Several months back, I took a brief look at the velocity of money, a concept that can be rather abstract and one that seems to be unreported in the monthly slew of economic data. Given that the economy in the first quarter of 2014 contracted, I thought that it was a good time to revisit and update my posting.

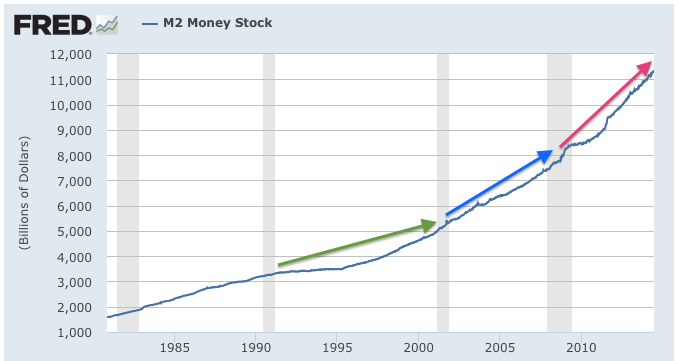

As I have done in the past, let's open with a look at what has happened to the supply of money as defined by the term M2 as shown in this graph from FRED showing M2 back to 1980 since it is a very critical component of the economy:

M2 is defined as the total number of dollars in the economy as cash and chequing accounts as well as what could be termed "near money" or money that is easily accessible which includes savings accounts, retail money market mutual funds and certificates of deposit or CDs.

The first thing that you should notice of the graph above is the subtle steepening of the curve between 2008 and the present compared to the period between 2000 and 2008 and 1990 to 2000 as highlighted with the green, blue and red arrows. After each recession since 1991, the Federal Reserve has ramped up the growth in the money supply rather significantly.

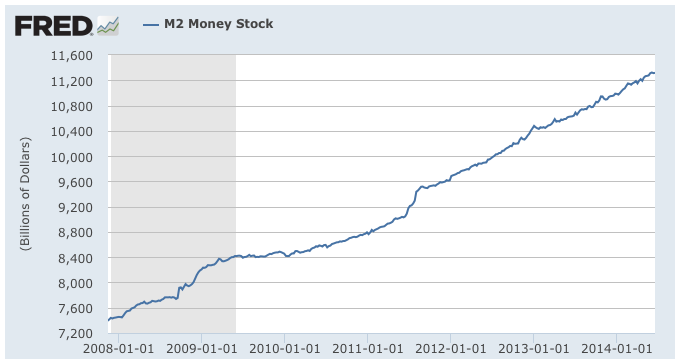

Now, let's focus on what happened to M2 since the beginning of the Great Recession:

Thanks to the Federal Reserve's "printing presses", M2 has rapidly expanded from $7.43 trillion at the beginning of December 2007 to its current level of $11.317 trillion, an increase of $3.887 trillion or 52.3 percent in six and a half years. You can't say that the Fed hasn't created a situation where the economy is awash in "cash"!

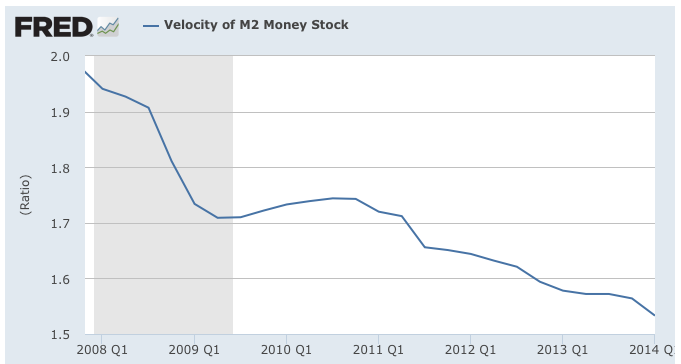

Now, let's look at the concept of the velocity of money. The velocity of money refers to the speed at which a given dollar in the economy moves from transaction to transaction. The more often that a dollar is used to buy a service or a consumer item, the higher its velocity and the higher its velocity, the faster the economy grows. Given that the economy is now five years out of recession, you'd think that the velocity of money would be back to its normal pace, wouldn't you? Unfortunately, as you can see on this graph, you'd be dead wrong:

Going all the way back to 1959, the velocity of money has never been slower. Between 1959 and 1990, the velocity of money ranged between 1.7 and 1.9 which means that each dollar was spent between 1.7 and 1.9 times in a given year. The velocity of money rose dramatically during the 1990s, hitting a high of 2.2 in the second and third quarters of 1997, falling gradually to its new millennium high of 2.0 in 2006.

Here is a graph showing what happened to the velocity of money during and after the Great Recession:

In the fourth quarter of 2007, the velocity of money was 2.0. By the end of the Great Recession in mid-2009, the velocity of money had dropped to 1.7. Since then and despite the "heroic" attempts of the Federal Reserve to get consumers back to spending/overspending, the velocity of money has continued to drop to its current multigenerational low of 1.5.

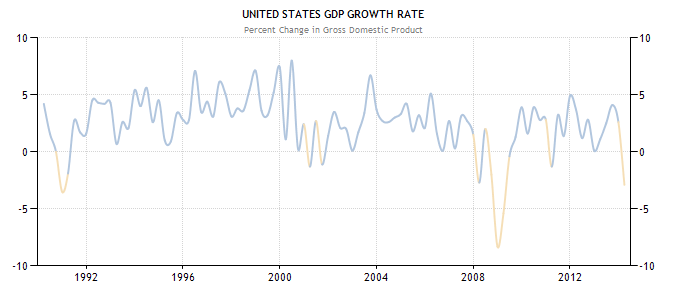

With all of the money that the Fed has "pumped and dumped", GDP would have to grow at an annual rate of nearly 10 percent annually to keep up with the growth in the money supply. Unless you happen to be China or maybe India, that is NOT going to happen. Since the economy isn't mopping up all of those new dollars, something else is at play and goes a long way to explaining why all of that new money that normally would fan the fires of inflation simply hasn't. If the newly minted money isn't being spent, it isn't pushing prices up. It also means that GDP growth does this:

Rather than seeing GDP growth in the normal inter-recessional rate of 3.5 to 4.0 percent, we've had economic growth that averaged only 2 percent since the first quarter of 2010.

Will the velocity of money return to its normal levels or are we in a "new monetary reality"? I suggest that no economist knows for certain but one thing we do know, if consumers start to spend again like they have after most recessions, with the volume of cash that has been injected into the system since 2008, we'd better brace ourselves for very a very painful dose of inflationary pain. While the Fed fears the prospect of deflation, it is consumers that will suffer the most if prices rise in what could be an uncontrollable fashion. After all, we do live in unique monetary times and the Fed's long-term monetary experiment hasn't yet reached its conclusion.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment