This week, once again, both Moody’s Investor Services and Standard & Poors Corporation are "sabre-rattling" about the rating given to the United States on its sovereign debt. These warnings have been issued before but it appears that the market (at least so far) is taking very little notice. Moody’s rates U.S. debt at Aaa, its highest rating, and in its most recent "Aaa Sovereign Monitor" publication which updates the fiscal situation of the four largest Aaa countries – France, Germany, the United Kingdom and the United States, it looks at changes to the "credit metrics" of each of the four countries.

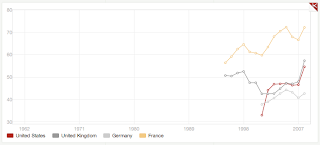

Of the four Aaa rated nations, the United Kingdom and the United States have seen the steepest increases in sovereign debt as a result of the Great Recession. Moody’s notes that the United States has taken a different economic tactic to the seemingly never-ending battle against the Great Recession; the government has implemented a program of additional stimulus which will ultimately add to the level of sovereign debt. In contrast, the United Kingdom, also suffering from a massive debt and deficit problem, has introduced a program of spending cuts in an effort to control deficit growth and ultimately reign in debt levels. The publication also notes that both Germany and France have seen significant debt increases, however, in general, both countries have moved toward deficit reduction, something that the United States has not done, at least not yet.

Here is Moody’s warning to the United States:

"...the outlook for near-term stabilization of US government debt ratios is not promising…"

While Moody’s still believes that all four of the major Aaa-rated nations have reasonable debt affordability in terms of the ratio of interest payments to government revenue, they are very concerned about the long-term government commitments that will arise from age-related pension and healthcare issues. If spending on these programs is not controlled soon, the ability of the countries to expand their level of debt will be under pressure. For the United States, Moody’s recommends a program of Social Security reform, cutbacks in the growth of Medicare outlays and modification (or elimination) of the mortgage interest tax deduction. My, aren’t the people at Moody’s just chock full of ideas to help us part with even more tax dollars!

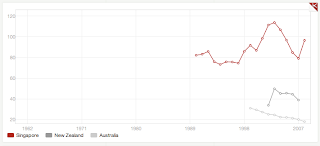

In the same publication, Moody’s looks at the fiscal picture of three Aaa-rated nations in the South Pacific; Australia, New Zealand and Singapore. Both Australia and Singapore show very strong fiscal pictures and are among the strongest Aaa-rated nations with Australia having one of the lowest debt levels of any Aaa-rated sovereign. Singapore has the fastest growing economy in Asia and is a net creditor. New Zealand is projected to show a rise in its debt ratios but they are already very low compared to both the United States and the United Kingdom.

In summary, let’s look at the debt-to-GDP level for all four major Aaa-rated nations according to the World Bank:

Now, let’s look at the three Aaa-rated South Pacific nations:

You can really see why Moody’s really likes Australia, can’t you? Just in case you want to have some fun with these charts, here’s the link to the World Bank site. Just pick the countries that you wish to compare and you’re off!

While many investors, myself included, are no great fans of ratings agencies, should they decide to finally act on their threats to cut the Aaa rating of United States debt, it will lead to further misery. Interest rates on Treasuries will rise, compounding the debt and deficit issues as more and more of the government’s revenue is required to service interest on the debt. As we saw from the Congressional Budget Office analysis of the deficit for the first quarter of fiscal 2011, interest payments on the debt totalled $61 billion in 3 months alone, up 9.5 percent year-over-year. Both Standard & Poors and Moody’s have been threatening to act on a downgrade for years, eventually, their threats will turn into action. Should the ratings agencies cut their triple-A ratings in the face of mounting debt, the situation will spiral out of control.

One has to wonder when the world’s bond markets will wake up and take notice.

Click HERE to read more of Glen Asher’s columns.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment