less than $15,000 each. Like most Americans, he does have more than one checking and savings accounts; unlike most of America, the balance in his WellsFargo account alone is between $250,001 and $500,000. In fact, in his three checking and savings accounts, he had a total balance ranging between $400,000 and $850,000, pretty much what I have in my checking account today. What I found most interesting on the liabilities (debt) side of the ledger was his now paid-off revolving account with Tiffany & Co. for between $500,001 and $1,000,000 as shown here:

Yes siree, Mr. Gingrich is just like the rest of America, isn’t he? I suspect that the vast majority of Americans have a revolving credit account at Tiffany & Co, don’t they?

Next up to bat, Michele Bachmann. Ms. Bachmann’s Disclosure shows that she is a part owner in Bachmann and Associates Inc, a psychotherapy clinic in Lake Elmo, Minnesota with a business value ranging between $100,001 and $250,000 and a property value worth between $500,001 and $1,000,000 as shown here:

She’s a faithful American, owning between $1001 and $15,000 worth of American Savings Bonds but, unlike Mr. Gingrich, she only carries a balance of between $16,000 and $65,000 in her two checking accounts. The remainder of her non-real estate assets are scattered amongst about 14 various funds with most having balances between $1001 and $15,000. Interestingly, she also lists an asset "Sentinel/Penguin Group USA Inc" with no ascertainable value; apparently, this asset is related to the value of her "Core of Conviction" (please don’t assume that this link is a plug for her book in any way) book-writing agreement for a book that was published on November 21, 2011. On the liability side of the ledger, Ms. Bachman has a 7.5 percent 20 year mortgage on her commercial property in Lake Elmo for between $250,001 and $500,000 and another business loan at prime plus 0.5 percent for between $100,001 and $250,000 as shown here:

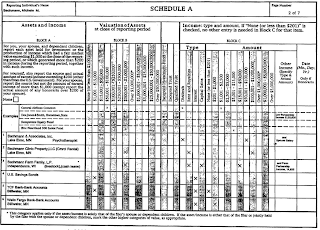

Let’s close this posting with a quick look at Rick Santorum’sfinances. As shown on this screen capture, Mr. Santorum is BIG into rental properties:

All told, his five rental properties in Pennsylvania have a declared value ranging between $500,000 and $1,250,000 with rental income ranging from $15,001 to $50,000 each on an annual basis. He has the obligatory checking accounts, the largest of the three has a balance of between $50,001 and $100,000. All I can say is, these candidates really like to carry large balances in their checking accounts! He has a sampling of stocks that lean toward the pharmaceutical and tech side with valuations generally between $1001 and $15,000 each, most held in various funds or as individual stocks in his IRA with Stifel Financial. He also has a small E*Trade account that holds 10 stocks with a value ranging from $10,000 to $150,000. His other compensation is rather eye opening; as a columnist, contributor or consultant for companies raning from the Philadelphia Inquirer to Consol Energy to his position as Senior Fellow with the Ethics and Public Policy Center, he raked in $896,037 in 2010. That’s quite a pay packet, roughly 18 times what an average American family earns in a given year!

Now for the bad news. Here are Mr. Santorum’s liabilities:

He owes between $350,000 and $750,000 on his rental properties in Pennsylvania, meaning that his actual equity in his rental properties ranges from $150,000 to $500,000.

I think that the information provided in this posting is enough to make my point. While the GOP candidates may come across as sympathetic to the plight of ordinary unemployed, underemployed and foreclosed upon Americans, the Financial Disclosure data released by Open Secrets tells another tale; these five individuals definitely live way, way on the other side of the tracks. In fact, they can hardly really see "our" side of the tracks from their vantage point.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment