Mr. Bernanke's recent comments before the Congressional Joint Economic Committee on June 7th brought up the subject of Europe and its debt crisis. Here is a quote from his testimony:

"Nevertheless, the situation in Europe poses significant risks to the U.S. financial system and economy and must be monitored closely. As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate."

That is an interesting comment in light of what I'm about to post. Can central bankers really help in this situation?

A paper entitled "Propping Up Europe" written by Jean Pisani-Ferry and Guntram B. Wolff and released by Bruegel, the Brussels-based think-tank, takes an interesting look at how the Bank of England, the Federal Reserve and the European Central Bank have responded to the crisis that basically had its genesis in the early days of the Great Recession. As you will see, the exceptional response has led to a massive and unprecedented increase in the balance sheets of all three central banks with results that are modest at best.

Since 2007, the Federal Reserve, the Bank of England and the ECB have undertaken a series of initiatives that were intended to ward off the Depression bogeyman. Both Ben Bernanke and Mervyn King have used quantitative easing in an attempt to stimulate the economy in the face of what was essentially zero interest rates. In contrast, the ECB took a sharply different approach since they were reluctant to purchase huge volumes of government bonds as you will see later.

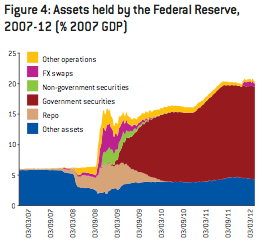

Here are two graphs that show the composition of each banks’ balance sheets, providing evidence that the Fed and the Bank of England have both embarked on massive purchases of government bonds(shaded in red), bloating their balance sheets with domestic government paper:

In the case of the Bank of England, effective March 29th, 2012, they are now the holders of nearly £304 billion worth of gilts as shown on this chart:

This works out to roughly one-third of the entire stock of the UK government debt of just over £1 trillion. At the end of February 2012, the purchase of gilts accounted for 116 percent of the increase in the Banks' balance sheet over the five-year period from February 2007.

In the case of the Federal Reserve, they have become the purchaser of last resort of U.S. Treasuries; as net purchases by the private and foreign sector have dropped off as shown here, the Fed has stepped in to pick up the slack. Purchases of government bonds by the Fed accounted for 103 percent of the increase in the overall size of its balance sheet since February 2007.

The result of these actions by both central banks has been elevated levels of unemployment, a housing market that is far from healthy and economic growth that is modest at best and moribund at worst. Surely, this is not particularly the resounding success that Mr. King and Mr. Bernanke had hoped for when they undertook their experiment, is it? Oh yes, and let's not forget near zero interest rates on savings and pension plan investments as an added benefit.

In sharp contrast, the European Central Bank (ECB) has relied on lending to financial institutions (the three year bank refinancing or LTRO) with repurchase agreements of collateral, commonly known as "repos" in financial circles, as shown on this graph (with repos shaded in beige):

LTRO is an attempt by the ECB to get banks lending again and to push interest rates down by providing abundant liquidity at fire sale prices, particularly in the most troubled nations. Liquidity received by the banks through the LTRO carries a one percent interest rate. The use of this massive intervention by the ECB has resulted in Europe's banking system parking their money at the ECB in record amounts as shown on this graph:

Basically, Europe's banking system is hoarding the ECB's cash injection by keeping it parked in overnight deposits at the Bank, despite the fact that deposits only receive a 0.25 percent interest rate, lower than the 1 percent interest cost of the LTRO liquidity. That tells us a lot about the state of Europe's banking system, doesn't it?

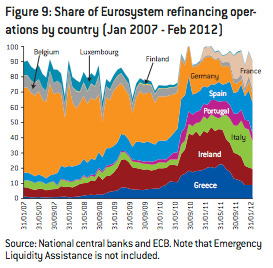

Here is a graph showing how several European nations have availed themselves of this once-in-a-lifetime opportunity:

Notice that prior to mid 2010, German banks were the primary users of the ECB liquidity. As the crisis has continued, the banking systems in the most troubled nations of Spain, Portugal, Italy, Ireland and Greece have availed themselves of the ECB's largesse as Germany’s demands have waned.

The authors of the paper question whether these actions, particularly LTRO, have been effective. They note that:

"…the low-cost three-year loans offered by the ECB should be seen by market operators as helpful for restoring the soundness of the banking system and thereby boosting bank stocks."

Here is a graph showing the stock market price indices for the banking systems in seven European nations with the LTRO events highlighted:

Oops! Apparently, the ECB's actions may have helped ensure the funding of banks, but, as we have seen in recent days and weeks, the banks still have questionable solvency, most recently in Spain but even Germany's banks are suffering under the stress.

Since the whole point of the exercise by all of these central banks was to stabilize the global financial system, it would appear that we can uncategorically state that, while the system has not yet imploded, the world's key central bankers should hardly be patting themselves on the back for a job well done. Rather, it appears that their desperate attempts may well have just postponed the inevitable. While Mr. Bernanke assures us that he is there to protect the system, his arsenal, and those of his fellow central bankers, has proven to be rather ineffective four years into this seemingly never-ending crisis no matter what remedial approach is taken.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment