Now that the Federal Reserve is considering when to "taper" its purchases of mortgage-backed securities and Treasuries, it's time to take a look at just how effective Mr. Bernanke's experiment has been.

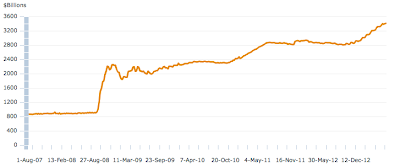

First, let's look at how QE has impacted the Federal Reserve and its balance sheet under Mr. Bernanke's leadership:

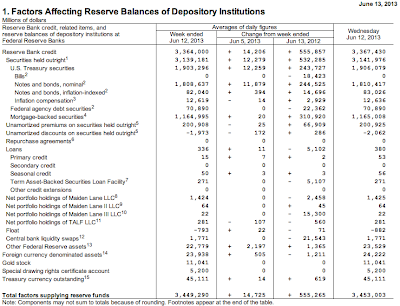

Since August 8, 2007, the Fed's balance sheet has grown from $869 billion to its current level of $3.453 trillion as shown on this statistical release:

As of June 12, 2013, the Fed is the lucky owner of $1.903 trillion worth of U.S. Treasuries. According to SIFMA, there were $11.390 trillion worth of outstanding Treasury Securities of all types at the end of April 2013, meaning that the Fed is now holding 16.7 percent of the United States debt (excluding debt owed by one arm of the government to another).

Now, let's use some graphs from FRED to show just how effective Mr. Bernanke's policies have been and whether the risks taken to prod the economy back to life after the Great Recession have been worth it. For this posting, I'll focus on the issues that concern Main Street the most; jobs, compensation for those jobs and personal net worth. Please also notice that the start date for each graph is November 2007, the last month of the previous economy growth cycle since according to NBER, the Great Recession commenced in December 2007.

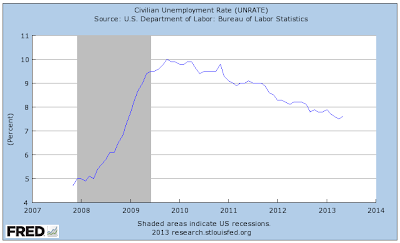

First, let's look at the unemployment rate:

In November 2007, the unemployment rate was an unbelievable 4.7 percent. Four years into the recovery it sits at 7.6 percent.

Here is a look at the average duration of unemployment:

In November 2007, the average American worker was unemployed for a period of only 17.3 weeks before finding a new job opportunity. Four years into the recovery, an average American finds himself or herself without work for 36.9 weeks, over twice as long as before the Great Recession.

Here is a look at the number of American civilians unemployed for 27 weeks and longer:

In November 2007, 1.374 million Americans were unemployed for 27 weeks and longer. Four years into the recovery, it sits at 4.357 million, over 3 times as many as before the Great Recession.

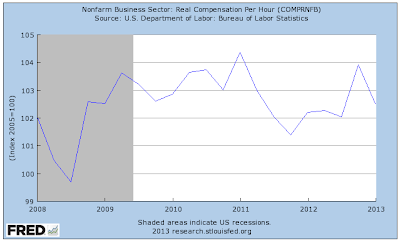

Here is a look at our personal bottom line, showing what has happened to real hourly compensation since November 2007:

The index sat at 102.041 at the beginning of the Great Recession and, four years into the recovery, has grown by a tiny fraction to 102.524. For the six decades before the last recession, growth in real compensation was generally steady, particularly in the 1960s and 1990s. Not so now!

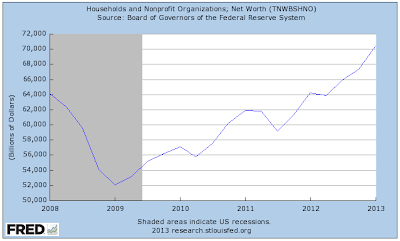

Lastly, here is a look at what has happened to the net worth of households and non-profit organizations:

At the beginning of the Great Recession, the total net worth of American households et al was $64.153 trillion. Four years after the end of the recession, this has grown to $70.349 trillion, an increase of only 9.7 percent over a 5 year period. No wonder we aren't feeling particularly "flush with cash"!

One can quite quickly see that, while there has definitely been improvement in the U.S. economy since the depths of the Great Recession, despite the "heroic" efforts of the Federal Reserve, this recovery is far different than previous recoveries if, indeed, one can call it a recovery at all. While the Great Recession was far deeper than previous incarnations, it's obvious that the Fed's trial economic medications have been less than completely successful. It will be most interesting to see what happens when the doctor (Mr. Bernanke) weans the patient (the economy) from the current course of treatment.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment