With nationwide home prices in the United States rising at 13.6 percent between October 2012 and October 2013, all is looking well for America's much beleaguered home owners as we can see on this graph:

Is the U.S. housing market really looking that healthy? How geographically balanced are the price increases and how many home owners are still being left behind?

According to RealtyTrac, there are millions of American homeowners that are still suffering mightily. According to RealtyTrac's December U.S. Home Equity and Underwater Report, 19 percent of all properties in the United States with a mortgage are severely underwater, a situation where "the combined loan amount secured by the property is at least 25 percent higher than the property's estimated value". That's one in five American homeowners with a mortgage that is substantially higher than what their home is worth.

Here is a graph showing the number of American homes with a Loan-to-Value ratio of 125 or greater:

Certainly, things are improving if, indeed, you can call a situation where one in five homeowners are severely underwater "an improvement). Back in May 2012, 12.82 million American homeowners were severely underwater, representing 29 percent of all U.S. properties with a mortgage so yes, technically, things have improved. Among residential properties in the foreclosure process in December 2013, 239,470 or 48 percent of the total were deeply underwater, a drop from 299,773 or 56 percent of the total in September 2013.

Looking at the housing situation from the other viewpoint, there were 9.1 million or 18 percent of all residential properties with a mortgage that had at least 50 percent equity. This has improved from 7.4 million properties or 16 percent of all mortgaged properties in September 2013, thanks largely to rapid price increases in some markets. States with the highest percentage of equity-rich properties include Hawaii (36 percent), New York (33 percent), California (26 percent) and Maine, Montana and the District of Columbia all coming in at 24 percent.

Which areas had the highest percentage of deeply underwater residential properties? Here is a list of the states with the biggest problem in order from greatest to least:

Nevada: 38 percent

Florida: 34 percent

Illinois: 32 percent

Michigan: 31 percent

Missouri: 28 percent

Ohio: 28 percent

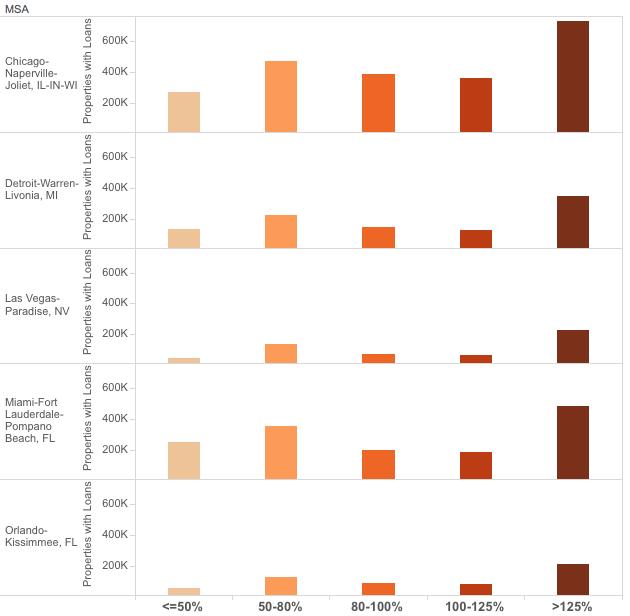

Here is a list of major metropolitan areas with the highest percentage of deeply underwater residential properties:

Las Vegas: 41 percent

Orlando, Florida: 36 percent

Detroit: 35 percent

Miami: 33 percent

Chicago: 33 percent.

Here is a bar graph showing the home equity profiles in each for these five metropolitan areas showing how many mortgaged homes have loan-to-equity values ranging from less than 50 percent (equity-rich) to greater than 125 percent (deeply underwater):

It's interesting to see that there are 726,489 mortgaged residential properties in the Chicago metropolitan area are deeply underwater. In comparison, there are only 276,699 similar properties in the Los Angeles metropolitan area and 308,352 in the New York City metropolitan area.

While house prices have been on a tear over the past year, even the dramatic price increases have not been enough to "rescue" millions of homeowners that are carrying mortgage debt that is worth far more than the value of their collateral. With only modest increases in residential property prices projected for 2014, increasing interest rates and household incomes that are stalled with wage increases barely keeping pace with inflation, it is highly unlikely that we will see a dramatic improvement in the number of deeply underwater home owners over the coming year.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment