Over the past few years we've been hearing a great deal about raising the minimum wage. In November 2016, voters in eight states, Alabama, Arizona, California, Colorado, Maine, Ohio, Oregon, South Caroline and Washington, will vote on initiatives that would see their minimum wages raised. In most cases, as shown on this table, the proposed minimum wage will not even come close to the oft-touted $15 per hour level:

In the worst-case scenario (Ohio), the proposed increase in minimum wage will not be fully implemented until 2021. If you are curious, here is a link which provides more details on each state's minimum wage ballot measures.

Obviously, these higher earnings will have several positive and negative impacts on workers' net income as follows:

1.) Supplemental Nutrition Assistance Program (SNAP) benefits will fall.

2.) payroll and income taxes may fall or rise depending on the state of residence and whether higher payroll and state income taxes are offset by increases in federal- and state-earned income tax credits (EITC) and child tax credits (CTC).

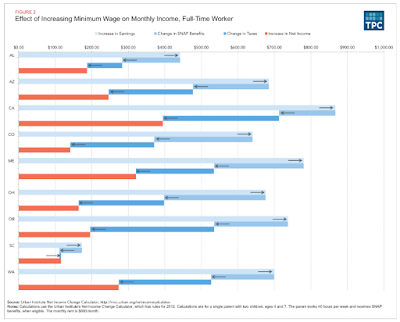

A study by the Tax Policy Center analyzes the impact of higher minimum by looking at a hypothetical case; a single mother with two children under the age of 10. She earns the state minimum wage and works full-time for 40 hours per week. She pays $600 in monthly rent and gets SNAP benefits. She also pays both income and payroll taxes and qualifies for refundable tax credits. Here is the Tax Policy Center's analysis showing the impact of increasing minimum wage for each of the eight states on the hypothetical recipient's income, taxes, SNAP benefits and net income:

Obviously, in each state, the hypothetical mother's income would increase by between $170 (South Carolina) and $867 per month (California) as shown in light blue. Her SNAP benefits as shown in medium blue would decrease by between $62 and $270 (South Carolina and Ohio respectively) and her income taxes would increase by between $90 and $340 (Alabama and Oregon respectively). This would leave her with a net take home income increase of between $120 and $390 (South Carolina and California respectively) thanks to higher minimum wage levels. The authors' calculations show that this hypothetical worker in California would see 55 percent of her wage increase eaten up by lower SNAP benefits and higher payroll and income taxes and a worker in the same situation in Colorado would see 78 percent of her higher wages eaten up by lower SNAP benefits and higher payroll and income taxes.

If you wish, you can calculate how much a family's benefits from safety-net programs and how much state and federal income and payroll taxes will change using the Urban Institute's Net Income Change Calculator that you can find here.

While most of America's lowest paid workers would benefit from raised minimum wages, there is no doubt that these proposed increases will result in far lower net take-home pay than these earners are likely expecting.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment