While Congress is focussing what passes for an important issue, that of the impeachment proceedings againt Donald Trump, they are failing completely when it comes to an issue that is of lasting importance and one that will have an even more significant detrimental effect on the United States over the medium- and long-term.

Let's open with this screen capture from the Debt-to-the-Penny website:

Remember when Donald Trump said that beating the federal debt and deficit were no big problem?

Here is a graphic showing the total federal debt up to the second quarter of 2019 and how its growth rate increased during and after the Great Recession:

Here is a graphic showing the total federal debt as a percentage of GDP up to the second quarter of 2019:

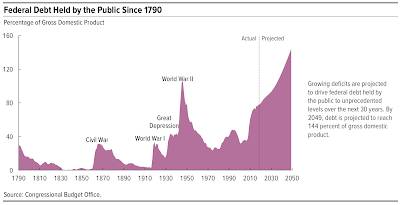

While Washington's debt-to-GDP ratio has more-or-less stabilized at around 103 percent of GDP since the fourth quarter of 2015, this is thanks only to the continued rather modest by historical standards growth in the American economy. If you look back to the recessions of the past, you will see that the debt-to-GDP ratio almost always rose during economic contractions, particularly during the Great Recession where it rose from 62.9 percent of GDP in Q4 2007 to 80.4 percent in Q2 2009, an increase of 17.5 percentage points or 27.8 percent. If the debt-to-GDP ratio were to rise by the same amount during the next recession, it would hit 131.6 percent, an uncomfortably high level by any measure. Here is a graphic from the Congressional Budget Office showing the mounting debt problem:

While Congress seems to pay attention to the federal debt issue only when the debt ceiling is either reached or technically breached, there is a greater problem. Here is a graphic showing the interest payments on the outstanding debt going back to 1947 and current to the second quarter of 2019:

At an annualized rate of $605.1 billion, interest payments on the debt in the second quarter of 2019 reached a new record. If individual tax revenues were the only source of income that the United States government had, roughly 35.6 cents of every dollar in individual taxes remitted would go to pay down interest on the federal debt. As it stands now, the federal government brought in $2.036 trillion in tax receipts during the second quarter of 2019 meaning that 29.7 cents of every dollar in federal tax revenue goes to pay interest on the federal debt.

There is only one saving grace as shown here:

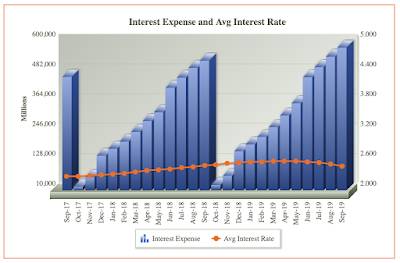

At 1.77 percent, interest rates on 10-year Treasuries are just slightly above their all-time low of 1.5 percent. Here is a graphic from the Treasury showing the cumulative interest expense (blue bars) and average interest rates for fiscal 2017 – 2018 and fiscal 2018 – 2019:

In September 2019, the average interest rate on the federal debt was 2.492 percent. If we go back in time, we find the following examples:

1.) January 2010:

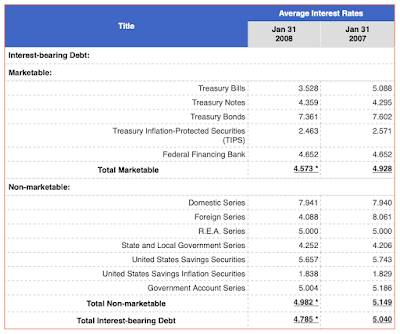

2.) January 2008:

3.) January 2006:

4.) January 2004:

5.) January 2002:

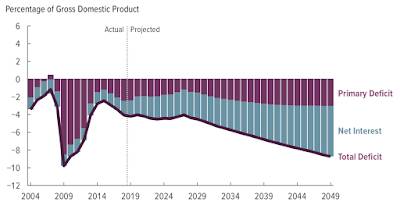

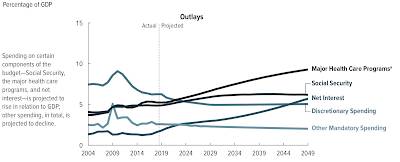

As you can see, we are living in historically unique times from an interest rate viewpoint; Washington has allowed itself to believe that it can continue to spend beyond its means with no repercussions, an artifact of the four year election cycle. If interest rates rose by even two or three percentage points, the annual interest payments on the federal would mushroom as shown on this graphic from the Congressional Budget Office:

According to the CBO's projections, net outlays for interest payments on the federal debt more than triple in relation to the size of the economy over the next 30 years, exceeding all discretionary spending by 2046, hitting 8.7 percent of GDP in 2049 (currently 4.2 percent of GDP):

While the left-leaning politicians among us are concerned about the impact of global climate change on American society over the coming decades, as you can see from this posting, it is going to be a very uncomfortable fiscal future where there are either significant cuts to discretionary programs and mandatory (entitlement) programs, increases in taxes or a combination of the two. Pain is a given, largely thanks to Washington's fiscal irresponsibility.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment