After the Federal Reserve cut interest rates by 25 basis points, its first interest rate cut since December 2008 as shown here:

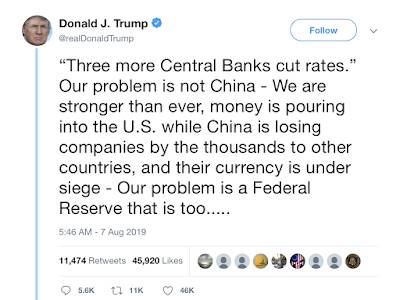

…Donald Trump tweeted the following:

The first thing that you might notice is his reference to the yield curve being at "too wide a margin". One would have to assume that he is referring to the spread between short-term interest rates and long-term interest rates.

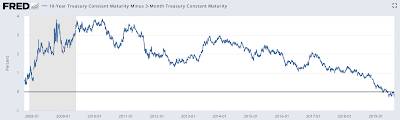

Let's look at the "margin/spread" between short- and long-term interest rates. Here is a chart from FRED showing the difference between 3-month Treasury rates and 10-year Treasury rates since the beginning of the Great Recession:

As you can see, the spread between the two rates is at or very close to all-time lows.

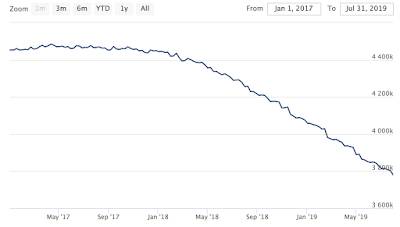

If we zoom in on the spread since Donald Trump took office in January 2017, this is what we find:

The spread between 3-month Treasuries and 10-year Treasuries is currently -0.30 percentage points, slightly lower than its all-time previous low of -0.28 percentage points As well, the spread is down from 2.0 percentage points when Donald Trump took office.

Donald Trump also notes that the Federal Reserve must "stop their ridiculous quantitative tightening NOW". Here is a graphic from the Federal Reserve showing the size of its balance sheet over the past decade:

The Federal Reserve began its balance sheet normalization program in October 2017. The total assets of the Fed's balance sheet have declined from a high of $4.5 trillion on January 14, 2015 to their current level of $3.803 trillion, a decline of $697 million or 15.5 percent.

As I did for the interest rate spread, here is a graph showing what has happened to the Fed's balance sheet since Donald Trump took office in January 2017:

That, to me, would appear to be a pretty clear cut case of ending quantitative tightening.

While I am certainly no great fan of the Federal Reserve and its market-distorting experimental monetary policies, there is no doubt in my mind that the Fed has boxed itself into a "monetary policy corner". Here is a graphic shnowing the federal funds rate going back to 1970:

As you can see, historically the Fed has had a lot of room when it comes to reducing interest rates as the economy slows or stalls. Let's look at each recession in turn:

1.) 1970 recession – 5.26 percent

2.) Mid-1970s recession – interest rates dropped by 9.44 percentage points

3.) 1980 recession – interest rates dropped by 9.92 percentage points

4.) 1981 recession – interest rates dropped by 13.44 percentage points

5.) 1990 – 1991 recession – interest rates dropped by 3.99 percentage points

6.) 2001 recession – interest rates dropped by 5.1 percentage points

7.) 2007 – 2009 recession – interest rates dropped by 5.18 percentage points

With the Fed Funds rate currently sitting at 2.14 percent, the Federal Reserve only has 2.14 percentage points to stimulate the economy, less that half of what it had when it needed to fight the Great Recession. Unless, of course, it wishes to follow the lead of its European central bank counterparts and enter negative interest rate territory, a sure bet in my reality.

I'm not sure what Donald Trump was referring to in his Twitter stream of consciousness on August 7th, 2019 but his comments certainly bely a misunderstanding of the Federal Reserve and its monetary policies.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment