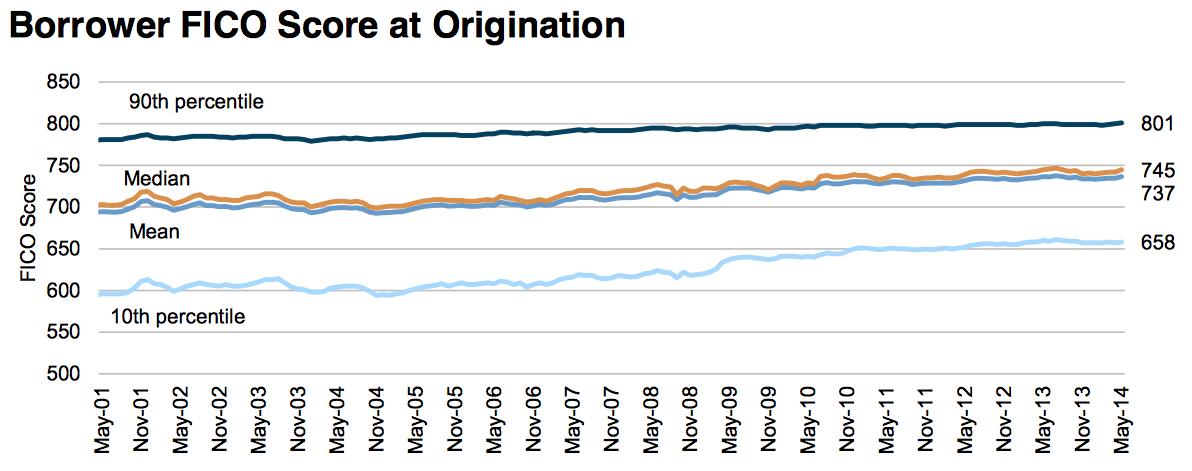

One graph from The Urban Institute's Housing Finance Policy Center gives us a good clue about why the improvements in the American housing market seem to be stalling:

As you can see, the average FICO score/creditworthiness measure of purchase-only mortgagees of all types (i.e. those that are less creditworthy (10th percentile) as well as those that are considered most creditworthy (90th percentile)) has risen steadily since 2001. In May 2014, the least creditworthy borrowers needed to have a FICO score of at least 658, up from the low 600s prior to the Great Recession. Even the most creditworthy borrowers have seen their credit requirements rise from around 790 prior to the Great Recession to 801 in mid-2014. Average (mean) FICO scores for borrowers has risen from the low 700s prior to the Great Recession to 737 in mid-2014.

These tighter credit restrictions have discouraged potential home buyers and led to a situation where cash bids have an advantage. This means that cash buyers, mainly investors, who are looking to purchase housing units to rent to families that cannot access mortgage funding are the ones benefitting from the current mortgage situation. Here is a graph from FRED showing the number of houses that were sold for cash:

In the third quarter of 2005, 16,000 homes were sold to cash buyers. This dropped rather precipitously to a Great Recession low of 4,000 units but has risen as high as 10,000 units in the second quarter of 2013. While this is a strong improvement, it is still below the pre-Great Recession long-term average of 11,000 units.

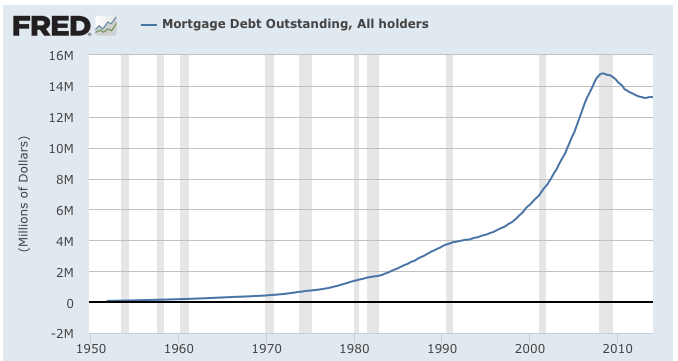

In general, in the past, as the economy recovered from a recession, the amount of mortgage debt in the system expanded. Such is not the case since the Great Recession as we can see on this graph from FRED that shows outstanding mortgage debt back to 1949:

You can see that the post-Great Recession situation of shrinking mortgage debt is very unique

Let's zoom in on the data from 2006 to the present:

In the last quarter of 2007 (the official beginning of the Great Recession) there was $14.622 trillion worth of outstanding mortgage debt. By the second quarter of 2008, mortgage debt had risen to a peak of $14.808 trillion. In the first quarter of 2013, mortgage debt had fallen to its post-Great Recession low of $13.219 trillion, a drop of $1.403 trillion or 9.5 percent. At the end of the first quarter of 2014, mortgage debt had increased very modestly from its post-Great Recession low, hitting $13.268 trillion, an increase of only 0.4 percent.

It is also interesting to look at how the type of mortgages being issued has changed since prior to the Great Recession as shown on this graph:

During the peak of the housing market in 2005/2006, up to 29 percent of all new mortgages (including refinances) were ARMs (adjustable-rate mortgages) as shown in light blue. This fell to a historic low of 1 percent in 2009 and has since risen to 7 percent. Currently, 70 percent of all mortgages are 30 year fixed-rate mortgages.

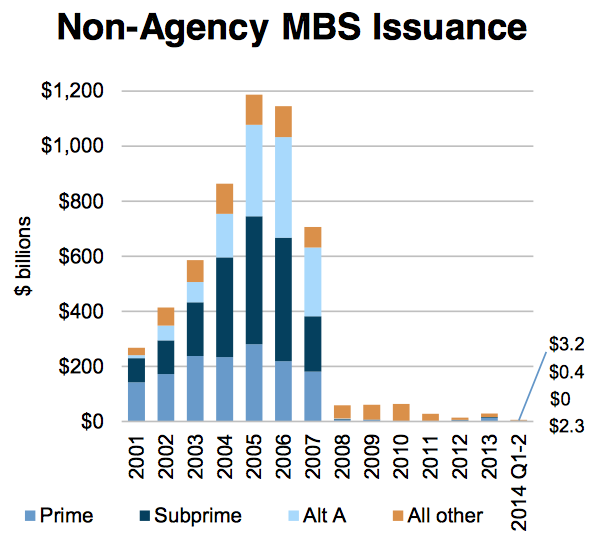

The issuers of mortgages has also changed markedly since the Great Recession as shown on this graph:

In the first seven months of 2014, non-agency issuance has totalled only $6.8 billion, down from $21.9 billion the year before. This is a tiny fraction of the nearly $1.2 trillion worth of non-agency mortgages that were issued in 2005 as shown on this graph:

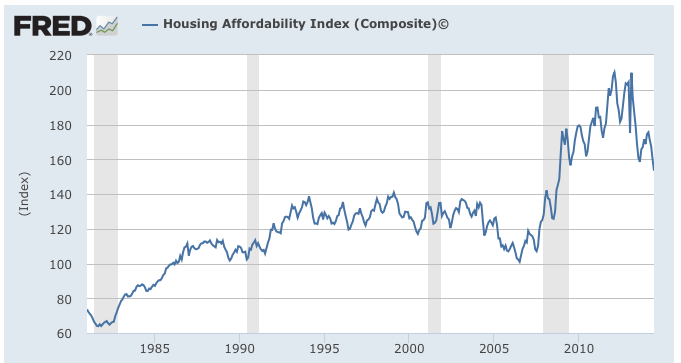

It is interesting to note that housing affordability is relatively high by long-term historical standards as shown on this graph where a value of 100 means that a family with a median income has enough income to qualify for a mortgage on a median-priced home and a value of 153.4 (the current value) means that a family has 153 percent of the income necessary to qualify for a mortgage loan that covers 80 percent of a median-priced home:

The current housing market is unique; prices have fallen to a point where housing is more affordable by a median family yet tighter borrowing behaviours by lenders (also known as the irrational restriction of credit) in response to the losses that they incurred during their overly loose lending standards of the mid-2000s has pushed home ownership rates down to levels not seen since the mid-1990s. As well, Helicopter Ben Bernanke's pumping up of the money supply to stimulate lending has not had the desired impact on the American housing market that the Federal Reserve expected, yet another failure in the Fed's monetary policy program.

Unless all of the players in the housing market work together, it is likely that improvements in America's housing market since the end of the Great Recession will stall and that we'll see very modest increases in housing prices until lenders decide to lend.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment