Update November 21, 2010

Ireland has been forced to take an economic bail-out from the European Union and IMF totalling £77 billion after an emergency telephone conference this weekend. British taxpayers will now pony up £7 billion as their share of the EU – IMF bailout.

Next on the bailout list – Portugal.

All in the name of saving the euro.

Original Article

Coverage of the Irish debt situation has been extensive over the past few days. Ireland’s banks desperately need a bailout after the country’s real estate market suffered a major "readjustment".

Here’s a quote from George Osborne, the United Kingdom’s Chancellor of the Exchequer from the Guardian today:

"Ireland is our closest neighbour – the only country with which we share a land border – it is in our interest their banking system is stable. Britain stands ready to support Ireland to bring stability."

A very nice bit of support from one government to another don’t you think, especially for two nations that share a common border?

Let’s take a quick look at the United Kingdom’s own fiscal situation before we get that warm and cozy feeling all over, shall we?

On June 22nd, 2010, the coalition government of U.K. Prime Minister David Cameron released its emergency Budget.

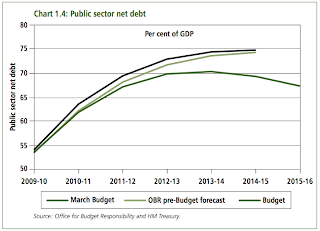

The United Kingdom has reached the point of budgetary desperation. As it stands now, the United Kingdom is considered by many economists to be the most indebted nation in the world. Their national debt stands at nearly £924 billion. Their public sector net debt (as shown in the chart below) is projected to reach 74.4 percent of GDP by 2013 – 2014. As it stood in 2009, according to the CIA World Factbook, the U.K.’s public debt as a percentage of GDP put them in 21st place in the world after such nations as Italy (115.8 percent – 6th place), Iceland (113.9 percent – 7th place), France (77.6 percent – 17thplace) and Germany (73.2 percent – 19th place).

By comparison, the United States public debt to GDP ratio is 53.5 percent and Canada’s is in the neighbourhood of 82.5 percent. I realize that the debt to GDP numbers vary depending on the source used but I have consistently used numbers from the CIA World Factbook.

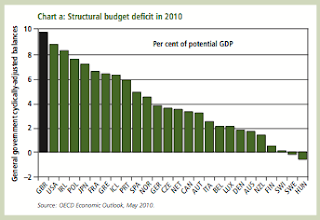

Here’s a chart from the OECD showing just how bad their structural deficit as a percentage of potential GDP is compared to other nations:

It’s a rather dire looking situation, isn’t it?

One item that caught my eye in this time of HST implementation in Canada was the change to the UK’s Value Added Tax (VAT). On January 4th, 2011, the tax will increase from its current level of 17.5% to 20%. What was particularly interesting was that this increase is expected to raise over £13.5 billion in a full year by 2014 – 2015. As well, the United Kingdom VAT rate still falls well short of the maximum of 25% allowed under European Union law. Heaven help U.K. residents if it reaches that level as it has in Denmark and Norway. Fortunately though, if you are a corporation, your tax rate will drop from 28 percent to 24 percent over the next 4 years. Lucky you!

The United Kingdom’s budget deficit is projected to be £148 billion for fiscal 2010 – 2011; it is hoped that the increased taxes (except corporate taxes) and reducing spending in the 2010 budget will help balance the budget by 2014 – 2015 (just in time for the next recession). In the budget of June 2010, the government anticipates expenditures of £44 billion on debt interest alone in 2010 – 2011; this is projected to rise to £67 billion by 2014 – 2015. Should interest rates rise to historic norms, I suspect that this projection will also be tossed out the window. The UK had been threatened with cuts to their credit rating by two rating agencies unless the new government made major changes to their tax and spend philosophy; the UK had not balanced their budget since 2002 – 2003 and their debt growth far exceeded their economic growth. The Cameron government will also reduce spending by £32 billion per year by 2014 – 2015 in a further desperate attempt to balance its budget. To put this into perspective, this small spending reduction compares to government spending of £697 billion in 2010 – 2011 and approximates what is currently budgeted for personal social services.

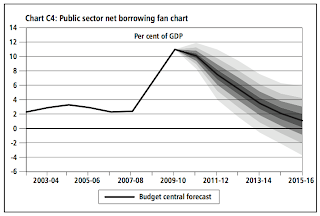

To keep track of public finances, the coalition government created the Office for Budget Responsibility (OBR) whose mission it is to independently assess the economy, control economic forecasts and make key judgments that drive official government economic projections most particularly for each Budget and Pre-Budget Report. All this for only £1.75 million per annum! Here’s their fiscal forecast for the 2010 Budget showing that they expect the United Kingdom’s finances to return to balance by 2014 – 2015 and surplus by 2015 – 2016 from a deficit of 5.3 percent of GDP in 2009 – 2010. The OBR also assesses the probability of actually reaching the government’s debt and deficit targets; their forecast shows that the government has a greater than 50 percent chance of actually meeting its targets for the period from 2014 to 2016 which, if you look at it realistically, means they have roughly a 50 – 50 chance of doing what they say they will do. It may be just me, but that indicates to me that the forecast is relatively meaningless and that a coin toss would just as easily predict whether or not the government’s targets are met. Here’s the fan chart showing their borrowing as a percentage of GDP projections for the next few years. Note how wide the fan becomes the further out in time they project data indicating growing uncertainty:

In conclusion, here is a direct quote from the 2010 Budget document showing U.K. residents just how serious the situation is:

“The fiscal challenge in the UK is, on some measures, larger than in any other advanced economy. In May, the International Monetary Fund (IMF) forecast that UK public borrowing would be the highest in the G20 in 2010; it is also estimated that the UK’s structural deficit will be the highest among all OECD countries and the 27 EU Member States. The rating agency Fitch has pointed out that “the rise in public debt ratios [in the UK] since 2008 is faster than for any other ‘AAA’-rated sovereign.”

And this is a government that has pledged to assist Ireland in its time of distress? Nice sentiment but not entirely realistic.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment