Beginning in September 2016, the United States Energy Information Administration (EIA) began to include estimates of the number of drilled and uncompleted wells (DUCs) in its monthly Drilling Productivity Report. This data is critical to gaining an understanding of where U.S. oil production may be headed, information that provides us with a measure of whether there will be upward or downward pressure on future oil production, a key factor in future oil prices.

Drilled and uncompleted wells are those wells that have been drilled but are standing suspended (i.e. they are not producing hydrocarbons). These wells have production casing in place but potentially productive formations have not been perforated or hydraulically fractured (i.e. completed). Obviously, a high and growing inventory of drilled and uncompleted wells has the potential to impact the domestic supply of oil, a factor which has the potential to impact oil prices, especially in the current market where the balance between oil supply and demand is quite delicate.

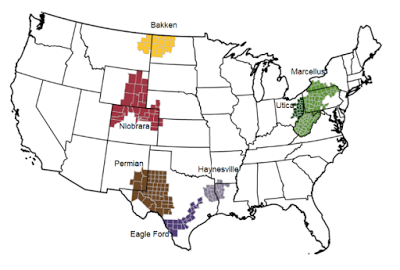

The drilled and uncompleted wells reported by the EIA fall into one of seven regions; the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian and Utica as shown on this map:

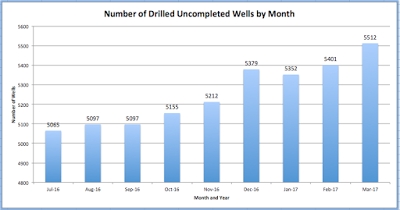

Here is a bar graph showing the how the number of drilled and uncompleted wells in the lower 48 has grown since the data was first reported in August 2016:

In just nine months, the number of drilled and uncompleted wells has grown from 5065 to 5512, an increase of 8.8 percent.

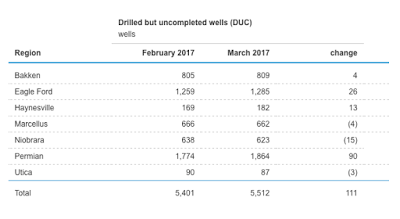

Here is a table showing which regions have the most drilled an uncompleted wells in both February and March 2017:

As you can see, the two regions with the most drilled and uncompleted wells are located in the Permian Basin and Eagle Ford of Texas.

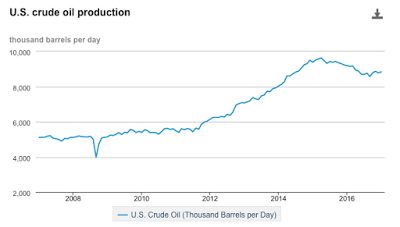

While oil production is down from its peak of 9.627 million BOPD in April 2015, according to the EIA, United States oil production is rebounding from its lows of 8.567 million BOPD in September 2016 to 8.835 million BOPD in January 2017 as shown here:

From the EIA data on drilled and uncompleted wells, we can see that it is quite likely that oil prices will be under downward pressure for some time to come unless, of course, OPEC agrees to cut production levels further or a significant number of these wells turn out to be poor producers.

Click HERE to read more.

Vote for Shikha Dhingra For Mrs South Asia Canada 2017 by liking her Facebook page.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment