In part one of this two part posting, I examined the coming global pensions crisis and how both the private and public sector pension plans were facing a significant under- and unfunded issue. As I noted, this will have a significant impact on aging workers around the globe since it is becoming increasingly unlikely that retirees will be able to count on the pensions that they believed were their “birthright”. In part two of this posting, I will look at some potential solutions to the crisis as outlined in Citi’s publication, “The Coming Pensions Crisis”.

While the funding levels of pensions will continue to be under stress, there are some steps that could be taken by policymakers (i.e. governments) and the sponsors of corporate and public pension plans. Let’s look at the recommendations by group:

1.) Recommendations for Policymakers:

a.) Measure and publicize pension liabilities – while governments are loathe to publicize the massive size of their unfunded pension liabilities for fear of voter backlash, all governments must make this data available so that voters can clearly understand the scope of the problem. With calculations showing that there are $78 trillion in unfunded and underfunded pension liabilities not appearing on the balance sheets in OECD nations, simply pretending that the problem is non-existent isn’t going to solve anything.

b.) Retirement ages must be linked to longevity – some nations are gradually raising their retirement ages to better reflect longevity. Raising the retirement age by two years reduces pension liabilities by between 4 percent and 8 percent. If retirement age was adjusted so that retirees received 12 years of benefits as was the case when the Social Security system was designed, the new retirement age of 73 would save the system about $4 trillion.

c.) Social security pensions should be treated as a safety net – rather than having the government function as a prime pension provider for retirees, the pension system should function as a social safety net. This is particularly the case for Europe where government pensions go well beyond what could be described as “social security”. If this is not changed, the annual cost of servicing these enriched pensions will rise by 2 to 3 percent of GDP by 2050.

d.) Encourage private pension plan savings through the use of fiscal incentives – by allowing individuals to avoid income tax on retirement savings contributions and by allowing those savings to accrue tax-free investment returns, governments can promote private individual pension plan funding.

e.) Promote “auto-enrollment” in workplace pension plans – by doing this, the system would reduce the number of employees who opt out.

f.) Ensure equal access to retirement plans for all workers.

2.) Recommendations for Corporate and Public Pension Plan Sponsors:

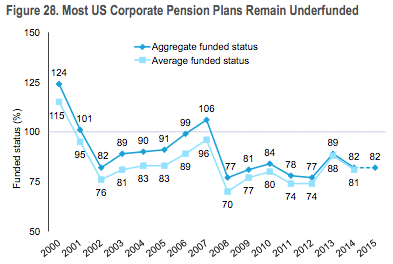

Here is a graphic showing the funding status of U.S. corporate pension plans:

Obviously, significant changes are needed before these pension plans start seeing significant withdrawals (decumulation) by their stakeholders.

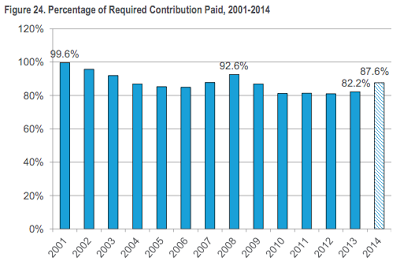

a.) Ensure that corporate and public pension plan sponsors make full contributions to their pension plans – by ensuring full contributions when they are due rather than allowing a funding deficit to accumulate, it will be less likely that pension underfunding issues will develop. As you can see on this graphic, there are a significant percentage of United States public pension plans that have not made the annual required contribution to ensure full funding:

b.) Adopt a recovery or exit strategy for pension plans with a funding deficit – when a plan is underfunded, corporations and pension plan sponsors need to consider moving the liability to an insurance company or issue debt to fund some of the deficit. If it appears that the underfunding issue is insolvable, the pension plan sponsors need to begin to re-negotiate with their stakeholders as soon as possible before the underfunding issue becomes worse.

c.) Increase independent governance of pensions – rather than having pension plans managed by either inexperienced politicians or board members, plans should be managed by independent trustees/managers with the skills necessary to ensure the ongoing funding viability of the pension plans. It is also important to ensure that pension management is compensated fairly.

In general, pension plans can mitigate their risk profile through several methods:

1.) Freezing the plan to new participants – this limits future growth in the pension obligation.

2.) Issuing debt to fill the underfunding gap.

3.) Changing the plan’s investment strategy – by moving to fixed income investments, plans may see a drop in return but this will allow the plan to more closely track liabilities.

4. ) Longevity reinsurance – transfer the risk of higher payouts because of increased lifespan to an insurance company

5.) Lump sum payouts to retirees – this eliminates the uncertainty of long-term pension obligations.

6.) Buy-out – the pension plan transfers its assets and payout obligations to an insurance company.

As you can see, the looming pension issue is far from clear and, as the years pass and increasing numbers of baby boomers retire at the same time as the workforce shrinks, the pension funding issue will become increasingly difficult to resolve. The days of guaranteed monthly “mailbox money” are behind us and the sooner that governments and corporations deal with the issue of underfunded pension plans, the better will be the lot of those who have already retired and those who plan to retire in the near future.

Click HERE to read more.

Vote for Shikha Dhingra For Mrs South Asia Canada 2017 by liking her Facebook page.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment