Governments around the world try to sell their citizens on the benefits of open global trade. This led to the creation of the World Trade Organization (WTO) as well as trade deals including the two most recent iterations, the Trans-Pacific Partnership (TPP) led by the United States and its competitor, the Regional Comprehensive Economic Partnership (RCEP) led by China. While all of these trade deals supposedly provide benefits for the economies of the signing nations, recent global trade data suggests that all is not well on the international trade front.

In the most recent analysis for the first quarter of 2016 from the WTO, world merchandise trade is looking sickly. Despite the mammoth efforts of the world's most influential central banks and their zero or negative interest rate policies, world trade as measured by exports dropped 0.8 percent in Q1 2016 with Asia recording the largest decline at -2.7 percent. World imports declined by 1.5 percent in Q1 2016 with Asia's imports declining by 3.9 percent and South and Central America experiencing a decline of 2.8 percent. Overall, world trade recorded a 1.1 percent decline in the first quarter of 2016 on a quarter-over-quarter basis and a 1.0 percent decline on a year-over-year basis.

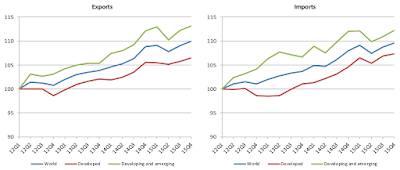

Despite the first quarter weakness, the WTO still expects that global trade will grow by 2.8 percent in 2016, the same level of growth as in 2015 and will actually rise to 3.6 percent in 2017. To put these numbers into perspective, annual trade growth has averaged 5.0 percent since 1990. This growth is largely on the backs of growth of both exports and imports in developing and emerging economies as shown on these graphs:

Here is a breakdown of the data for 2015:

1.) Developed Economies

– import volumes grew by 0.2 percent

– export volumes grew by 2.6 percent

2.) Developing Economies

– import volumes grew by 4.5 percent

– export volumes grew by 3.3 percent

This is the fourth year in a row that growth in world merchandise trade has remained below the 3 percent level on an annual basis. On the basis of the projections for 2016, world trade will have grown at roughly the same rate as global GDP for five years, a low level of positive trade growth that is unprecedented given that world trade has historically grown at twice the growth rate of global GDP.

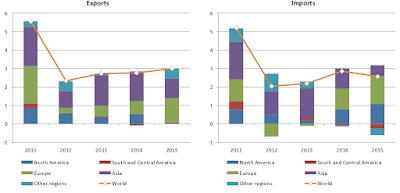

Here is a graphic showing the regional contributions to total annual global trade growth (in percentage points) over the past five years:

Notice that Asia (coloured purple) has been a major contributor to both exports and imports over the period between 2011 and 2014. This relationship changed markedly in 2015 with Asia being responsible for for only 1 percentage point or 35 percent of global export growth compared to 1.3 percentage points or 44 percent of export growth for Europe. Interestingly, North America (coloured dark blue) was responsible for almost none of the growth in global exports during 2015. On the import side of the ledger, Asia was responsible for 0.5 percentage points or 17 percent of global imports while Europe was responsible for 1.5 percentage points or 54 percent, the largest contributor to global import growth in 2015.

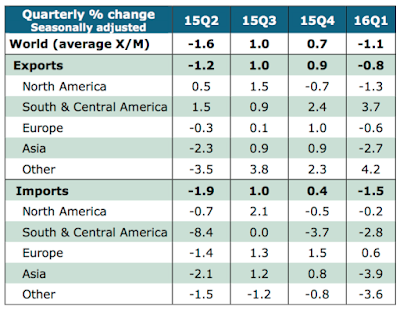

Let's take another look at the most recent quarter for which data is currently available. Here is a table showing the quarter-over-quarter percentage changes in exports and imports for the major economic regions of the world:

In Q1, 2016, the only positive data points are seen in growing exports in South and Central America and in imports in Europe.

Here is a graphic showing the average of world exports and imports since the third quarter of 2011:

As you can see, since the fourth quarter of 2014, there has been basically no growth in the average of world imports and exports.

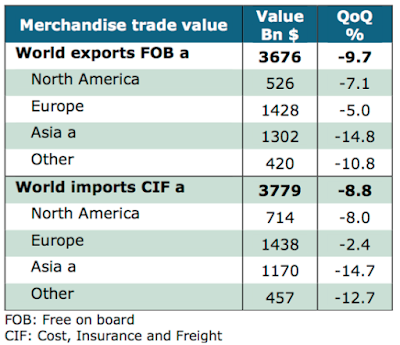

To close this posting, let's look at the non-seasonally adjusted value of merchandise trade volume for the first quarter of 2016 and the change in that value on a quarter-over-quarter basis:

Obviously, the trade value of merchandise in the first quarter of 2016 looks particularly unhealthy on a quarter-over-quarter basis.

Given that it is impossible for an economy to grow when both imports and, particularly exports, stop growing or are contracting, this data makes it clear that the global economy is headed into its next recession. When trade volumes for nearly all major trading regions are contracting as they did in the first quarter of 2016, the writing is on the wall. Unfortunately, this time out, the globe's central bankers have painted themselves into a policy corner from which there is no easy escape and no easy solution.

Global trade – the central bankers' next dilemma.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment