In the Bank of Canada’s semi-annual publication "Financial System Review" for December 2011, Canada’s central bank notes that there are some worrisome trends that could well have a negative impact on Canada’s financial system. While Canada’s economy appears to be unscathed compared to both Europe and the United States, the Bank of Canada’s Governing Council notes that there are several factors that have increased the risk of financial system instability which could result in weaker economic growth in Canada. The Bank notes that the main risks are:

In the Bank of Canada’s semi-annual publication "Financial System Review" for December 2011, Canada’s central bank notes that there are some worrisome trends that could well have a negative impact on Canada’s financial system. While Canada’s economy appears to be unscathed compared to both Europe and the United States, the Bank of Canada’s Governing Council notes that there are several factors that have increased the risk of financial system instability which could result in weaker economic growth in Canada. The Bank notes that the main risks are:It is the interconnectedness of the global economy that could well make Canada’s economy the victim of collateral damage from the sovereign debt crisis in Europe.

Here’s an interesting chart that shows how the level of risk has changed for each of the five aforementioned factors over the past six months:

Note that the overall level of risk to the Canadian financial system has risen since June 2011. The Bank notes that it is crucial that the debt issues of the less solvent Eurozone members be resolved and that meaningful efforts to solidify Europe’s banking system be undertaken since, even with a rescue plan in place, it will take time the return Europe’s economic system to a position of strength.

For this posting, I’d like to focus on one risk factor that could impact the stability of Canada’s financial system; Canadian household finances, with an emphasis on the real estate debt portion of the risk factor. That is the one economic factor that most of us deal with on a daily basis and can relate to most easily. The Governor of the Bank of Canada, Mark Carney, has repeatedly warned about the levels of household indebtedness in Canada and how the current environment of ultra-low interest rates has lulled consumers into a false sense that all is well.

The Bank of Canada now finds itself concerned that a significant portion of Canadian households would be unable to service their household debt if the world experienced an adverse economic shock. Canadian banks would be forced to raise their loan-loss provisions leading to overall tighter conditions for granting new or additional credit. This would impact the health of Canada’s financial sector, pretty much the world’s only financial sector that did not suffer during the Great Recession although, as shown here, even the share prices of two of Canada’s most highly regarded banks, TD Bank (TD) and Royal Bank of Canada (RY), suffered massive losses during the depths of the Great Recession:

As many economists note, drops in stock prices often have a strong negative impact on savers and consumers since a drop in the value of their portfolios (including real estate) is usually accompanied by a loss in the "wealth effect" that keeps savers consuming.

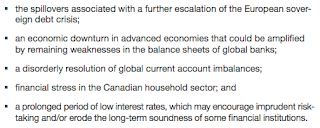

The Bank notes that household credit growth was very strong likely due to the imposition of new more stringent rules on government-backed insured mortgages in the first quarter of 2011 but has moderated over the second and third quarters of 2011. That said, the Bank notes that mortgage credit rose in October with the robust growth in housing resale activity. Here is a graph showing the growth in total household credit (in red), residential mortgage credit (in blue) and consumer credit (in green):

Please note that this graph shows the growth in credit as an annualized 3 month growth rate, not total outstanding credit.

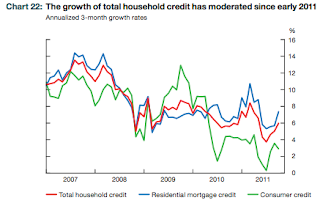

Here is a graph that shows how Canada’s household debt-to-income level (red line) has risen to a historical high of 149 percent in the second quarter of 2011, surpassing the household debt-to-income levels for both the United States (blue line) and the United Kingdom (purple line):

Notice that while Canada’s household debt-to income level is at an all-time high, it is still roughly 15 percentage points lower than the level experienced by American households just prior to the Great Contraction. The Bank expects that the growth in household credit will moderate in the coming quarters since the growth of personal disposable income is expected to moderate. As well, the Bank expects that the uncertainty in the global markets may cause Canadian households to moderate their spending (again, the wealth effect) but with overall credit still growing, the household debt-to-income level is not expected to end its climb upwards. Particularly concerning is the rising share of Canadian households with a debt-service ratio (DSR) that exceeds 40 percent (i.e. the percentage of household income required to service debt). Both the number and share of Canadian households with elevated DSRs is above the average over the past decade. As a rule of thumb, households with a DSR in excess of 40 percent are likely to have more difficulty making payments against their outstanding credit.

Here’s a graph from the St. Louis Federal Reserve Bankshowing what happened to the household debt service ratios for United States households over the past 30 years:

Notice how the debt service ratio reached an all-time high just before the beginning of the Great Recession? Perhaps there is a lesson to be learned.

Canadians holding mortgages that are in arrears are also higher in number than they were prior to the Great Contraction. While the numbers have fallen in the past quarter, here is a graph showing that banks are carrying an elevated number of delinquent mortgages on their books:

Let’s take a little deeper look at the Bank’s viewpoint on Canada’s housing market. The Bank notes that the elevated level of household debt makes individual Canadian’s more vulnerable to either a significant decline in house prices or a deterioration in the country’s employment picture. With high-ratio mortgages in Canada being insured by the taxpayer-funded Canadian Mortgage and Housing Corporation (CMHC), a modest fall in house prices would lead to lower household net worth (and lower wealth effect) which would reduce access to credit and would lower employment in the housing sector.

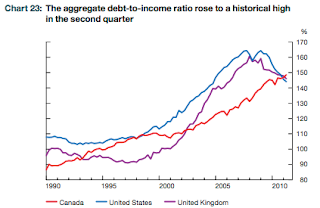

The report notes that Canada’s house prices remain very high compared to normal levels when measured in terms of household disposable income as shown on this graph:

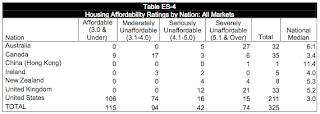

For the 15 year period between 1985 and 2000 the house price multiple averaged about 3 (i.e. the average house was priced at 3 times the average household disposable income). This multiple rose throughout the first decade of the 21st century and now stands just below 5. As I’ve posted here, Demographia multiple calculations (median price divided by median income in a given market) show that most major Canadian cities have multiples that are well in excess of 5, a price level that is considered to be severely unaffordable. In fact, Vancouver has one of the highest multiples in a seven nation study at a whopping 9.5. Here’s a chart showing the results for all nations in the study noting that, out of 35 markets, Canada has six that are severely unaffordable and 3 that are seriously unaffordable with the bulk of the remainder being considered moderately unaffordable:

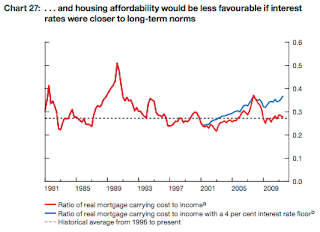

Fortunately (or unfortunately depending on your viewpoint), generational lows in interest rates have made what would have been traditionally unaffordable housing more affordable. Here’s a graph showing how mortgage payments as a fraction of household disposable income would increase (blue line) if interest rates had been closer to historical norms:

In 2010, rather than mortgage carrying costs being 28 percent of disposable income (i.e. 0.28), it would have risen to 37 percent (i.e. 0.37) with a floor interest rate of just 4 percent. The red line reflects the actual carrying cost to income ratio with the current low interest rate environment. From this graph, you can readily see that the situation could rapidly become critical if interest rates rose to 6 or 7 percent. In case you were wondering, here’s a graph showing Canada’s historical one, three and five year posted fixed mortgage rates over the past 10 years:

Here is a graph showing just how ugly things were back in the early 1990s:

Over the 10 year period, the average 1 year fixed mortgage rate averaged 5.07 percent with a peak of 7.35 percent, the 3 year fixed mortgage averaged 5.71 percent with a peak of 7.55 percent and the 5 year fixed mortgage averaged 6.33 percent with a peak of 7.54 percent with all of the peaks occurring in December of 2007. Like most of us, apparently, I have conveniently forgotten just how high mortgage rates were just 4 short years ago.

The Bank is more concerned about some types of real estate than others. They note that the multiple-unit sector (i.e. condominiums) are more susceptible to price corrections since the supply and demand picture in some urban markets is no longer in balance with an excess supply of completed but unoccupied condominiums. Any Canadian that lives in a major urban centre has first hand evidence of the burgeoning number of new (and partially completed) condominium projects, particularly in core areas. Personally, I have always wondered who is lining up to buy all of these new units. What should be particularly concerning is that in many cases, one can rent a condo for far less than what would be paid in mortgage, taxes and condo fees combined. This is a very worrisome trend.

To summarize, I always find it most interesting that Canada’s central bank remains concerned about household debt levels when it is their deliberate policy of maintaining a low interest rate environment that is largely to blame. Low interest rate policies are used by central banks to encourage credit and discourage saving thereby stimulating economic growth. While we may be suckers for what appears to be easy money, we should be taking a close look at what happened to over-indebted consumers in the United States over the past few years. Their fate could well be ours.

As we are starting to see, what happens on the other side of the Atlantic doesn’t necessarily stay on the other side of the Atlantic. The ultimate fate of our economy may well be out of our control.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment